Can you give an introduction to Actinium Pharmaceuticals Inc. (ATNM:NYSE.MKT) and its mission?

Sandesh Seth: Actinium has the simple mission of using radioimmunotherapies to "nuke cancer," with a focus on cancers with high unmet needs, where traditional cancer therapies do not work. Most people are unfamiliar with radioimmunotherapy, but they are familiar with its two core components, which are monoclonal antibodies that target specific markers on cancer cells, and radioisotopes that kill cancer cells by emitting radiation energy. The result of this combination is a targeted, powerful cancer killing therapy that does not have many of the side effects and toxicities seen with traditional cancer therapies, such as chemotherapy and external beam radiation. We believe Actinium is a leader in the field of radioimmunotherapy and we are very excited for the future.

What stages of clinical development are Actinium's therapies in, and which cancers are you addressing with radioimmunotherapy?

"Actinium has the simple mission of using radioimmunotherapies to 'nuke cancer.' "

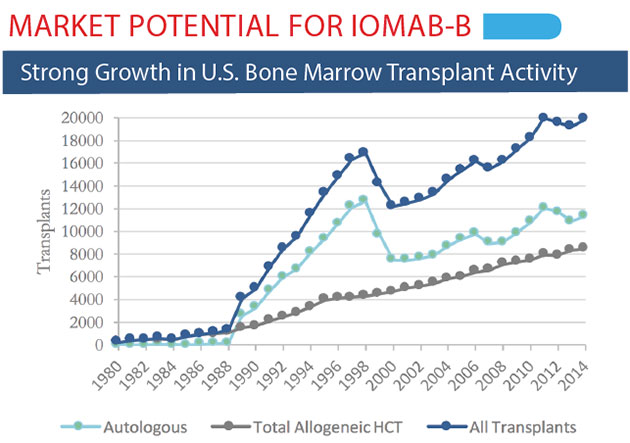

SS: Actinium currently has two clinical-stage radioimmunotherapy assets. Iomab-B, our lead program, recently began a pivotal Phase 3 clinical trial as an induction and conditioning agent prior to a bone marrow transplant (BMT), also known as a hematopoietic stem cell transplant (HSCT), in patients with relapsed or refractory acute myeloid leukemia (AML) who are over the age of 55. We are particularly excited about Iomab-B because the patient population, elderly relapsed or refractory AML patients, has no standard of care, and there are no other induction and conditioning agents in development. We are creating an entirely new market segment with Iomab-B, with the goal of offering these patients a better, faster and safer path to a BMT.

Our second program, Actimab-A, is being studied in a Phase 1/2 clinical trial in patients newly diagnosed with AML who are over the age of 60, and who are ineligible for "7+3," which is considered the standard front-line therapy in AML. We recently completed the Phase 1 portion of the trial and will begin the Phase 2 portion in the second half of this year.

Both Iomab-B and Actimab-A are being developed for older AML patients. Can you elaborate on how they are different?

SS: We look at the AML market being broken up into four quadrants: newly diagnosed below age 55; relapsed or refractory below age 55; newly diagnosed above age 55; and relapsed or refractory above age 55. Actinium is focused on the latter two—the older patient populations. We see the patients over age 55, whether newly diagnosed or relapsed/refractory, as having the highest unmet needs. We think this is where new therapies can have the biggest impact.

We think of newly diagnosed AML and relapsed or refractory AML as two different diseases, as the approaches to treating these patients are markedly different. The goal of AML treatment for patients newly diagnosed is to put the patient into remission, and that is what Actimab-A is intended to do. Safety and tolerability are very important in this older patient population, and Actimab-A appears to be tolerable, with a clear anti-leukemic effect and the ability to put patients into remission.

"We are particularly excited about Iomab-B because the patient population, elderly relapsed or refractory AML patients, has no standard of care."

In patients who are relapsed or refractory, meaning unresponsive to therapy, the goal is to get the patient to a bone marrow transplant. The dilemma is that to receive a BMT, a patient must be given high-intensity chemotherapy and/or radiation, and have no active disease. These older patients, who have already been through rounds of therapy, are very frail and sick. They are not able to tolerate this preparative treatment, therefore they cannot go on to receive a BMT. Iomab-B is intended to address this dilemma by effectively preparing patients for a BMT without the side effects and toxicities they would experience with chemotherapy and/or radiation.

You highlight that Iomab-B and Actimab-A are more tolerable and less toxic than chemotherapy. Why is that?

SS: The answer is in two parts. First, we utilize monoclonal antibodies to target specific markers on the surfaces of cancer cells. For Iomab-B, that marker is CD45, which is expressed on leukemia cells, white blood cells and stem cells. The marker for Actimab-A is CD33, which is expressed on approximately 90% of AML cells. The antibodies act as "heat-seeking missiles," bringing the radioisotope payload directly to the cancer cells.

That is the second part of the answer to the question: We use radioisotopes as our payload to kill cancer cells. Radioisotopes kill cancer cells by emitting energy that breaks the DNA of the cancer cells apart and prevents them from replicating. The energy emitted from the radioisotopes travels limited distances in the body so the damage to surrounding normal, healthy tissues is minimized. Also, radioisotopes are very potent when it comes to killing cancer cells, so we can administer orders of magnitude less of our therapies compared to other approaches, such as chemotherapies. This results in far fewer systemic toxicities.

Did Actinium develop Ioamb-B and Actimab-A internally, or did the company license them?

SS: Actinium licensed both Iomab-B and Actimab-A. Actimab-A was developed at Memorial Sloan Kettering Cancer Center (MSK) in New York, and was the basis on which the company was formed. We licensed both Actimab-A and our Alpha Particle Immunotherapy (APIT) technology platform from MSK. Actimab-A is a second-generation therapy from the APIT platform. In total, the first generation therapy and Actimab-A have been studied in four clinical trials on almost 90 patients.

"We believe alpha particles, particularly Actinium-225, are an incredibly valuable payload that can be used to treat cancers."

Iomab-B was licensed from the Fred Hutchinson Cancer Research Center in Seattle, Washington. The significance of this is that bone marrow transplant for leukemia patients was practically invented at the Fred Hutchinson Cancer Research Center, and it is therefore considered the "temple" of BMT. Prior to us licensing Iomab-B, it had been studied in almost 300 patients in seven Phase 1 and Phase 2 clinical trials. We were very compelled by the data we saw from Iomab-B, and believed we could create a new market segment with Iomab-B, which prompted us to license it.

Can you provide detail on the results of the previous studies you mentioned for Iomab-B and Actimab-A?

SS: In a Phase 1/2 proof-of-concept study in relapsed or refractory AML patients—the same patient population that will be in our pivotal Phase 3 trial—Iomab-B showed a 100% complete response rate, meaning all patients in the study were able to receive a BMT, and at day 28 100% of the patient's transplants engrafted. Furthermore, one-year survival was 30% and two-year survival was almost 20%, versus current survival rates of 10% at one year and 0% at two years. These statistics speak to the compelling efficacy of Iomab-B, in our opinion. I should also note that the medical community considers two-year survival following a bone marrow transplant to be a medical cure, as the likelihood of the patient's cancer returning is virtually nonexistent.

Actimab-A recently completed the Phase 1 portion of a Phase 1/2 clinical trial that I would like to highlight. Again, these were patients over the age of 60 newly diagnosed with AML. The endpoint was complete response rates, and this was dose escalation study. Overall we saw a 28% response rate. We will be going into the Phase 2 portion of the trial at the highest dose level from the Phase 1 portion of the trial, which is 2.o µCi/kg/per fractionated dose. This was the second Phase 1 trial for Actimab-A, and in total we have studied this drug in 38 patients.

In our analysis of the data from both of these trials, we uncovered a key finding related to peripheral blast (PB) burden. PB burden means that a patient's leukemia or cancer cells have moved out of his or her bone marrow and are elsewhere in the body, typically the spleen and liver. We noticed that patients with a PB burden above a certain level did not respond as well to Actimab-A. Our hypothesis is that the peripheral blasts in the spleen and liver act like sponges and soak up Actimab-A before it can reach the bone marrow, which is where it is intended to go. Perhaps the most interesting part of our PB burden hypothesis is that we can correct PB burden to a low state by using hydroxyurea, a widely used agent that was allowed per the trial protocol. In the recently completed Phase 1 trial, at the 2.o µCi/kg/per fractionated dose level patients with a low PB burden had a 50% complete response rate. These are the patients we will be taking into the Phase 2 trial.

Would you go through the next steps in the clinical development of Iomab-B and Actimab-A?

SS: As I mentioned earlier, Iomab-B is in a pivotal Phase 3 clinical trial that we have named the SIERRA trial. The trial is a randomized, controlled study that will enroll 150 patients, and it will conducted in the U.S., with many of the top bone marrow transplant centers expected to be trial sites. The SIERRA trial will compare Iomab-B followed by a bone marrow transplant to physician's choice of chemotherapy followed by either a bone marrow transplant or other treatment options with curative intent. The primary endpoint is durable complete remission (dCR) at six months, meaning is the patient cancer-free at six months. The secondary endpoint is one-year overall survival. We expect enrollment to be completed at the end of 2017, which would make topline results available in the second half of 2018. We have an agreement with the FDA that the SIERRA trial could be the basis of approval for a biologics license application (BLA).

"We are taking lessons learned from the past and applying them to our development and growth strategy."

In regards to Actimab-A, we are focused on getting the Phase 2 trial started. We made changes to the protocol for the Phase 2 portion of the trial, most notably the removal of low-dose cytarabine, which the FDA has already agreed to. The Phase 2 portion of the trial will be Actimab-A as a monotherapy. Based on our PB-burden hypothesis, we are going back to the FDA to make additional modifications to the protocol to mandate the use of hydroxyurea in patients with PB burden above a key threshold level. We will also expand the number of centers to at least twice those in the Phase 1 portion of the trial. The Phase 2 Actimab-A trial will enroll an additional 51 patients starting in the second half of this year, with a primary endpoint of complete response rates at six weeks, and a secondary endpoint of one-year overall survival.

You mentioned Actinium's Alpha Particle Immunotherapy (APIT) technology platform. What is company's strategy in regards to APIT?

SS: We believe alpha particles, particularly Actinium-225, are an incredibly valuable payload that can be used to treat cancers. We have invested in the development of processes to manufacture Actinium-225 in a cyclotron at lower costs and higher yields than what is currently available today.

We have also generated significant expertise in the handling and harnessing of Actinium-225—the linking of it to monoclonal antibodies and its use in treating cancer—all of which we have intellectual property around. We believe pharmaceutical and biotechnology companies that have monoclonal antibodies could benefit by incorporating Actinium-225 as the payload, as we have done with Actimab-A.

We are beginning to see renewed interest in radioimmunotherapies, and we believe this will result in more interest in using Actinium-225, leading to potential licensing, partnership or collaborations for Actinium in the future. Actinium-225 could be used to increase the effectiveness of monoclonal antibodies that have strong binding capabilities but do not have strong therapeutic characteristics, to extend the patent life of monoclonal antibodies or to create new "bio-betters."

Can you elaborate on the renewed interest in the radioimmunotherapy space you are seeing?

SS: We believe we are in the era of radioimmunotherapy 2.0, with era 1.0 being defined by Bexxar and Zevalin. Bexxar was developed by GlaxoSmithKline (GSK:NYSE) and Zevalin was developed by Spectrum Pharmaceuticals Inc. (SPPI:NASDAQ). These therapies were developed to address various types of lymphomas, and were met with great fanfare from investors at the time.

Unfortunately, Bexxar and Zevalin ran into Rituxan (Genentech/Biogen [BIIB:NASDAQ]), a blockbuster drug used to treat patients with lymphomas. While Bexxar and Zevalin had good data that was comparable to Rituxan, they had to be administered at the hospital, while Rituxan could be administered in the physician's office—which meant the physician would lose patients if he prescribed Bexxar or Zevalin.

As a result, the drugs failed to deliver on their promise and investors became turned off by radioimmunotherapy. Subsequent to Bexxar and Zevalin, Algeta, a Norwegian company, developed the drug Xofigo, which was an alpha particle radiopharmaceutical used to treat advanced prostate cancer. Xofigo was approved in May 2013, and in December 2013 Algeta was acquired by Bayer AG (BAYRY:OTCMKTS; BAYN:XETRA) for $2.9 billion.

Another recent success in the radiopharma space is Advanced Accelerator Applications SA (AAAP:NASDAQ), which is developing Lutathera, a radiopharmaceutical intended to treat neuroendocrine tumors of the midgut. Advanced Accelerator Applications SA is expected to file its new drug application (NDA) for Lutathera in the near future, and after going public in November 2015, the company currently has a market value that we think is consistent with its addressable market and stage of development.

On the backs of these successes, we believe we are in radioimmunotherapy 2.0, and we are taking lessons learned from the past and applying them to our development and growth strategy. The main lesson is physicians will not prescribe radiopharmaceuticals if there is a therapy that can be given as a pill or simple injection. Therefore, it is our strategy to employ radioimmunotherapy in cancers or applications that have high unmet needs—needs we do not think can be met by traditional therapies. Iomab-B for preparation prior to a BMT and Actimab-A for newly diagnosed older AML patients who cannot receive 7+3 are two great examples. But we believe there are many more opportunities for radioimmunotherapy.

What milestones should investors be looking for from Actinium Pharmaceuticals?

SS: With Iomab-B in a Phase 3 trial and Actimab-A moving into the Phase 2 trial, we expect milestones to occur on a quarterly basis for some time going forward. Investors will receive Iomab-B enrollment updates via independent data monitoring committee (DMC) reports that will occur at 25%, 50% and 75% patient enrollment.

We are also pursuing orphan drug designation in the European Union for Iomab-B. As a reminder, we have orphan drug designation for Iomab-B and Actimab-A in the U.S. already.

With Actimab-A, we will have the initiation of the Phase 2 clinical trial later this year, which will be followed by an interim data analysis next year.

Beyond these clinical milestones, we are confident that the APIT platform will result in a partnership, licensing transaction or collaboration, but those are tough to handicap and even harder to predict in regards to timing.

Sandesh Seth is the executive chairman of Actinium Pharmaceuticals Inc., a biopharmaceutical company developing innovative, targeted payload radioimmunotherapeutics for the treatment of advanced cancers. Mr. Seth has 20-plus years of healthcare industry experience that encompasses in investment banking (Cowen & Co.), equity research (Bear Stearns, Commonwealth Associates) and the pharma industry (Pfizer, Warner-Lambert, SmithKline in strategic planning, business development and R&D project management). In addition, Mr. Seth is the chairman of Relmada Therapeutics Inc., a publicly listed specialty pharmaceuticals company focused on pain therapeutics. He has an M.S. in pharmaceutical science from the University of Oklahoma, and an M.B.A. in finance from New York University's Leonard Stern School of Business.

Read what other experts are saying about:

Want to read more Life Sciences Report discussions like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see recent interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosure:

1) Actinium Pharmaceutical Inc. is a sponsor of Streetwise Reports. Streetwise Reports does not accept stock in exchange for its services. Click here for important disclaimers. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

2) Sandesh Seth had final approval of the content and is wholly responsible for the validity of the statements. Opinions expressed are the opinions of Sandesh Seth and not of Streetwise Reports or its officers.

3) Sandesh Seth: I was not paid by Streetwise Reports to participate in this management discussion. I had the opportunity to review this for accuracy and am responsible for the content. I or my family own shares of the following companies mentioned in this discussion: Actinium Pharmaceuticals and Spectrum Pharmaceuticals.

4) Discussions are edited for clarity. Streetwise Reports does not make editorial comments or change experts' statements without their consent.

5) The discussion does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This discussion is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

6) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their families are prohibited from making purchases and/or sales of those securities in the open market or otherwise during the up-to-four-week interval from the time of the interview until after it publishes.