In an article posted recently in MiningWEALTH, Ben Kramer-Miller describes Terraco Gold Corp. (TEN:TSX.V) as a "a junior royalty company with a NSR royalty on Waterton's Spring Valley deposit." Though Kramer-Miller calls Spring Valley "a highly advanced, multimillion-ounce gold deposit in low-risk Nevada," Terraco's shares have yet to reflect the value of the Spring Valley asset. "As a result, we believe that there is a market disparity worthy of exploitation by shrewd investors," Kramer-Miller states.

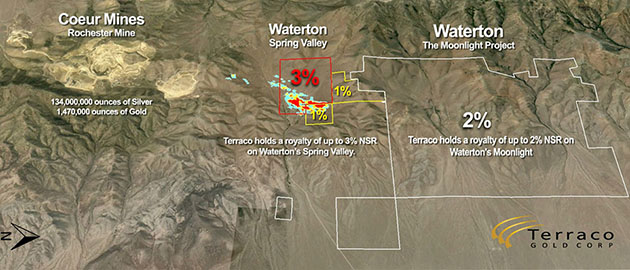

As noted in an in-depth look at Terraco in an article posted by The Critical Investor, the company "made headlines with a game-changing deal based on the well-known Spring Valley gold project (next to the Rochester mine owned by Coeur Mining Inc. [CDE:NYSE]) in Nevada" in May, and closed the "US$19M transaction with Solidus Resources, a subsidiary of Waterton Precious Metals Fund II Cayman, LP (in short Waterton)" in June.

The result, according to the expert, "was an extensive set of royalties on Spring Valley, and a resulting CA$3.3M in cash, besides [the company's] already owned Idaho asset."

Calling Terraco an "aggressive royalty (and former advanced exploration and development) company with experienced management and gold assets in mining friendly Nevada and Idaho," the article goes on to detail resources at the Spring Valley and Almaden/Nutmeg projects. In short, "both are heap-leach open-pit gold projects, of which Spring Valley can be touted as a world class project considering the size and grade of the resource, the jurisdiction and the financial backing," the article states, adding "Almaden/Nutmeg clearly provides a healthy project, and implies significant additional value to be added in the near future."

In his article, Kramer-Miller states the company has "strong management with skin in the game. . .led by Todd Hilditch who masterminded the Salares-Talison deal." In addition, "Terraco's board is loaded with geologists with experience in gold."

The Critical Investor asserts while Terraco has maintained steady growth over the past year, recent news and the resurgence of the gold market have resulted in further awareness of the company's promise. "As other coverage recently highlighted Terraco Gold, investor awareness is certainly increasing, and hopefully this analysis will add further to the robust story of this new royalty play," he writes.

Kramer-Miller, citing "overwhelming circumstantial evidence that Spring Valley is a high priority asset in Waterton's portfolio," contends that the value of the royalty company is "worth multiples of its current valuation. . .Terraco is a clear takeover target."

The Critical Investor sums it up this way: "The company is looking to position itself as a new royalty player, has a one of a kind royalty package on the excellent Spring Valley project, is advancing the prospective Almaden/Nutmeg project to PEA before the end of this year, has a very strong strategic partner in Waterton, and is looking for aggressive growth of its royalty portfolio in this new bull market for gold."

For investors, that means Terraco "is a very interesting long term gold play with fairly low downside risk, clear upside through development on very low costs, an expected premium for royalty/stream companies to happen, and lots of growth potential."

Read what other experts are saying about:

Want to read more Gold Report interviews like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see recent interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosure:

1) Tracy Salcedo compiled this article for Streetwise Reports LLC. Tracy Salcedo provides services to Streetwise Reports as an independent contractor. She owns, or her family owns, shares of the following companies mentioned in this article: None.

2) Terraco Gold Corp. is a billboard sponsor of Streetwise Reports. The companies mentioned in this article were not involved in any aspect of the article preparation. Streetwise Reports does not accept stock in exchange for its services. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Comments and opinions expressed are those of the specific experts and not of Streetwise Reports or its officers.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their families are prohibited from making purchases and/or sales of those securities in the open market or otherwise during the up-to-four-week interval from the time of the interview or article until after it publishes.

Additional disclosures about the sources cited in this article