In an Aug. 18 research report, Zacks analyst Grant Zeng reviewed Soligenix Inc.'s (SNGX:OTCQB) Q2 financials. "Total revenue for the second quarter was $3.2 million, as compared to $1.1 million for the same period for the prior year. Revenues included contracts with BARDA and NIAID in support of OrbeShield® development in the treatment of gastrointestinal acute radiation syndrome (GI AR and advanced development of the Company thermostabilization technology, ThermoVax, combined with its ricin toxin vaccine RiVax, as a medical countermeasure to prevent the effects of ricin exposure," the analyst stated.

Zeng continued by noting, "Net loss for 2Q16 was $0.1 million ($0.00 per share), as compared to $4.0 million ($0.15 per share) for the same period last year. Included in the net loss for quarters ended June 30, 2016 and 2015 is non-cash income of $0.9 million and a non-cash expense of $1.9 million, respectively. This non-cash item reflects the change in fair value of the liability related to warrants issued in the Company's June 2013 registered public offering and is included in other income/(expense)."

Zeng also focused on Soligenix's Aug. 18 announcement that the FDA granted orphan drug designation to dusquetide for treatment of macrophage activation syndrome (MAS). This follows dusquetide's orphan status for acute radiation syndrome.

"Dusquetide (SGX942), the company's lead candidate," explained Zeng, "is an innate defense regulator (IDR), a new class of short, synthetic peptides that accelerates bacterial clearance and resolution of tissue damage while modulating inflammation following exposure to a variety of agents including bacterial pathogens, trauma, radiation and/or chemotherapy."

Zeng enumerated some of the benefits of orphan designation: "In addition to providing a seven-year term of market exclusivity upon final FDA approval, orphan drug designation also positions Soligenix to be able to leverage a wide range of financial and regulatory benefits, including government grants for conducting clinical trials, waiver of expensive FDA user fees for the potential submission of a New Drug Application, and certain tax credits."

Zeng also discussed Soligenix's late-July announcement that it had received additional funding from the Biomedical Advanced Research and Development Authority (BARDA) and the National Institute of Allergy and Infectious Diseases (NIAID), part of the National Institutes of Health (NIH).

"OrbeShield is an oral BDP (beclomethasone 17,21-dipropionate) formulation, which represents a first-of-its-kind oral, locally acting therapy tailored to treat gastrointestinal inflammation. BDP is a corticosteroid that has been marketed in the U.S. and worldwide since the early 1970s via other methods of delivery," Zeng stated, adding, "Soligenix's oral BDP is specifically formulated for oral administration including SGX203, SGX201, orBec, and OrbeShield. Each is designed as potent, topically active corticosteroid to treat GI inflammation and provide superior safety profile."

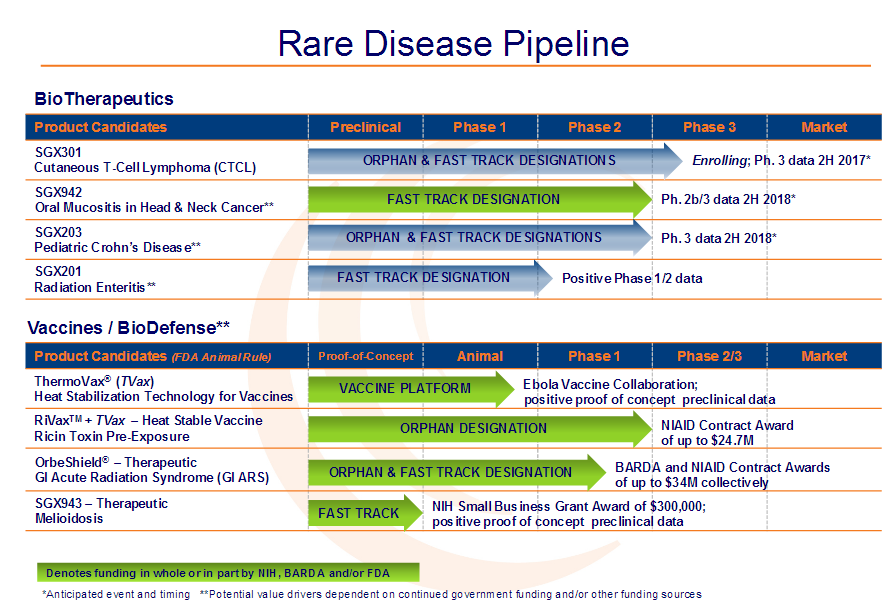

Soligenix had also earlier announced "positive preliminary proof-of-concept results from a heat stable subunit Ebola vaccine," "additional NIAID funding to advance development of a ricin vaccine," "positive results from its Phase II proof of concept (POC) clinical trial of SGX942 for the treatment of oral mucositis in head and neck patients," and "the initiation of its much anticipated pivotal Phase III trial of SGX301 for the treatment of cutaneous T-cell lymphoma (CTCL)," Zeng noted.

Zeng concluded, "We remain optimistic about Soligenix's long term prospect. Our fair value for the company remains at $4.00 per share. We believe there are multiple catalysts to drive the share price up in the next 6 to 12 months. . .we believe Soligenix shares are undervalued at current market price [of $0.60/share]."

Read what other experts are saying about:

Want to read more Life Sciences Report interviews like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see recent interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosure:

1) Patrice Fusillo compiled this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee. She owns, or her family owns, shares of the following companies mentioned in this article: None.

2) The following companies mentioned in this article are sponsors of Streetwise Reports: Soligenix Inc. The companies mentioned in this article were not involved in any aspect of the article preparation. Streetwise Reports does not accept stock in exchange for its services. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Comments and opinions expressed are those of the specific experts and not of Streetwise Reports or its officers.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their families are prohibited from making purchases and/or sales of those securities in the open market or otherwise during the up-to-four-week interval from the time of the interview or article until after it publishes.

Additional disclosures about the sources cited in this article