West Red Lake Gold Mines Inc. (RLG:CSNX) is actively setting the stage for exploration work in the fall. I recently met with Executive Chairman Thomas Meredith and President John Kontak in Toronto.

The established resource, which stands at 4.5 million Inferred tonnes grading 7.57 g/t gold for 1.1 million ounces, in the prolific Red Lake Gold District in northwestern Ontario, grounds the company.

Last winter a set of five holes stepped east from the resource along the Pipestone Bay-St. Paul deformation zone—the major gold-bearing structure in the region—toward the northeast-southwest Golden Arm structure.

That structural intersection is the real area of interest, as major deposits in the Red Lake area occur at intersections like that. The last hole of that program returned 1.5 meters grading 69.55 g/t gold, in the closest hole to the structural intersection to date.

Interest certainly got piqued.

West Red Lake Gold raised $575,000 in March, which it used to fund a spring drill program. Most of the spring program holes continued to step east, from that high-grade hit toward the structural intersection. I say "most" of those holes because one of the spring holes was used for a slightly different end.

This one hole was drilled from west to east, parallel to the known vein sets. Why? Because West Red Lake has information from a new geophysical survey that suggests there should also be north-south breaks between the east-west veins.

The company hit mineralization exactly where the AMT map predicted, even within meters of the depth prediction.

The real test will take another three holes. Those will punch into the heart of the AMT anomaly, which, comfortingly, sits pretty much right at the structural intersection that West Red Lake was targeting from the start.

The anomaly is big. If it's real, it would be a game changer for West Red Lake. Unfortunately, those three holes have to wait.

West Red Lake just closed a financing, putting another $1.3 million in the bank. Those dollars are earmarked to drill beneath the established Rowan resource, expanding it at depth. It's a sensible choice—the odds of success are very high, which is a good gamble for a company still trading around $0.25/share. Do the sure thing, put out good results, get a share price lift, finance again at a higher price, and then drill the flyer holes. It's the right plan, even if I'm keen for the company to test the AMT anomaly now!

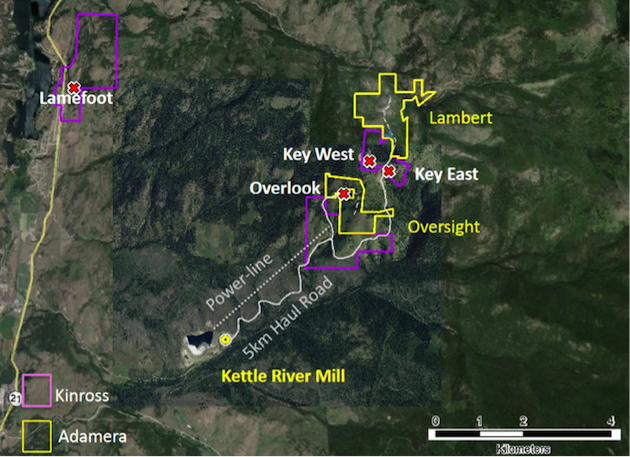

Adamera Minerals Corp. (ADZ:TSX.V) is another company out in the field. The company closed a $600,000 financing in mid-June and another $360,000 is in the bank from warrant exercises at the end of July. Three forces are driving this season's exploration:

- Adamera's conceptual model for the Oversight property, where the team believes a stratigraphic fold means it needs to search for mineralization below the limestone unit rather than above it, where it was found at historic mines in the area (like Overlook).

- Soil sampling to identify new areas of mineralization.

- Assessing the targets generated by the airborne audio-magnetotelluric (AMT) survey completed in the spring.

Just as with West Red Lake, this is the next-level electromag survey technology that incorporates audio waves to generate a much more detailed picture of not just structure but also lithology and mineralization.

Earth Science Services flew Adamera's Washington State properties with its AMT system in the spring and the work generated a target near the old Overlook mine. The target is coincident with a strong gold, copper, and arsenic soil anomaly but is an area that has never been drilled.

"Adamera Minerals Corp.'s current field program is designed to refine its targets through additional soil sampling and mapping work."

Adamera is being financially cautious and not drilling until it has defined high confidence targets. The current field program is designed to do just that: refine its targets through additional soil sampling and mapping work. Adamera's plan is to be ready to drill in the fall.

The company has been pretty quiet in recent months and its share price is accordingly quiet, trading sideways for the last two months. It's unlikely the current exploration program will generate results that grab major attention. My hope is that the work will boost confidence in the potential for good results from fall drilling, but I am aware that only those of us following the story closely will understand.

Either way, this investment is a speculation on that fall drilling. Shares are still inexpensive, so if Washington State exploration designed to feed a Kinross mill that is running out of ore piques your speculative interest, this is a good buy.

Northern Shield Resources Inc. (NRN:TSX.V) recently announced electromag (VTEM) results from the Sequoi property and I liked what I saw.

All of Northern Shield's projects are in the Labrador Trough in Quebec and all have a similar story: They offer various signs of hosting Norilsk-style nickel-copper-platinum-group-element massive sulphide mineralization. The most advanced asset is Huckleberry, the project where South32 is funding work to earn an initial 50% stake.

A recent sampling and mapping effort at Huckleberry returned dozens of copper-mineralized samples; many also carried platinum group elements. The sampling work continued to highlight the Western Copper Zone as the main area of interest. Adding to that, a VTEM survey is still being interpreted, but initial analysis shows 15 conductors with conductivities in the range that would be expected from a segregated, copper-rich magmatic system plus several anomalies with higher conductivities as would be expected from a copper-nickel system.

The results were enough to convince South32 to drill, which should get underway shortly.

That's all Huckleberry. The latest results were from Sequoi, an adjacent property that Northern Shield owns outright and where the VTEM survey went after it finished up at Huckleberry.

The Sequoi survey returned six anomalies. The anomalies are interpreted to be 50 to 100 meters thick and 200 to 1,100 meters long.

In short, the VTEM results at Sequoi look great. There is zero guarantee that these anomalies outline nickel-copper-PGE mineralization until they are drill tested, but at this point the coincidence with magnetic highs, synergy with the geologic model, and size and shape bode well for success.

Northern Shield's VTEM work continues, with results expected next from the Se2 and Idefix properties.

This is early-stage elephant hunting. Right now things are looking good. If you are not yet on board, I would suggest buying a ticket.

Read what other experts are saying about:

With almost a decade of junior resource-focused journalism under her belt, Gwen Preston launched Resource Maven. Preston watches the wires, talks to her network and analyzes economics to identify resource news that matters and figure out how to profit. She focuses on early-stage exploration and development stories. Preston has been interviewed on CBC and in the Financial Post.

Want to read more Gold Report interviews like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see recent interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosure:

1) The following companies mentioned in this article are sponsors of Streetwise Reports: Adamera Minerals Corp. The companies mentioned in this article were not involved in any aspect of the article preparation. Streetwise Reports does not accept stock in exchange for its services. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

2) Gwen Preston: I or my family own shares of the following companies mentioned in this article: Red West Lake Gold Mines Inc., Adamera Minerals Corp. and Northern Shield Resources Inc. I personally am or my family is paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this article: None.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

4) Patrice Fusillo assisted Gwen Preston in compiling this article. Ms. Fusillo is an employee of Streetwise Reports. She owns, or her family owns, shares of the following companies mentioned in this article: None. She personally, or her family, is paid by the following companies mentioned in this article: None.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families may have a long or short position in securities mentioned. Directors, officers, employees or members of their families are prohibited from making purchases and/or sales of those securities in the open market or otherwise during the up-to-four-week interval from the time of the interview or the time an article is accepted for publication until after it publishes.