The Gold Report: What's your gold price forecast for the rest of 2015?

Joe Reagor: For the full year, our average price is $1,260 per ounce ($1,260/oz). If the U.S. dollar were to remain steady and not strengthen, gold could reach $1,300/oz by year-end.

TGR: Gold was sold off heavily in the last week of April based on an anticipated interest rate hike by the Federal Reserve. Should the Fed actually raise the rate, how much of a negative effect will that have on gold and for how long?

"Integra Gold Corp.'s Lamaque is a near-term production opportunity with a minimal capital budget and an after-tax IRR of over 50%."

JR: It is commonly believed that rates will rise because the U.S. economy is improving, but we keep getting mixed signals. The most recent jobless claims were exceptionally good, but the Q1/15 GDP increase was only 0.2%. If we see a stiff rate increase because the Fed thinks the economy is strengthening, that could be bad for gold. Should the Fed choose to raise rates slowly over time, giving it the option to lower rates again if need be, I don't think that's bad for gold.

TGR: Some people believe that a stiff rate hike would spook the market and cause an equities crash. What do you think?

JR: I doubt the Fed would move on that without first providing a cushion to the markets. Should a rate hike spook the market and force the Fed to quickly lower rates again, I think gold would move higher quickly.

TGR: Is it possible an interest rate hike has already been priced in to the price of gold?

JR: The expectation of rate hikes is definitely priced into gold inherently through the strength of the U.S. dollar, as compared to, say, Europe, which has been forced to introduce further quantitative easing.

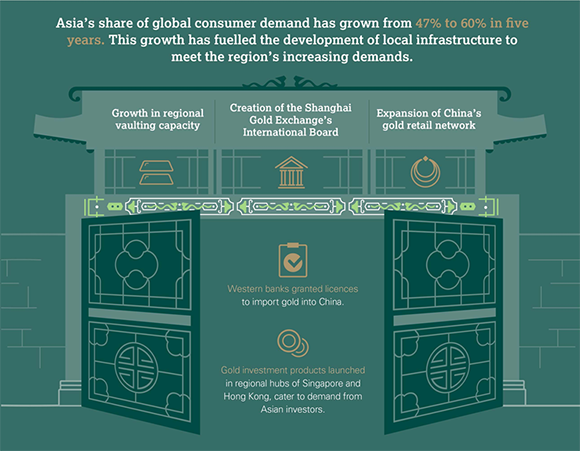

TGR: The World Gold Council (WGC) 2014 survey showed continuing strong demand for physical gold both from Asian consumers and central banks. Do you think this trend will continue?

JR: Definitely. The WGC's Q1/15 survey demonstrates that this trend is continuing. We believe that China will maintain its position as the world's largest consumer of gold as a store of value, with India as the largest consumer of gold for jewelry.

TGR: Over the past year Russia has bought more than $7 billion ($7B) worth of gold bullion. Its total gold holdings of 1,208 tons are worth $49B, making it the world's fifth-largest holder. Some suggest that Russia and China are working in concert to use gold as part of a strategy to shift economic power from the U.S. to this rival axis. Is there any credence to this?

JR: I believe Russia and China would prefer that the U.S. dollar not remain the world's reserve currency, which would shift the dynamics of the pricing of many commodities, not just gold. Exactly how they intend to accomplish this is not certain, but there's no question that this pushback against the U.S. dollar has the support of many countries.

TGR: Shouldn't rising physical gold demand force higher gold prices?

JR: The contract (or paper) gold market is significantly larger than the physical gold market. So an increase in physical demand doesn't necessarily result in enough of a total increase in gold demand to force higher prices in U.S. dollars.

"Part of the reason we like Pretium Resources Inc. so much is that it is now so close to the finish line."

Outside the U.S., the value of gold in other currencies is up almost 20% already this year, which should result in better margins for non-U.S. producers. Should the U.S. dollar weaken by, say, 10%, that would move the gold price up to around the $1,300/oz we're predicting for year-end 2015. Beyond that, we believe that rising marginal production costs could drive gold to $1,450/oz.

TGR: What are your forecasts for the prices of silver and zinc for the rest of 2015?

JR: We expect a gold-silver price ratio of 70. Based on $1,300/oz gold, that would mean a silver price of about $18.50/oz.

Our zinc forecast is a conservative $1.15 per pound by year-end. We believe there could be a serious zinc shortage by 2016. MMG Inc.'s (1208:HK) Century mine in Australia, which alone produces 4% of world zinc, will close shortly. Already, the London Metals Exchange (LME) zinc inventory has fallen from 1.2 million tons two years ago to under 500,000 tons (500 Kt) today.

TGR: Given that silver is easier to buy and store than gold, could a decline in confidence in the U.S. dollar lead to the gold-silver ratio falling toward lower historic norms?

JR: Perhaps over time the ratio will move to 65 or 60, but I doubt that we will see a return of 2010–2012, when it was below 50. The recoverable ratio of silver to gold in the average deposit discovered today is now closer to 80. This is due to significant recent improvements in silver recovery rates that have not been matched by gold recovery rate improvements, which came decades earlier.

TGR: Can we expect an increase in the number of pure-play silver companies?

JR: Not without sustained higher gold and silver prices. Miners generally are moving away from pure plays in order to lessen the impacts of swings in the prices of precious metals. In recent years, a number of big silver producers have made gold asset purchases and have built mines with strong base metals components so they can operate even in down markets.

TGR: Which Canadian juniors with near-term gold projects are your favorites?

JR: There are two: Pretium Resources Inc. (PVG:TSX; PVG:NYSE) and Integra Gold Corp. (ICG:TSX.V; ICGQF:OTCQX). Pretium's more of a mid cap, but because it is in the development stage and doesn't have revenues, we put it in the junior basket.

TGR: Pretium has reached two milestones this year: permitting approval of the Brucejack project by the British Columbia government and the signing of a cooperation and benefits agreement with the Nisga'a Indian band. How do these events affect their valuation?

JR: Pretium has derisked its asset but still has two hurdles remaining. The company needs federal permitting, which is expected to take 150 days from the receipt of the environmental permits, and it needs to complete the financing process. Part of the reason we like this company so much is that it is now so close to the finish line.

There has been an overhang on Pretium's valuation since Strathcona Mineral Services stepped away during bulk sampling in October 2013.

TGR: The Brucejack deposit has been characterized as "nuggety," which is often hard to understand. Has Pretium demonstrated greater confidence in the quality of its resource since 2013?

JR: When Strathcona stepped away, Pretium was only 2 Kt into a 10 Kt bulk sample. The remaining 8 Kt came in above expectations and demonstrated that Brucejack does have significant gold-production capabilities. Pretium got 5,800 oz gold out of 10 Kt, and its target was only 4,000 oz.

Brucejack is not "nuggety" in the sense of how we understand that term in the U.S. and Canada. The deposit structure is more similar to that which we see in islands in the Pacific Ocean, which makes sense because geologists tell us that part of British Columbia was an island before it joined the mainland. Brucejack has high-grade veinlets and thus manifests quite variable gold grades. There will be pockets with a low-grade halo and then a spike of visible gold will appear.

TGR: How does Pretium propose to deal with this variability?

JR: By employing large-scale bulk mining in order to capture all the gold.

TGR: Brucejack will require a capital expenditure (capex) of $747 million ($747M). How does Pretium intend to raise it?

JR: The company raised CA$81M in equity in January. We expect that the rest will be raised through a combination of bank debt and a gold-streaming agreement, perhaps 50% bank debt and 25% gold streaming, which wouldn't leave much in the form of equity to be raised. We're pretty confident that we'll see that in the next two to three months.

We would also note that because of the weakness of the Canadian dollar, the capex might be reduced by as much as 20% in U.S. dollar terms.

TGR: When do you expect Brucejack to begin construction and then production?

JR: Should Pretium break ground in July, that would put it on a timeframe of Q1/17 for first production.

TGR: Is Pretium a takeover target?

JR: We don't really expect this unless it was to happen before financing is completed, and that's expected pretty soon. To buy Pretium and develop Brucejack would cost about $1.5–1.8B all told, and that would be a big risk for a major to take on in this environment.

TGR: Let's talk about Integra's Lamaque gold project in Quebec. How does it compare to Brucejack?

JR: Lamaque is a much smaller project. Brucejack has 10+ million ounce (10+ Moz) gold, while Lamaque has about 1 Moz gold Indicated and Inferred. We like Lamaque because it's a small, very simple project with an average grade of over 9 grams per ton gold. There is an existing mill, and the preproduction capex is only $62M. Integra already has permits for three of the four potential production site ore bodies. So this is a near-term production opportunity with a minimal capital budget and an after-tax internal rate of return of over 50%. It could be very interesting to some of the other mid-cap gold and silver producers.

TGR: Integra closed a $13M bought-deal private placement May 1. How does it stand for financing?

JR: Integra wasn't cash poor to begin with, and this money provides the additional means to get Lamaque shovel ready over the next six to nine months and develop the underground deposits. Integra is not in a rush, from a production standpoint. I think it wants to optimize the asset a little bit first, which could result in an even higher potential rate of return on the project.

There remains the possibility that Lamaque could be financed via a larger company earning in to the project, which would still maintain a significant portion of the upside for shareholders.

TGR: When do you anticipate first production at Lamaque?

JR: It's tough to say because the company hasn't really given a solid timeline, but we expect it could be in 24 to 36 months. The mill is already built and just needs some refurbishment. If Integra decides to spend more time on exploration, it will be closer to three years than two.

TGR: Which U.S. junior with a near-term gold project is your favorite?

JR: We really like Solitario Exploration & Royalty Corp. (SLR:TSX), mainly because its Mt. Hamilton project in Nevada is effectively shovel ready. The company needs one last permit. My sense is that it may actually look to sell this asset. Solitario was initially a project generator, and Mt Hamilton was its first attempt to bring a project all the way to production.

Capex is $91M, and it would be tough for a company this small to finance it on its own. It would be much easier for a mid- to larger-cap gold producer to see it as an opportunity to enter the Nevada market with a simple project in a great jurisdiction that would produce gold at $558/oz.

Whether Solitario owns it or not, Mt. Hamilton should begin construction this year, with production beginning in early- to mid-2017.

TGR: Solitario's market cap is only $35M. This suggests a great deal of potential leverage, does it not?

JR: Mt. Hamilton alone probably justifies the market cap. The company has other assets in South America that are carried either to production or to feasibility study. One in particular, the Bongará zinc project in Peru, has significant upside. This is a joint venture (JV). Brazil's Votorantim Group is earning in through one of its subsidiaries. If Votorantim brings it to production, it would have a 70% interest, and Solitario would retain 30%. Solitario would have to repay the cost of construction to Votorantim but would retain 50% of its share of cash flow generated by the mine.

TGR: Given what you said about a future zinc shortage, isn't this is a timely asset to have?

JR: It is. We anticipate 2019 production. However, its asset value could rise sharply should the price of zinc spike, and that could force Votorantim to buy Solotario out. So Solitario could have, within less than two years, two opportunities to sell assets and return value to shareholders.

TGR: Would you name a mid-tier gold producer you think is underappreciated by the market?

JR: IAMGOLD Corp. (IMG:TSX; IAG:NYSE) has not gotten credit for its improvements.

TGR: How specifically has the company improved?

JR: First, IAMGOLD sold a niobium mine for $500M. This put the company in a net cash position for the first time since 2013. There is no longer any worry it could be forced into bankruptcy when its debt came due assuming the cash is used to repay debt. The company is considering using some of this capital to finance acquisitions or potentially to buy out some partners on smaller-scale assets. Our preference would be that IAMGOLD uses the majority of the half-billion dollars to repay debt, and I expect it to make a decision to do so by the end of 2015 or early 2016. This would fundamentally strengthen the company.

The second way the company has improved is by reducing costs at the majority of its mines. That puts IAMGOLD in a much better position to be sustainable at low gold prices, but because it is also somewhat of a higher-cost producer, it still has significant leverage in a gold price recovery.

TGR: What are its prospects for growth?

JR: Mostly through the expansion of existing assets over the next two to three years.

TGR: Do you see IAMGOLD as a takeover target?

JR: I don't think the company is a takeout target because its management team is a bit different from the norm. They're more from the energy sector and so they don't have the usual personal connections with other companies in this sector.

I think IAMGOLD's management is more concerned with delivering value to shareholders. On the acquisition side, I think a smaller-scale buy would be viewed as a positive by the market. There has been some speculation about larger asset purchases, but I think that's a bit more than the company can afford to bite off at this time. And I think IAMGOLD knows this.

TGR: Agnico Eagle Mines Ltd. (AEM:TSX; AEM:NYSE) has bought three companies in the last two years at very attractive prices. Should miners strike while the iron is hot, and valuations are low?

JR: Some of the smarter companies with very strong balance sheets—and Agnico falls into that category—are buying up earlier-stage assets that are far enough along so that there is a vision of how long it will take to get them into production and what their potential returns are.

The vast majority of people expect that over the next two to three years there should be a substantial recovery in gold prices. So Agnico is trying to be ahead of that curve, as are some other mid caps. I don't see this sort of thing coming as much from the majors, however. A lot of them did their buying at the top, and their balance sheets aren't as clean as they once were.

TGR: A great many investors in gold equities fled after the price of gold fell from over $1,900/oz to almost $1,100/oz. Does this smaller market mean more bargain companies with greater leverage?

JR: Yes, there are some bargains out there. But I think it will take a catalyst of some sort for investors to return to the market. I've heard repeatedly that many investors believe certain spaces are a bit frothy now, and if we see a pullback in some of them, capital would be freed up to invest in mining as an alternative in longer-term portfolios.

TGR: Joe, thank you for your time and your insights.

Joe Reagor is a research analyst with ROTH Capital Partners, providing equity research coverage of the natural resources sector. Prior to ROTH, he worked in equity research at Global Hunter Securities and at Very Independent Research, covering a wide array of resources companies including metals (steel and aluminum), mining (gold, silver and base metals) and forest products (containerboard, OCC, UFS and pulp). Reagor earned a Bachelor of Arts in economics and mathematics from Monmouth University.

Joe Reagor is a research analyst with ROTH Capital Partners, providing equity research coverage of the natural resources sector. Prior to ROTH, he worked in equity research at Global Hunter Securities and at Very Independent Research, covering a wide array of resources companies including metals (steel and aluminum), mining (gold, silver and base metals) and forest products (containerboard, OCC, UFS and pulp). Reagor earned a Bachelor of Arts in economics and mathematics from Monmouth University.

Read what other experts are saying about:

Want to read more Gold Report interviews like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent interviews with industry analysts and commentators, visit our Streetwise Interviews page.

DISCLOSURE:

1) Kevin Michael Grace conducted this interview for Streetwise Reports LLC, publisher of The Gold Report, The Energy Report and The Life Sciences Report and provides services to Streetwise Reports as an independent contractor. He or his family own shares of the following companies mentioned in this interview: None.

2) The following companies mentioned in the interview are sponsors of Streetwise Reports: Pretium Resources Inc. and Integra Gold Corp. The companies mentioned in this interview were not involved in any aspect of the interview preparation or post-interview editing so the expert could speak independently about the sector. Streetwise Reports does not accept stock in exchange for its services.

3) Joe Reagor: I own, or my family owns, shares of the following companies mentioned in this interview: Agnico-Eagle Mines Ltd. I personally am, or my family is, paid by the following companies mentioned in this interview: None. My company has a financial relationship with the following companies mentioned in this interview: None. I was not paid by Streetwise Reports for participating in this interview. Comments and opinions expressed are my own comments and opinions. I determined and had final say over which companies would be included in the interview based on my research, understanding of the sector and interview theme. I had the opportunity to review the interview for accuracy as of the date of the interview and am responsible for the content of the interview.

4) Interviews are edited for clarity. Streetwise Reports does not make editorial comments or change experts' statements without their consent.

5) The interview does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer.

6) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their families are prohibited from making purchases and/or sales of those securities in the open market or otherwise during the up-to-four-week interval from the time of the interview until after it publishes.