The Gold Report: The year started off with quite a lot of volatility. From your perspective in Switzerland, what was the root cause of the stock decline? China, the Middle East, the United States?

Florian Siegfried: In our November 2014 interview, we outlined the notion that the cycling credit markets were undergoing a profound change where typically we see spreads going into widening. That climaxed in December of last year when we experienced a dramatic spike in spreads.

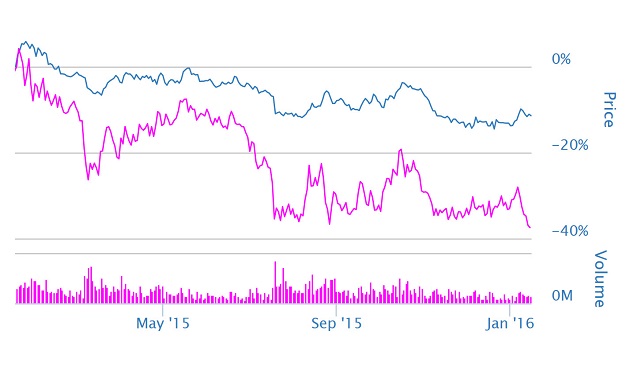

China and the Middle East are more of a catalyst than a cause for the volatility. The root cause is, in my opinion, from the credit side. This is why probably people are nervous. They see yields going up in the high-yield market. It's still a very leveraged market with a lot of marching yields that have to be served now with lower prices, which creates a downside momentum. I think we have been answering the cyclical bear in equities. This should be good for gold on the other side, which is probably forming a bottom here. We are most likely at the late stages.

"Falco Resources Ltd. released some metallurgy results that are looking quite robust."

TGR: What are the indicators you watch to understand these cycles?

FS: In addition to the high-yield bond markets, the other indicator is action in the reverse repo market whereby the Federal Reserve is somehow sucking up liquidity by selling treasury bonds to the banks. Interestingly, the oil price falling so dramatically goes vis-à-vis with quite an explosive volume in the reverse repo market. This is probably related to underlying oil derivatives of hedges being unbound, and with WTI crude oil now trading below $30 per barrel the situation could get serious for the exposed big banks. In my opinion, that's all related and a cause for concern because it's created this liquidity now.

TGR: At the same time, gold is flirting with $1,100/ounce ($1,100/oz) levels. Is that related as well?

FS: As the economic conditions are deteriorating, oil prices continue to fall, credit defaults are set to rise and currencies are tumbling, I think we are building a floor in the gold price. Nevertheless, the sentiment is still extremely negative in gold and precious metals, which is probably an indicator that we could be at the turning point. A few weeks ago, a leading Swiss private bank was recommending its clients sell all gold. That was days before the equity market started to tank and gold took off. I consider this kind of capitulation by big institutions as a reliable contrarian indicator that the precious metals sector is about to turn around.

TGR: Is $1,100/oz a high enough price that some mining companies can be profitable?

FS: It depends on the company. What is driving earnings for many producers is not the U.S. dollar price but the Canadian gold price or the Australian dollar gold price, which are currently trading at $1,580/oz, up another 8% to 9% alone this year. This is a two- to three-year high price, and it's a good price. The smaller Australian or Canadian producers get the whole benefit from currency depreciation.

Last year Australian miners enjoyed an extremely good market. A basket of six Australian midtier gold producers would have returned between 50% and 70% in the year. I think a $1,100/oz gold price, when you transfer it to local currencies, is a good price. The U.S. producers, which are not getting the same benefit because they have a high dollar, are clearly underperforming in this market. So each company has to be evaluated independently.

TGR: Let's talk about some of the companies we discussed in your interview last August.

FS: Torex Gold Resources Inc. (TXG:TSX) had some good news at the end of December when it was celebrating the first gold pour at El Limon. Recall El Limon is really a world-class asset with more than 5.5 million ounces (5.5 Moz) and a relatively high-grade resource. I think it's significant because the company spent $800 million ($800M) on the project in a downmarket, and achieved production on time and on budget, which underlines the quality of the management when it comes to execution. Let's see how the ramp-up goes. Usually, nothing goes straight in mining, but the rerating potential here is very interesting for investors because Torex was trading sideways all over the last few years. It has become a show-me story. If the company can deliver economic commercial production, Torex is a name you want to own because it has more than 2.5 grams per ton (2.5 g/t) in its resource category, which is very rare these days.

"TerraX Minerals Inc. has the kind of exploration model that continues to work in this challenging market environment."

The other thing to keep in mind with Torex is the second deposit, Media Luna, is even bigger. It's 7.4 Moz gold equivalent (Au eq). It has only a preliminary economic assessment (PEA) at this stage, but expect all-in costs of $636/oz Au eq. The catalyst could be moving this PEA into some sort of feasibility study and connecting the Media Luna deposit with the mill through some sort of a conveyor belt, which is the strategy of President and CEO Fred Stanford.

TGR: Do you want to update us on the company that was acquired?

FS: St Andrew Goldfields Ltd. (SAS:TSX) is being acquired by Kirkland Lake Gold Inc. (KGI:TSX). I think the merger makes sense for shareholders because the new Kirkland Lake will be the new big kid in town in the Abitibi gold belt. It operates four producing mines, with annual expected production around 260,000–310,000 oz per year at all-in costs of below $1,000/oz. On top of that, you get in the combined entity a very nice underexplored land package from St Andrew, which goes over 120 kilometers of strike length along the Destor-Porcupine fault zone. Given the close proximity of St Andrew's Holt and Kirkland's Macassa mine, I would expect some good operational synergy among the operations once they are combined.

"Victoria Gold Corp. has received all the permits for the Eagle project in the Yukon."

The acquisition looks good on paper, but we have to see if it will pass the reality check. It is really difficult to create shareholder value through merger and acquisition (M&A) transactions. But in the case of Kirkland, the management has been on board for more than two years and created credibility as a turnaround agent for an underground mine. That is why I expect Kirkland to achieve the synergies the market is expecting. Obviously, the market does not think that Kirkland Lake paid too much based on the 25% premium. St Andrew has had a very nice ride. I think the shareholders are happy to get good paper and become Kirkland Lake shareholders.

TGR: In that interview, you named another possible future takeover target that you saw in the Abitibi belt. Can you update us on that?

FS: Falco Resources Ltd. (FPC:TSX.V) is still too early stage. It is developing its Horne 5 deposit in Val-d'Or. In December it released some metallurgy results that are looking quite robust. The next step for Falco is to move the project to a PEA in H2/16. Management wants to take as much risk as it can out of the deposit and show the market that there could be a mine. It has the ingredients. It has a high-grade ore body and given the elevated gold price in Canadian dollar terms, this should bode well for the preliminary economics in a PEA. But the institutional shareholders backing the company don't want the company to be sold out at these levels. They want to move the project along, get a higher share price and then sell it to a major once it has a reasonable resource, a good PEA or even a feasibility study.

TGR: How large of a resource are you expecting when it announces that?

FS: The current maiden resource sits at 2.8 Moz Au eq, but management thinks this number will grow to >3.5 Moz Au eq through confirmation drilling. I think the Falco management team is thinking big numbers, and I would not be surprised to see something between 4 and 5 Moz Au eq eventually.

TGR: You mentioned another Canadian company in the Northwest Territories. How is that one doing?

FS: TerraX Minerals Inc. (TXR:TSX.V) is an interesting one. It has this huge district called the Yellowknife City gold project, just north of city of Yellowknife in the Northwest Territories. It's a past-producing area of some 14 Moz. It has to focus on defining an initial resource on two zones, Crestaurum and Barney Shear. The market's expectations are quite high because it's a resource-rich belt and quite prolific. In order not to disappoint those expectations, I would say the resource should be at least 1.5–2 Moz to start with. TerraX raised $6M last year and made some additional discoveries at Yellowknife City. West of Barney Shear, it had assays of up to 130 g/t gold. Let's see what comes out. But I would expect something between 1.5 and 2 Moz would definitely be a good resource. We could see that this year.

TerraX Minerals is the kind of exploration model that continues to work in this challenging market environment. Most companies have no access to capital and are completely diluting their shareholders if they raise equity at current prices. Some of them will become takeover targets but with no benefit to the shareholders. But TerraX is very lean. Management is incentivized through options and through a 15% stake in the company and doesn't draw a salary so most of the money that the company raises will go into the ground. This should really be the model for the exploration industry as a whole, not to pay big salaries, but have low general and administrative expenses and deploy the capital raised as effectively as the company can.

TGR: What about a new name that you're excited about?

FS: I think Victoria Gold Corp. (VIT:TSX.V) is interesting because it has received all the permits for the Eagle project in the Yukon. The company raised a little capital recently to do some drilling, but the management is not going to build the mine now because it's probably impossible to raise the capital, which is north of $300M. Victoria also doesn't want to sell any kind of royalties or get any kind of expensive debt financing now. I think it is doing it the right way. It is very prudent to wait for better times. This is, in the end, why I think it will pay out for shareholders. Many companies are so distressed, they want to build the project and need to get any financial terms they are being offered. Victoria has the cash to keep the lights on for the next two to three years and doesn't want to dilute its shareholders at the low point of the market. I think that kind of management will be reflected in a higher share price going forward.

TGR: At the Silver Summit, Rick Rule was talking about how he valued "optionality," meaning that management doesn't do anything to waste shareholder value until the market gets better. Others we have interviewed, including Bob Moriarty, have celebrated this as a great time to move projects forward because everything from oil to manpower is less expensive. Which camp do you fall in?

FS: I think it's the perfect time to buy and build a mine. In the last 15 years, costs have never been lower. Oil is collapsing below $30 a barrel, so energy is cheap. There is excess capacity from the base metal players and the contractors. This is the time to bargain on project development and get cheap financing from equipment leasing agents to build a mine. There is also not a lot of competition to acquire new assets. Most companies are very stretched financially and have no cash to pay. That leads to a situation where only the best run companies or the ones that have cash can execute on M&A transactions. It's all part of buying low and selling high. This is the time where value is created.

Regarding optionality, I think this is of upmost importance when it comes to project development. Let's make the simple assumption that a company is building a mine today based on a $1,100/oz gold price and the minable resource in the block model consists of 50% of the total resource. The other 50% of the resource is considered not economical at a current gold prices. Let's assume next that when the mine has been built and is up and running, the gold price rises to $1,400/oz and at this level probably 80% of the total initial resource is considered economical. At this point the company would want to mine that additional 30% of the resource because it generates additional cash flow. However, it may only do so if it can expand the mine at a reasonable additional capital expense. Otherwise, the project expansion yields a negative rate of return. This is the kind of project optionality that can potentially add significant project value in the future in a rising gold price environment but is not reflected at current share prices. For investors, this is like a free option without an expiry date on a rising gold price.

For investors, my recommendation would be to watch closely what companies are buying, contact the management team about their plans and how much capital they need to put an old mine back into production, how much time they would require to put out a new feasibility study and what they expect in terms of cost savings. Avoid investing in companies with a "bull market" mentality, where management has not taken the necessary cost cutting measures in the past to preserve cash and continues to operate at a suboptimal efficiently level. That is how you will avoid pitfalls and find the right companies to watch.

TGR: Thank you for your time, Florian.

Florian Siegfried is head of precious metals and mining investments at AgaNola Ltd., an asset management boutique based in Switzerland. Previously Siegfried was the CEO of Precious Capital AG, a Zürich-based fund specializing in global mining investments. Prior to this Siegfried was CEO of shaPE Capital, a SIX Swiss Exchange-listed private equity company that was founded by Bank Julius Baer & Co. Siegfried holds a masters degree in finance and economics from the University of Zürich.

Read what other experts are saying about:

Want to read more Gold Report interviews like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see recent interviews with industry analysts and commentators, visit our Streetwise Interviews page.

DISCLOSURE:

1) JT Long conducted this interview for Streetwise Reports LLC, publisher of The Gold Report, The Energy Report and The Life Sciences Report, and provides services to Streetwise Reports as an employee. She owns, or her family owns, shares of the following companies mentioned in this interview: None.

2) The following companies mentioned in the interview are sponsors of Streetwise Reports: TerraX Minerals Inc., Victoria Gold Corp. and Falco Resources Ltd. The companies mentioned in this interview were not involved in any aspect of the interview preparation or post-interview editing so the expert could speak independently about the sector. Streetwise Reports does not accept stock in exchange for its services.

3) Florian Siegfried: I own, or my family owns, shares of the following companies mentioned in this interview: St Andrew Goldfields Ltd., Kirkland Lake Gold Inc. and Victoria Gold Corp. I personally am, or my family is, paid by the following companies mentioned in this interview: None. My company has a financial relationship with the following companies mentioned in this interview: None. I was not paid by Streetwise Reports for participating in this interview. Comments and opinions expressed are my own comments and opinions. I determined and had final say over which companies would be included in the interview based on my research, understanding of the sector and interview theme. I had the opportunity to review the interview for accuracy as of the date of the interview and am responsible for the content of the interview.

4) Interviews are edited for clarity. Streetwise Reports does not make editorial comments or change experts' statements without their consent.

5) The interview does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer.

6) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their families are prohibited from making purchases and/or sales of those securities in the open market or otherwise during the up-to-four-week interval from the time of the interview until after it publishes.