Despite a relatively low gold price, 2014 marked a banner year for the Precious Metals Summit in Beaver Creek, Colorado, observed The Gold Report Publisher Jason Mallin. It topped 2013 records for attendees and presenting companies by 20%. "Nonproducing companies are still confident they can bring projects online. By starting smaller or through a strategic acquisition, they are looking for cash flow as soon as possible," Mallin observed. Meanwhile, at the Denver Gold Forum, the producing gold companies were focused on the bottom line. "The majors are reducing greenfield exploration expenses as they focus on maximizing cash flow from current production assets."

Canaccord Genuity Analyst Joe Mazumdar noted a striking difference between the moods at the Precious Metals Summit and the Denver Gold Forum. Part of the emotional shift was timing. During the earlier conference, gold was trading at about $1,250 per ounce ($1,250/oz). By the time the Denver Gold Show closed its doors, gold had dropped 2% to $1,222/oz.

"Companies like Asanko Gold Inc. are in good shape to advance and develop their respective projects."

To put that in perspective, Mazumdar pointed out that gold is about flat year to date. But, more importantly, the Market Vectors Junior Gold Miners ETF (GDXJ:NYSE.MKT) is up 10–11%. "Investors seem to feel it's better to own the equity now than it is to own gold, which was not the case a couple of years ago," he said. "When gold was going up to $1,900/oz in Q3/11, it far outperformed equities. Perhaps people didn't believe gold would hold, and therefore the stocks are overvalued. Today, the overall thesis is that gold may have bottomed, which makes the equities potentially attractive. We are even seeing a premium for projects that make sense, with management teams that can deliver the goods."

Another reason for the difference in attitude could be the makeup of the companies attending the separate events, Mazumdar noted. The Precious Metals Summit is primarily composed of early- to advanced-stage exploration and development companies, whereas the Denver Gold Forum accommodates producing companies with larger market caps. Mazumdar found that well-funded development companies were in a much better position than companies having to produce at depressed commodity prices.

"Companies like Rubicon Minerals Corp. (RBY:NYSE.MKT; RMX:TSX), Roxgold Inc. (ROG:TSX.V), Asanko Gold Inc. (AKG:TSX; AKG:NYSE.MKT), Torex Gold Resources Inc. (TXG:TSX), Midway Gold Corp. (MDW:TSX.V; MDW:NYSE.MKT) and, potentially very soon, Golden Queen Mining Co. Ltd. (GQM:TSX) aren't as impacted by the gold price, as they can still generate catalysts with their current working capital. They are in good shape to advance and develop their respective projects," Mazumdar said. These companies also have very little competition for labor, contractors and equipment, which has limited capital escalation.

"Cayden Resources Inc. could be the new benchmark for valuing juniors."

"The lack of development in the sector overall is, in part, because the majority of juniors aren't getting funded. Their projects are challenged at these gold price levels, and/or they lack the skill set to build and operate a mining project," Mazumdar said. Also, the lack of a push for growth has restrained many producers from stressing their balance sheets with new projects.

"The companies that don't have the money going into this kind of gold price environment will have to wait," Mazumdar warned. "The question is, do they have enough working capital to keep the lights on?" And even if they do, Mazumdar thinks most investors are not looking for companies that can only keep the lights on. "We need to cover companies that can generate meaningful catalysts on worthwhile projects."

Adrian Day, founder of the self-named asset management company, saw a similar shift in attitude. "The crowd at Beaver Creek seemed more optimistic—cautiously optimistic, but optimistic nonetheless," he said. "Juniors, by definition, tend to be optimistic. But a lot of these companies raised money early in the year, when the price of gold was up, so they are positioned to move forward with projects and hope for a better gold price by the time they are in production."

At the Denver Gold Forum, where the larger companies were clustered, it was much more somber. "The message from the podium was about pulling in the horns, cutting costs and cutting exploration," Day said. "The challenge is that companies have to replace ounces, so if they aren't finding more, they have to buy, and that leads to mergers and acquisitions (M&A). We have seen a little bit of M&A already, and I think that will lead to more as companies that were waiting are going to have to act quickly or lose their chances."

"Integra Gold Corp.'s mill acquisition puts the company in a position to go into production sooner."

Exploration Insights author Brent Cook agreed that the trend is to be bright-eyed at the beginning of a project. "Explorers are almost always more optimistic than the staid old large-cap producers. The explorers are in the early stages of proving a deposit and things usually look brighter at that point. The producers are focused on reducing costs, a very tough thing to do."

Although a lot of stock prices have been beat down, Cook didn't see a lot of bargains. "For the most part, the only people who see a lot of buying opportunities are those selling those opportunities." Then he added, "There are, of course, exceptions."

Cook also didn't see a lot of possible mergers in the works at the bar. "Most projects will have a tough time at under $1,250/oz gold," he said. "Producers lack the cash to buy or share price to make the deal. Some will happen, but overall there are just very few high margin deposits out there."

Cook is looking forward to when prices improve "sometime in 2015." But honestly, he said, "There is very little quality to buy. If the gold price rises substantially, then things look better. But that assumes input costs don't rise in tandem, as they did over the previous 10 years."

Gold Stock Trades newsletter writer Jeb Handwerger noted the number of companies that announced news at conference time, on top of the buzz around Agnico Eagle Mines Ltd.'s (AEM:TSX; AEM:NYSE) acquisition of Cayden Resources Inc. (CYD:TSX.V; CDKNF:OTCQX). "It surprised everyone that Cayden would be taken out so early, and for CA$205 million at that. It could be the new benchmark for valuing juniors."

Other news included Integra Gold Corp.'s (ICG:TSX.V; ICGQF:OTCQX) Sigma-Lamaque mill acquisition. "This puts Integra in a position to go into production sooner rather than later. Quebec has been an exciting area lately," Handwerger said.

Meanwhile in Colombia, Red Eagle Mining Corp. (RD:TSX.V) completed its feasibility study on the San Ramon deposit. It showed a 52% internal rate of return (at $1,300/oz gold). "It could have some of the highest margins in the industry," Handwerger said.

"Red Eagle Mining Corp. could have some of the highest margins in the industry."

And in Nevada, Corvus Gold Inc. (KOR:TSX) announced the discovery of a new high-grade gold and silver zone at the North Bullfrog project. "Drilling is ongoing as the company continues to make new discoveries," Handwerger pointed out.

Gold companies weren't the only ones with news. Wellgreen Platinum Ltd. (WG:TSX.V; WGPLF:OTCPK;) filed an updated mineral resource estimate at the beginning of September that showed improved recoveries from metallurgical tests that could be applied to the 5.5 million ounces of platinum, palladium and gold indicated in the July resource estimate. "I am excited for the updated preliminary economic assessment coming this year," Handwerger said.

"The common theme is that companies are continuing to put out news. As in past bear markets, great assets are being ignored by the masses as smart investors get ahead of the inflationary times to come. I lived through it before, when Barrick Gold Corp. (ABX:TSX; ABX:NYSE) could be bought for almost nothing. Barrick became the company we know today during a temporary deflationary correction," Handwerger concluded.

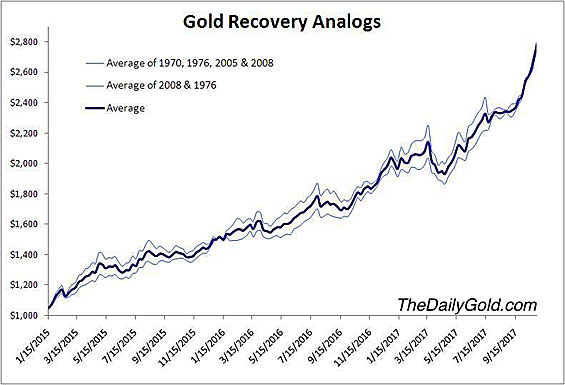

Jordan Roy-Byrne, editor of The Daily Gold Premium, focused his time at the Precious Metals Summit, and was concerned that the mood was too positive. "The final cleanout may still be coming," Roy-Byrne warned. "Based on the way September sets the tone for the rest of the year, and the fact that the main support below $1,200/oz is $1,080/oz, or even $1,050/oz, we have to be prepared for sub-$1,100/oz gold prices," he said.

The chartered market technician also noted that price-to-book value and a number of other metrics show companies trading at 10-year lows. "Historically, the lower the low, the higher the bounce," he said. "We may be seeing the extreme end of a normal bear market. That could be a boomerang setting us up for a really good 2015. Gold could reach $1,500/oz by the end of 2015." Until then, he is being defensive. "I'm making my lists and trying not to lose any more money."

Sprott U.S. Holdings' Rick Rule felt that the mood was "dismal" at both conferences, but saw that as a positive sign. "Markets never spring on hope," he said. "They spring on surprise: They move up when companies exceed expectations, and right now expectations are very low." Still, he didn't see the jump as imminent, only that it will be significant when it comes.

What Rule did see at the Precious Metals Summit was bags of money walking around looking for a place to leverage private equity cash, and lots of companies in need of capital to move forward. "The problem is that there is a gap between what this smart money is willing to pay, and what companies will take." Rick also saw the recent Cayden Resources acquisition at a healthy premium as a sign that managements are getting to the point that they can't pay their own salaries anymore and will be more open to mergers with other companies to reduce general and administrative expenses.

"You are living in the good old days," he told attendees from the stage. "Someday you will look back on 2014 and say I shoulda, coulda bought stocks at a fraction of their current price. Mark my words."

Brent Cook brings more than 30 years of experience as a geologist, consultant and investment adviser. His knowledge spans all areas of the mining business, from the conceptual stage through detailed technical and financial modeling related to mine development and production. Cook's weekly Exploration Insights newsletter focuses on early discovery, high-reward opportunities, primarily among junior mining and exploration companies.

Brent Cook brings more than 30 years of experience as a geologist, consultant and investment adviser. His knowledge spans all areas of the mining business, from the conceptual stage through detailed technical and financial modeling related to mine development and production. Cook's weekly Exploration Insights newsletter focuses on early discovery, high-reward opportunities, primarily among junior mining and exploration companies.

Adrian Day, London born and a graduate of the London School of Economics, heads the eponymous money management firm Adrian Day Asset Management (www.adriandayassetmanagement.com; 410-224-2037), where he manages discretionary accounts in both global and resource areas. Day is also sub-adviser to the new EuroPacific Gold Fund (EPGFX). His latest book is Investing in Resources: How to Profit from the Outsized Potential and Avoid the Risks.

Adrian Day, London born and a graduate of the London School of Economics, heads the eponymous money management firm Adrian Day Asset Management (www.adriandayassetmanagement.com; 410-224-2037), where he manages discretionary accounts in both global and resource areas. Day is also sub-adviser to the new EuroPacific Gold Fund (EPGFX). His latest book is Investing in Resources: How to Profit from the Outsized Potential and Avoid the Risks.

Jeb Handwerger is an author, speaker and founder of Gold Stock Trades. He studied engineering and mathematics at University of Buffalo and earned a master's degree at Nova Southeastern University. After teaching technical analysis to professionals in south Florida for more than seven years, Handwerger began a daily newsletter, which grew to include thousands of readers from over 40 nations.

Jeb Handwerger is an author, speaker and founder of Gold Stock Trades. He studied engineering and mathematics at University of Buffalo and earned a master's degree at Nova Southeastern University. After teaching technical analysis to professionals in south Florida for more than seven years, Handwerger began a daily newsletter, which grew to include thousands of readers from over 40 nations.

Joe Mazumdar joined Canaccord Genuity in December 2012 from Haywood Securities, where he also was a senior mining analyst focused on the junior gold market. The majority of his experience is with industry including corporate roles as director of strategic planning, corporate development at Newmont in Denver and senior market analyst/trader at Phelps Dodge in Phoenix. Mazumdar worked in technical roles for IAMGold in Ecuador, North Minerals in Argentina/Chile and Peru, RTZ Mining and Exploration in Argentina and MIM Exploration and Mining in Queensland, Australia, among others. Mazumdar has a bachelor of science degree in geology from the University of Alberta, a master of science degree in geology and mining from James Cook University, and a master of science degree in mineral economics from the Colorado School of Mines.

Joe Mazumdar joined Canaccord Genuity in December 2012 from Haywood Securities, where he also was a senior mining analyst focused on the junior gold market. The majority of his experience is with industry including corporate roles as director of strategic planning, corporate development at Newmont in Denver and senior market analyst/trader at Phelps Dodge in Phoenix. Mazumdar worked in technical roles for IAMGold in Ecuador, North Minerals in Argentina/Chile and Peru, RTZ Mining and Exploration in Argentina and MIM Exploration and Mining in Queensland, Australia, among others. Mazumdar has a bachelor of science degree in geology from the University of Alberta, a master of science degree in geology and mining from James Cook University, and a master of science degree in mineral economics from the Colorado School of Mines.

Jordan Roy-Byrne is a Chartered Market Technician, a member of the Market Technicians Association and a former official contributor to the CME Group, the largest futures exchange in the world. He is the editor of The Daily Gold Premium, and his work has been featured in CNBC, Barron's, the Financial Times, Alphaville, Yahoo Finance, Business Insider, 321Gold, Gold-Eagle, FinancialSense, GoldSeek and Kitco.

Jordan Roy-Byrne is a Chartered Market Technician, a member of the Market Technicians Association and a former official contributor to the CME Group, the largest futures exchange in the world. He is the editor of The Daily Gold Premium, and his work has been featured in CNBC, Barron's, the Financial Times, Alphaville, Yahoo Finance, Business Insider, 321Gold, Gold-Eagle, FinancialSense, GoldSeek and Kitco.

Rick Rule, CEO of Sprott US Holdings Inc., began his career in the securities business in 1974. He is a leading American retail broker specializing in mining, energy, water utilities, forest products and agriculture. His company has built a national reputation on taking advantage of global opportunities in the oil and gas, mining, alternative energy, agriculture, forestry and water industries. Rule writes a free, thrice-weekly e-letter, Sprott's Thoughts.

Rick Rule, CEO of Sprott US Holdings Inc., began his career in the securities business in 1974. He is a leading American retail broker specializing in mining, energy, water utilities, forest products and agriculture. His company has built a national reputation on taking advantage of global opportunities in the oil and gas, mining, alternative energy, agriculture, forestry and water industries. Rule writes a free, thrice-weekly e-letter, Sprott's Thoughts.

Read what other experts are saying about:

Want to read more Gold Report interviews like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see recent interviews with industry analysts and commentators, visit our Streetwise Interviews page.

DISCLOSURE:

1) JT Long conducted this interview for Streetwise Reports LLC, publisher of The Gold Report, The Energy Report, The Life Sciences Report and The Mining Report, and provides services to Streetwise Reports as an employee. She owns, or her family owns, shares of the following companies mentioned in this interview: None.

2) Joe Mazumdar: I own, or my family owns, shares of the following companies mentioned in this interview: None. I personally am, or my family is, paid by the following companies mentioned in this interview: None. My company has a financial relationship with the companies mentioned: Rubicon Minerals Corp. is an investment banking client of Canaccord Genuity. I was not paid by Streetwise Reports for participating in this interview. Comments and opinions expressed are my own comments and opinions. I determined and had final say over what companies would be included in the interview based on my research, understanding of the sector and interview theme. I had the opportunity to review the interview for accuracy as of the date of the interview and am responsible for the content of the interview.

3) Jeb Handwerger: I own, or my family owns, shares of the following companies mentioned in this interview: Integra Gold Corp., Red Eagle Mining Corp., Corvus Gold Inc., Wellgreen Platiunum Ltd. I personally am, or my family is, paid by the following companies mentioned in this interview: None. My company has a financial relationship with the companies mentioned: Integra Gold Corp., Red Eagle Mining Corp., Corvus Gold Inc., Wellgreen Platinum Ltd. are all sponsors of the Gold Stock Trades website. I was not paid by Streetwise Reports for participating in this interview. Comments and opinions expressed are my own comments and opinions. I determined and had final say over what companies would be included in the interview based on my research, understanding of the sector and interview theme. I had the opportunity to review the interview for accuracy as of the date of the interview and am responsible for the content of the interview.

4) The following companies mentioned in the interview are sponsors of Streetwise Reports: Asanko Gold Inc., Cayden Resources Inc., Integra Gold Corp., Red Eagle Mining Corp. Streetwise Reports does not accept stock in exchange for its services. The companies mentioned in this interview were not involved in any aspect of the interview preparation or post-interview editing so the expert can speak independently about the sector.

5) Interviews are edited for clarity. Streetwise Reports does not make editorial comments or change experts' statements without their consent.

6) The interview does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer.

6) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their families are prohibited from making purchases and/or sales of those securities in the open market or otherwise during the up-to-four-week interval from the time of the interview until after it publishes.