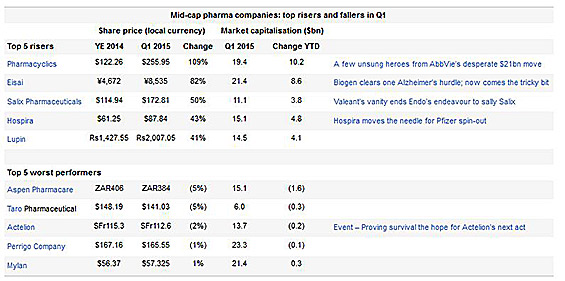

The best and worst performing mid-caps are likely to look very different later this year compared with at the end of the first quarter. For one, Pharmacyclics, Salix Pharmaceuticals and Hospira will no longer exist as they are folded into their respective buyers AbbVie, Valeant and Pfizer.

For another, Perrigo and Mylan were among the worst performers of the quarter – worst being a relative term when the latter rose 1% – and their shares have both rocketed this month on Mylan's proposed takeout of Perrigo. These changes demonstrate how M&A continues to define this peer group, making inexpensive biotech assets as rare as hen's teeth.

Who Was Not Bought?

In the absence of the takeout targets, the biggest mid-cap riser so far in 2015 is Eisai, which was buoyed by positive early data from Biogen's Alzheimer's disease project BIIB037, to which it has an option for co-development and co-commercialiaation. Looking at significant risers that would make the top five in the absence of the takeout targets, Kyowa Hakko Kirin and United Therapeutics figure prominently.

Big faller Aspen Pharmacare – again, big being relative in that it declined 5% – was knocked by GlaxoSmithKline’s decision to sell half of its 12.4% stake in the South African blood-products and generics group.

Actelion's 2% decline in the first three months is a bit of a surprise given success in defending its PAH franchise, but it is coming off record highs that coincided with the topline readout of the Griphon study of Uptravi. The macro effect of Switzerland's decision to unpeg its currency from the euro was a bigger effect, causing shares to tumble along with compatriots Roche and Novartis in January.

CAR-T Pulls the Sector

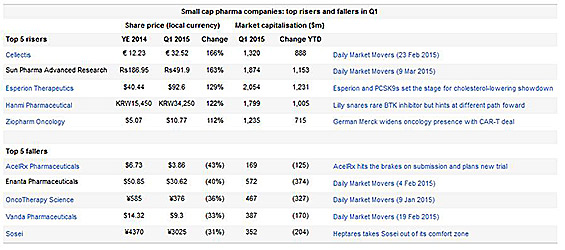

Among the smaller players it is hard to ignore the impact of CAR-T on the sector. The French group Cellectis and Massachusetts-based Ziopharm Oncology bracketed the top risers in the small-cap sector as enthusiasm for the engineered T-cell technology reached fever pitch.

Other beneficiaries in this grouping were Esperion Therapeutics, which in PTC-1002 hopes to have a small-molecule answer to the potent cholesterol-lowering biologicals Praluent and Repatha, and the South Korean group Hanmi Pharmaceutical, which licensed to Lilly the BTK inhibitor HM71224, from the same pharmaceutical class as Pharmacyclics' Imbruvica.

It does not hurt that many of these companies appear to be relative bargains compared with the pricey mid-caps as investors hunt for better value in the midst of the biotech boom.

The biggest fallers have all faced clinical, commercial or strategic setbacks, with the curious exception of Enanta. That group should be riding high with the launch of its protease inhibitor paritaprevir as part of AbbVie's Viekira Pak, but the product has struggled in the face of Gilead Sciences’ dominance in hepatitis C. News on the next-generation combination containing Enanta's ABT-493 could lift the company’s shares later in the year.

In the smallest of the small, immuno-oncology again has made its presence known in the guise of MediGene, which moved into this field with the takeout last year of Trianta Immunotherapies. Pfenex, meanwhile, was the beneficiary of one of the other great themes of 2015 as it struck a deal with Hospira on a biosimilar version of Lucentis.

In the fallers, MEI Pharma and Can-Fite BioPharma were the two with clear-cut setbacks, leading to significant falls. MEI’s myelodysplastic syndrome project pracinostat fell short and Can-Fite's psoriasis candidate, CF101, failed in phase 2/3.