Are we too focused on gold's U.S. dollar performance to see its real value for those outside the U.S.?

LBMA gold price end 2013: US$1,201.50; Gold price end 2014: $1,199.25—only down a minute 0.19% over the year. Thus, by effectively marking time vis-à-vis the U.S. dollar over the full year gold outperformed virtually all other currencies in maintenance of value.

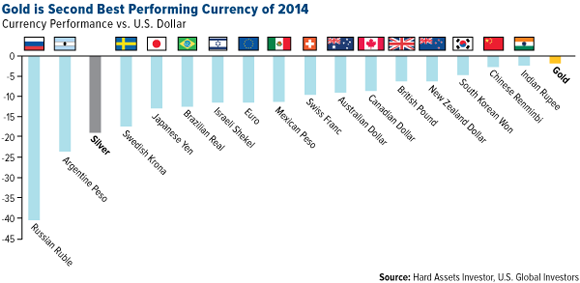

Frank Holmes of U.S. Global Investors pointed this out neatly with the graph below in a recent article. Indeed its LBMA afternoon price on Dec. 30 at $1,206 was actually 0.4% higher than its 2013 close in U.S. dollars too but something of a dollar rally on the morning of Dec. 31 brought it down a little. See Frank Holmes' chart below comparing key currency performance with that of the US dollar over the year. To read his full original article click on Gold Beat All Other World Currencies in 2014. Spot gold prices fell further after the London "fix" but have since recovered in early trade Monday back up to the low $1,190s.

While many gold investors may have considered 2014 a poor year with gold making early-year moves upwards before coming back down again in the latter part. However if one looks at the strength of the U.S. dollar (or perhaps this should be the weakness of other currencies vs the dollar) with the dollar index rising 12.4% over the year, an investment in gold in any other currency will have seen a decent increase over the year. And if one lives in Russia or Argentina, or even in Sweden or Japan, the percentage increase would have been large indeed! Gold has thus, over 2014, performed extremely well globally as a wealth protector. As an example—in Swiss Francs the gold price actually rose 9.5% over the year. In the Russian ruble it rose no less than 77% over the period. Perhaps we are far too focused on gold's U.S. dollar performance to see its real value for those outside the U.S. Sometimes one needs to take a step back and look at other valuation parameters.

For the time being at least, gold seems to have found something of a price equilibrium at, or perhaps a little below, the $1,200/ounce level. Every time it slips back below this kind of level it seems to quickly recover back to it. We might argue that this is the kind of level China is comfortable with—see: Path of the gold price is in China's hands. Whether China is, or is not, keeping the price at this level is obviously open to speculation, but it certainly has the capability of so doing.

By comparison, silver investors almost everywhere have had a pretty dismal year. Of the countries featured in Frank Holmes' chart above, only silver investors in Russia and Argentina will have seen value protection or growth in their own currencies, but then silver perhaps isn't generally looked upon as a safe haven metal in the same way as gold. Silver investors take much more of a gamble than those investing in gold given the white metal's vastly increased volatility over its yellow sibling—volatility which has been particularly evident on the downside over the past year.

This year's silver price performance, or lack of it, could be considered remarkable vis-à-vis gold with which it usually has a closer relationship. By many calculations silver is currently in a supply deficit, but this seems to have had no positive effect on price movement. The key silver price drivers at the moment appear to be purely speculative and as a much smaller market than gold, speculators have a far easier path to price manipulation than with gold. And there is a belief nowadays by many gold followers that the gold price is being manipulated too by mega-money players. If the manipulation premise is correct, then the gamble therefore with silver is in picking the point at which the speculators change tack to make huge profits on an upturn. Maybe this point is near, but relying on this is not for widows and orphans.

Lawrence Williams

Mineweb