The Life Sciences Report: Anthony, thank you for joining us. Would you tell us a little about yourself?

Anthony Vendetti: I'm director of research at Maxim Group, and I'm also a covering analyst. I've been following healthcare stocks for 22 years, and I have followed healthcare services stocks as well as device stocks. I also follow health and wellness companies. In the medical device area, I look at a lot of aesthetic companies as well as interesting emerging-growth medical device companies.

Viveve Medical Inc. (VIVE:NASDAQ) fits into one of the trends we have been focused on for the last 10 to 12 years, which is the trend toward private-pay aesthetic procedures. When I say private pay, I mean nonreimbursable types of procedures. That trend has been growing. The companies that provide these types of aesthetic procedures have grown rapidly over the last 10 years.

Viveve has patented technology for tissue tightening that Thermage Inc. had for the face and body. It uses a particular energy source called monopolar capacitive-coupling radiofrequency, a type of radiofrequency that is efficacious for tissue tightening. Thermage sold that product for many years for the face, for wrinkles around the eyes, for tissue tightening on different parts of the body.

The founder of Thermage, Dr. Edward Knowlton, M.D., was able to acquire those patents for Viveve. Since then, Viveve has filed additional method patents and other patents for this technology for the treatment of vaginal tissue to improve sexual function.

"Viveve Medical Inc. has the technology, it's putting together a worldwide distribution network, and it has the management team to execute."

Viveve recently announced that it submitted its investigational device exemption for the FDA under de novo 510(k) to begin a study, which will involve about 250 patients. The study is randomized and double blinded in a 1:1 ratio for active and sham treatments. The treatment takes about 30 minutes. After the treatment, the study is going to measure whether or not there was improved sexual function. There's a common scale that the FDA has approved called the Female Sexual Function Index (FSFI), which will be the primary efficacy endpoint.

In a previous, smaller study that Viveve did on its own, patients achieved above that index, which is necessary to meet that endpoint. We believe this double-blind, randomized trial has the potential to get FDA approval for something that other companies with devices for vaginal rejuvenation don't have. So we believe that if this 250-patient trial is successful, Viveve could have FDA approval for the treatment of vaginal tissue to improve sexual function in women. That could be a very powerful approval, if Viveve is able to get it. We're estimating that, by 2018, Viveve could be the first company to have that approval, which would open up a huge market for Viveve, in our opinion.

TLSR: How does this trial differ from the Viveve 1 clinical trial?

AV: That was a much smaller trial that consisted of two single-arm studies in the U.S. and Japan. It wasn't double-blinded or randomized, but it should be sufficient to get the FDA 510(k) clearance by the end of this year for electrocoagulation and hemeostasis so physicians in the U.S. could use it for vaginal rejuvenation as some of the competitors do, like Cynosure Inc. (CYNO:NASDAQ), a company I follow, and Syneron Medical Ltd. (ELOS:NASDAQ), another company I follow, where that product is just one of a portfolio of products. It would be able to use it for vaginal rejuvenation while it waits for the expected FDA approval for improvement of sexual function.

TLSR: Would you to talk a little bit about where Viveve is on its worldwide regulatory approval process and what in markets specifically?

AV: It has distribution partnerships in place in 69 countries, and it has regulatory clearance in 30. So for a company at this stage, the fact that it has all this in place is impressive.

TLSR: You mentioned Viveve's competition. At this point, do you see Viveve leapfrogging what other companies currently have if it were to make it to the next level?

AV: Yes, for us that's what makes the stock compelling. Right now there is no other company that has this approval, and we're not aware of any company conducting a trial similar to the one that Viveve just submitted to the FDA. I think it gives the company a chance to leapfrog the competition if this trial is successful, and it becomes the first company to have a label that is based on the FSFI scale.

TLSR: Do you have a sense of how large this market is?

AV: The total market opportunity is estimated to be $7 billion ($7B), $2B in the U.S., $5B outside the U.S. If Viveve can indeed leapfrog the competition and have the best product, we think it can grab its fair share of that market.

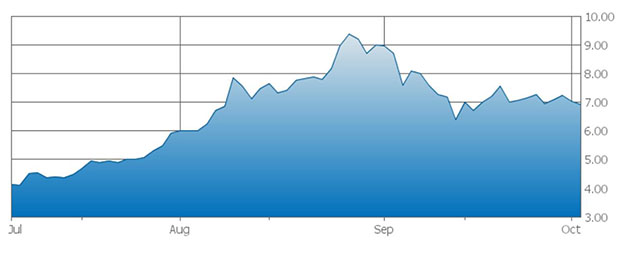

TLSR: In June, Viveve uplisted to NASDAQ, and also that same month it closed a $14 million secondary offering. What catalysts other than FDA approval in 2018 do you see ahead for the company?

AV: Viveve typically announces when it gets new regulatory clearances. It has distribution in 69 countries, and it has 30 regulatory clearances. So between now and 2018, I think you'll see those regulatory clearances in some of the countries where it doesn't yet have clearance continue to roll out.

The major near-term catalyst from a product standpoint or an FDA standpoint is this 510(k) clearance that it's using, in my opinion, as a bridge to the 2018 de novo clearance for the improvement of sexual function. By the end of the year, we expect Viveve to have the 510(k) for electrocoagulation and hemeostasis so that it will have a label that is similar to the competition.

As Viveve continues to get other regulatory clearances—for example, China is a big market—these clearances should be able to drive revenue in other countries until it hopefully gets that U.S. 510(k) clearance by the end of this year. And then the big one is 2018 to really bolster North American sales.

TLSR: Does the company have sufficient capital to make it to that point?

AV: Based on our model, we expect that sometime in 2017 Viveve will probably need additional capital to get all the way to FDA approval in 2018.

TLSR: Can you tell us about Viveve's management?

AV: Viveve has an experienced management team. Pat Scheller, the CEO, was at Johnson & Johnson (JNJ:NYSE) and worked in its stent division, which she was responsible for growing. Its chief business officer and president, Jim Atkinson, was at Ulthera Inc., a privately held aesthetic company, which developed technology for nonsurgical facelifts or brow lifts. He helped grow it to almost a $100M business from scratch; and he is trying to replicate that with Viveve today. He set up the distributor network so that Ulthera could sell its products worldwide. Some of that distribution network, which he's already very familiar with, is very valuable to Viveve.

TLSR: Any parting thoughts?

AV: Viveve has the technology. It's putting together a worldwide distribution network. And it has the management team to execute, which is a significant part of any equation of a company that is at the stage of Viveve.

TLSR: Thanks for your time, Anthony.

Anthony Vendetti is the director of research and senior healthcare analyst at Maxim Group, LLC. Vendetti has been on Wall Street for more than 20 years and follows the medical device, healthcare information technology and services industries. Prior to joining Maxim Group, he was a senior healthcare analyst at Gruntal, UBS Securities and Ladenburg Thalmann. Vendetti also worked for three years in the healthcare industry at CIGNA, ultimately as a senior healthcare analyst in the managed care division.

Read what other experts are saying about:

Want to read more Life Sciences Report interviews like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see recent interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosure:

1) Patrice Fusillo conducted this interview for Streetwise Reports LLC. She provides services to Streetwise Reports as an employee. She owns, or members of her immediate household or family own, shares of the following companies mentioned in this interview: None. She is, or members of her immediate household or family are, paid by the following companies mentioned in this interview: None.

2) The following companies mentioned in this article are sponsors of Streetwise Reports: Viveve Medical Inc. The companies mentioned in this article were not involved in any aspect of the interview. Streetwise Reports does not accept stock in exchange for its services. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Anthony Vendetti: I own, or members of my immediate household or family own, shares of the following companies mentioned in this interview: None. I am, or members of my immediate household or family are, paid by the following companies mentioned in this interview: None. See additional disclosures below. I was not paid by Streetwise Reports for participating in this interview. Comments and opinions expressed are my own comments and opinions. I determined and had final say over which companies would be included in the interview based on my research, understanding of the sector and interview theme. I had the opportunity to review the interview for accuracy as of the date of the interview and am responsible for the content of the interview.

4) Maxim Group Disclosures:

VIVE Disclosures:

Maxim Group makes a market in Viveve Medical, Inc.

Maxim Group managed/co-managed/acted as placement agent for an offering of the securities for Viveve Medical, Inc. in the past 12 months.

Maxim Group received compensation for investment banking services from Viveve Medical, Inc. in the past 12 months.

Maxim Group expects to receive or intends to seek compensation for investment banking services from Viveve Medical, Inc. in the next 3 months.

CYNO Disclosures:

Maxim Group makes a market in Cynosure Inc.

Maxim Group expects to receive or intends to seek compensation for investment banking services from Cynosure Inc. in the next 3 months.

ELOS Disclosures:

Maxim Group makes a market in Syneron Medical Ltd.

Maxim Group expects to receive or intends to seek compensation for investment banking services from Syneron Medical Ltd. in the next 3 months.

5) Interviews are edited for clarity. Streetwise Reports does not make editorial comments or change experts' statements without their consent.

6) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

7) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their families are prohibited from making purchases and/or sales of those securities in the open market or otherwise during the up-to-four-week interval from the time of the interview or article until after it publishes.