Marcel Wijma, CEO and managing director of Van Leeuwenhoeck Research, when asked to comment on Resverlogix Corp. (RVX:TSX), said, "Resverlogix announced that it started a new Phase 1 trial with its lead drug apabetalone in patients with severe kidney disease. If successful, the clinical results will allow for more advanced kidney impairment and dialysis trials to proceed. The results are expected before the end of the year. This new trial is part of the company's strategy to expand its clinical program with apabetalone (RVX-208) into new indications and orphan diseases."

According to Wijma, Resverlogix had announced earlier that it intended to "initiate an Orphan Disease Program that will target diseases where BET inhibition may hold a promising approach. This will increase the probability that apabetalone can be filed for approval much earlier than anticipated with the current Phase 3 BETonMACE trial in high-risk cardiovascular patients. Also, pricing for rare indications could run into hundreds of thousands per patient per year. We also feel that this would increase the company's chances to make successful partnerships with pharmaceutical companies in different parts of the world."

In a May report Wijma stated, Resverlogix "holds a nine-year lead in the field of epigenetic small molecules for vascular disease risk reduction."

Calling findings from earlier trials in major adverse cardiac events (MACE) with RVX-208 "significant and intriguing," Wijma has set a CA$8.50/share target price for the company based on "the successful licensing deal with Shenzhen Hepalink Pharmaceutical Co., the initiation of the Phase 3 clinical trial BETonMACE [and] the commencement of other clinical research programs with apabetalone, specifically in orphan diseases."

Resverlogix's epigenetic approach to the treatment of cardiovascular and other diseases represents "a novel and important new area of focus for the pharmaceutical industry," according to the analyst.

"With a successful Phase 3 trial, and considering the market potential for RVX-208, we feel that a very significant upside potential for RVX-208 and Resverlogix is attainable," Wijma wrote.

In his June initiation report on Resverlogix, John Vandermosten of Zacks Small-Cap Research noted he expects top-line data in the BETonMACE trial to read out in 2018.

"With a potential impact on multiple markers for cardiovascular disease (CVD) we are optimistic on a materially significant impact on MACE," the analyst noted. "We view Resverlogix shares as undervalued, and in a position to provide long-term upside potential." Vandermosten established at target price of CA$5 per share; the company currently trades at ~CA$1.20 per share.

Vandermosten's report of July 29 maintained the target price of CA$5 and noted that "expansion into new geographies, the orphan disease program, and renal disease, could provide further upside to our valuation." He commented, "While we do not currently include a valuation component for an orphan renal indication, we recognize the attractiveness of this pathway, find it to be an unqualified positive and will adjust our model accordingly as development details become more certain."

The Phase 1 study for renal indications, Vandermosten noted, "is being conducted in New Zealand and [the company] expects to post results in the second half of 2016, after which additional renal impairment and dialysis trials will proceed if positive data is seen. We hope to see a Phase 2 trial begin shortly after the completion of the data analysis and [Resverlogix] could potentially obtain approval in a renal indication under an orphan designation prior to an approval for high-risk cardiovascular disease."

The new trial, in which two patients have been enrolled, "has the potential to create increased value for apabetalone in new high-risk patient segments [that] have shorter development paths to product registration and market adoption," the epigenetics-based company announced in the July 21 press release.

Apabetalone's ability to selectively inhibit a specific BET domain "produces a specific set of biological effects with potentially important benefits for patients with diseases such as high-risk cardiovascular disease (CVD), diabetes mellitus (DM), chronic kidney disease, Alzheimer's disease, orphan diseases, and peripheral artery disease, while maintaining a well-described safety profile," according to the company.

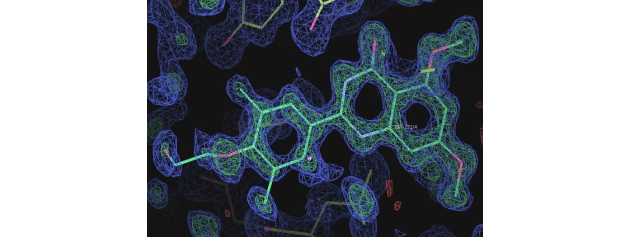

RVX-208 is intended to inhibit bromodomain and extra terminal domain (BET) proteins. The Phase 3 trial, known as BETonMACE, is focused on patients with chronic kidney disease, DM, and low HDL (high-density lipoprotein). The Phase 3 study is currently "enrolling as planned," the company stated.

Read what other experts are saying about:

Want to read more Life Sciences Report interviews like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see recent interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosures:

1) Tracy Salcedo and Patrice Fusillo compiled this article for Streetwise Reports LLC. Tracy Salcedo provides services to Streetwise Reports as an independent contractor. She owns, or her family owns, shares of the following companies mentioned in this article: None. Patrice Fusillo provides services to Streetwise Reports as an employee. She owns, or her family owns, shares of the following companies mentioned in this article: None.

2) The following companies mentioned in the article are sponsors of Streetwise Reports: Resverlogix Corp. The companies mentioned in this article were not involved in any aspect of the article preparation. Streetwise Reports does not accept stock in exchange for its services. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Comments and opinions expressed are those of the specific analysts and not of Streetwise Reports or its officers.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their families are prohibited from making purchases and/or sales of those securities in the open market or otherwise during the up-to-four-week interval from the time of the interview or article until after it publishes.

Additional disclosures about the sources cited in this article