Finding diamonds in the rough isn't difficult. What is difficult is finding diamonds in the rough that are not fully priced if not overpriced given this stage of a new bull market in gold and silver. What is still cheap in this new bull market?

Redstar Gold Corp. (RGC:TSX.V) hit a high of $0.68 in the late summer of 2011 just as gold was about to peak. With financing out of the question, the company pretty much went into hibernation as the share price dropped to a low of $0.025 in December of 2015 as gold bottomed. The action since then pretty much shows the potential of penny dreadfuls as the stock has rebounded by 440% and money is beginning to flow into the sector.

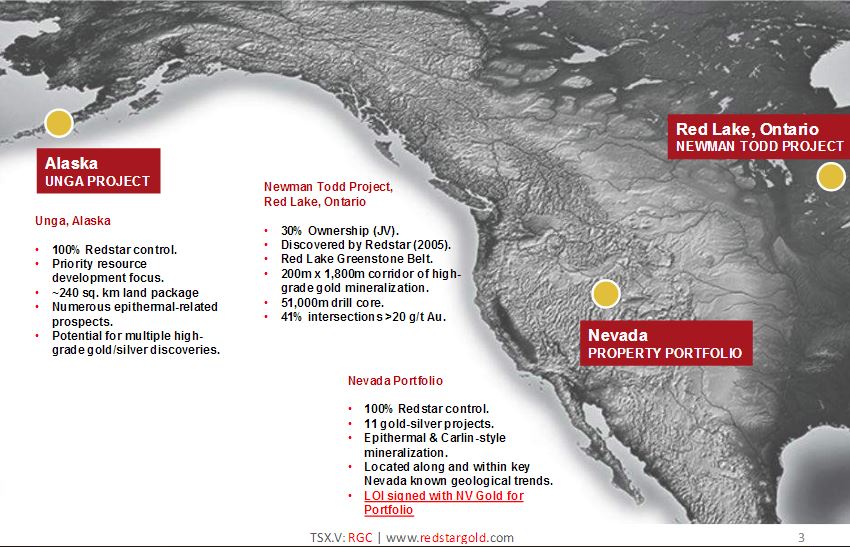

Redstar was a triple threat as far back as 2011 with a major high-grade gold project in Ontario called the Newman Todd project within the Red Lake gold district. The company entered into an option agreement with Confederation Minerals (CFM-V) that allowed Confederation to earn up to a 70% interest in the project by spending $5 million on the project, making certain cash payments to Redstar and completing a PEA on the project. Confederation has earned the 70% and in accordance with their agreement issued 500,000 shares of the company to Redstar.

The PEA showed that Confederation and Redstar either need a higher price for gold or a lot more drilling on the Todd Newman project to be economically viable.

In addition to the Todd Newman project, Redstar also had a swarm of 11 projects in Nevada they got from AngloGold-Ashanti in 2005 complete with a database of past exploration results done before AngloGold-Ashanti departed Nevada. In early 2014 Redstar did a deal with a company named True Grit. (TGI.H) Love that name. True Grit was to pay Redstar Gold a total of $200,000, spend $750,000 on exploration and issue 2.5 million shares to Redstar. Alas True Grit lacked grit, money or both and managed to be forced into returning the projects to Redstar on December 21, 2015, a mere two days after the lowest price for gold in years.

Redstar vended those same projects to NV Gold (NVX-V) in early August of 2016 in return for NV Gold issuing 6 million shares to Redstar and agreeing to do a financing of at least $350,000. That was probably a real good move on the part of Redstar because it allows President and CEO Peter Ball to focus on the company's star project, the Unga gold project located on Unga and Popof islands some 900 km southwest of Anchorage, Alaska.

Redstar has been working on putting the Unga package together for at least five years. They did a deal with NGAS Production in 2011 where they paid about US$2.3 million in cash and shares for a 100% interest in Unga. They picked up the Popof project on an adjoining island from Full Metal Minerals in early 2014 for an agreement to pay FMM CA$125,000, US$225,000, 750,000 shares and exploration costs of $3.4 million over five years.

This project was home to the first underground mine in Alaska named the Apollo-Sitka Gold Mine. It began production in 1891 that continued until 1922 when high expenses caused the mine to be shut down. It should be notable that the mine was in production well before the Klondike Gold Rush that started in 1896. Redstar has a 240 square km land position on Unga and Popof islands. And while it looks remote, there is commercial service from Anchorage six days a week on a runway that can handle up to C-130 size aircraft.

Redstar has about $500,000 in the bank and will be closing at $4.1 million placement next week. This is a company that had a total market cap of under $7 million at the first of this year and a week from now will have $4.5 million in the bank. Eric Sprott is participating in the placement for 30 million shares at $0.10 and he's been hitting a lot of home runs lately. The Chairman of Redstar, Jacques Vaillancourt, owns over 10% of the shares so management has quite a stake in the company. Management and insiders hold about 60% of the shares.

Strangely, the company has gone from cash poor for years to cash rich. In addition to the cash in hand from the recent private placements they have 39.3 million warrants at $0.10 that expire October 21st and an additional 27.6 million warrants at $0.12 that expire November 27th. Assuming all of those warrants are exercised, that would bring in an additional $7.24 million.

So you have this very unusual situation where I think the stock should go a lot higher than it is today but until all of those warrants are paid for or expire, they will provide a sort of lid over the stock. If the stock went to $0.20 a week from now, a lot of investors would sell the shares to exercise the warrants so the stock would go back down. Interested investors have a three-month time frame where the price of the stock will probably be artificially low.

Redstar drilled the Unga gold project in both 2011 and 2015 and they just completed an evaluation of the project by Dr. Jeffery Hedenquist to determine drill locations and to advise how Redstar should move forward. The 2015 drill results confirmed similar results from 2011 along the 9.5 km Shumagin trend including bonanza grades of 202 g/t Au over a true length of 1.5 meters in SH011 and 20.90 g/t Au over a meter with 232.0 g/t Ag in SH013. The company is aiming to define a 1–2 million ounce resource within the Shumagin Scarp where the vein system outcrops and grab samples have returned high-grade results.

The Apollo/Sitka trend is where the original 1891 mine was located. It, too, is about 9.5 km long. There was a non-43-101 resource of about 280,000 tonnes at 28 g/t Au and 127 g/t Ag. Think one ounce per tonne. That was all done in the days where they used black powder and drilled holes with drill steel and a hammer. Redstar has managed to stay alive long enough for the market to revive. Armed with $4.5 million to conduct exploration and drilling, I think they will come through with the goods and I suspect this will one day soon be a mine again.

I tried to get some firm numbers on a drill program but the company is still going over past records. Expect some sort of announcement in September about a big drill program. The company can drill through the winter so I would expect a drill to be turning by November or so. There will be some concrete results coming in the next few months.

Redstar is perfectly positioned. They have 30% of a nice project in Ontario and have a major share position in the company advancing their Nevada projects. You can do a lot of exploration for $4.5 million and with any success at all, the warrants will provide more than enough for a major program in Alaska. Past exploration in Alaska has delivered some barn burning results and I expect that to continue.

My only gripe is the number of shares outstanding. I understand that when a company is trading for pennies and the cupboard is bare that they have to issue a lot of shares just to stay alive. Redstar has understood the potential of Unga for five years now and has done everything in its power to move it forward but for years there was no money in the cookie jar. Now they have the project put together with the addition of Popof Island and have enough cash in the till to fill it or kill it.

But they have 218 million shares outstanding now. After the placement closes next week there will be 259 million shares out in addition to 85 million warrants and 13 million options. That's a total of 357 million shares fully diluted. This isn't an Australian stock or an AIM listing. Having a stock at $0.13 is absurd.

With the substantial percentage of stock in strong hands, Redstar should bite the bullet and do a 10–1 rollback. It's not an admission of failure; it's a way of giving the company credibility to potential shareholders. The existing strong shareholders won't care what the share price is after a rollback; their slice of the pie will remain exactly the same.

Redstar is an advertiser and I have participated in the latest private placement. I am biased. Please do your own due diligence. There is a video and technical presentation here and take my word, it is technical but this project has major gold potential. If you want a solid gold project in a friendly political environment you owe it to yourself to look at Redstar.

Redstar Gold Corp.

RGC-V $0.13 (Aug 31, 2016)

RGCTF OTCQX 218 million shares

Redstar Gold website

Bob and Barb Moriarty brought 321gold.com to the Internet almost 14 years ago. They later added 321energy.com to cover oil, natural gas, gasoline, coal, solar, wind and nuclear energy. Both sites feature articles, editorial opinions, pricing figures and updates on current events affecting both sectors. Previously, Moriarty was a Marine F-4B and O-1 pilot with more than 820 missions in Vietnam. He holds 14 international aviation records.

Want to read more Gold Report interviews like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosure:

1) The following companies mentioned in the article are sponsors of Streetwise Reports: None. The companies mentioned in this article were not involved in any aspect of the article preparation or editing so the expert could write independently about the sector. Streetwise Reports does not accept stock in exchange for its services. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

2) Bob Moriarty: I or my family own shares of the following companies mentioned in this article: Redstar Gold Corp. I personally am or my family is paid by the following companies mentioned in this article: None. Redstar Gold Corp. is an advertiser of 321 Gold. I determined which companies would be included in this article based on my research and understanding of the sector.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their families are prohibited from making purchases and/or sales of those securities in the open market or otherwise during the up-to-four-week interval from the time of the interview/article until after it publishes.