Here at U.S. Global Investors, we strive to serve our clients to the best of our abilities by detecting and accounting for trends and patterns not just in the market but also the world at large. That includes everything from changes in monetary and fiscal policy, both domestic and foreign; the weather; lifecycles of mines; and advances in technology. We would be remiss indeed to exclude developments in any of these fields when making decisions about how to manage the funds our clients have entrusted us to grow.

In the following whitepaper, we'll fold back the layers of the "messy and chaotic" and try to understand what makes the market tick.

The Importance of Cycles in the Investment Management Process

Elon Musk, CEO of Tesla Motors, told the Guardian in July 2013: "The lessons of history would suggest that civilizations move in cycles. You can track that back quite far—the Babylonians, the Sumerians, followed by the Egyptians, the Romans, China. We're obviously in a very upward cycle right now and hopefully that remains the case."

Similarly, financial markets are influenced by relatively predictable cycles, a lesson we at U.S. Global Investors rely on to help us manage expectations and be effective stewards of your money. This is a theme I've frequently written about and discussed during presentations, one of which, "Anticipate Before You Participate," is a classic that I often use to remind investors of these timeless principles.

Precedent plays a big role in our decision-making process just as it does in our day-to-day lives. I don't know about you, but I know not to wait until the rains have flooded the streets ankle-deep before I buy an umbrella.

A keen awareness of the ebbs and flows of historical and socioeconomic conditions, on both the macro and micro scales, allows our investment management strategy to be more proactive than reactive. Although reacting to sudden and unexpected developments is often necessary—Russia's involvement in Ukraine is a good example—our team tries to mitigate their impact on our funds by leveraging our knowledge of the complex interplay and overlap of important cycles, from the short-term to very long-term.

Weather—A Cycle in One Season

Just as the moon's gravitational pull changes the ocean tides, so too does the weather influence the behavior of the market.

Case in point: a strong link exists between El Niño, the weather pattern, and global asset prices. Steady rains are good for Brazilian coffee output, for example, but bad for the Chilean metals industry—the reason being, when the rain is heaviest, access to mountainous mining regions is blocked.

Here in the U.S., an unusually brutal winter at the beginning of 2014 put a damper on consumer spending. Sales were pummeled as many consumers, especially those in the Northeast, were disinclined to go shopping after shoveling bucketsful of snow off their front lawns. Consequently, the ISM Manufacturing Index in January closed at a weak 51.3, below economists' expectations of 56.0. Car sales were way down.

On the bright side, stock trading tends to be more spirited on sunny days than cloudy days. In a thought-provoking paper titled "Reassessment of the Weather Effect: Stock Prices and Wall Street Weather," University of California-Berkeley student Mitra Akhatari finds a significant correlation between sunshine in New York City and a bump in stock prices: "If it is the case that people tend to evaluate future prospects more optimistically when they are in a good mood than when they are in a bad mood," she writes, "then sunnier days are associated with investors being more willing to take on risky investments."

The reverse also seems to be the case, according to Akhatari. On overcast days, investors' less-than-peachy mood invariably leads to uninspired trading.

Or even calamity, as was the rare case on the morning of October 29, 1929—infamously known as Black Tuesday—when autumn clouds blotted out the sun's warmth and light.

This doesn't mean that every time the sky turns gray, the market suffers. Some people are better than others at separating their emotions from their investment decisions.

In any case, let's all take a moment to appreciate the fact that the U.S.'s main stock exchange is not located in Seattle, which averages more than 200 cloudy days per year.

Gold Seasonal Trends – One Year Cycle

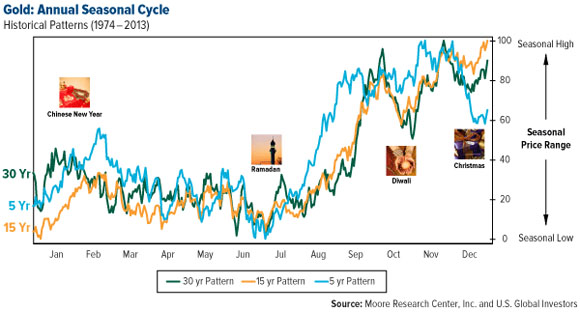

Gold is a classic example of a commodity that rotates through seasonal cycles year after year. I've written at length on the ways in which gold behaves in response to international festivals and holidays such as the Chinese New Year, Diwali and Ramadan. You can look back five, 15 and 30 years to spot the patterns the precious metal dependably follows, reaching annual highs starting in August and September as gold jewelry demand spikes.

Another cyclical indicator—or theory, I should say—we use to track the performance of gold is mean reversion. Mean reversion, which I'll talk about in full detail later, is the idea that a commodity will eventually revert back to its historic value, whether it's currently sailing in the stratosphere or crawling through the weeds.

What goes up must come down, as they say, and we saw this play out last year when gold plunged 28 percent after an exhilarating years-long bull run. Although many traders let go of their bullion and gold stocks,

Presidential Election Cycles—Four to Eight Years

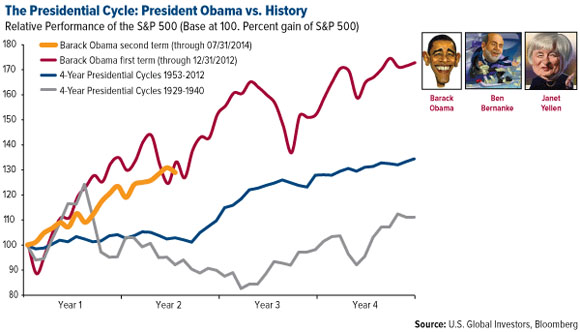

At U.S. Global we like to say that government policy is a precursor to change, and no person in the nation has more control over policy than the president. The decisions he makes and actions he takes have far-reaching consequences in markets both domestic and international, more so than perhaps even he can anticipate.

President Barack Obama began his first term by injecting $700 billion into the economy. It's still debatable how successful this legislation was. We've also seen several rounds of quantitative easing (QE) to loosen money and facilitate loan-taking.

Largely as a result of these policies, the S&P 500 Index during both of Obama's terms has performed above the average four-year presidential cycle. Early in June, the Dow Jones Industrial Average hit a record high of 17,000.

Just over the horizon are midterm elections, a time when the market historically becomes bullish. According to the most recent Stock Trader's Almanac:

"An impressive 2.7% has been the average gain during the eight trading days surrounding midterm election days since 1934. This is equivalent to roughly 52 Dow points per day at present levels. There was only one losing period in 1994 when the Republicans took control of both the House and the Senate for the first time in 40 years."

Lifecycle of a Mine—Multiple Years

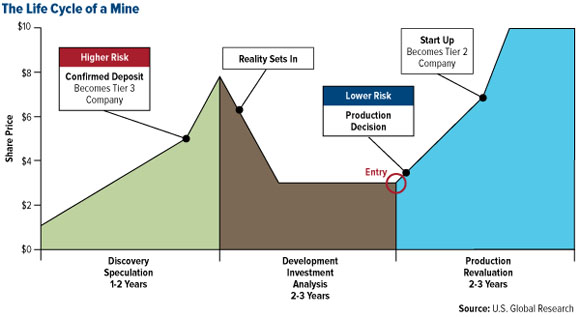

Not only is it important for us to understand the seasonality of the commodity itself, it's equally important to be aware of the stages a mine must proceed through before it becomes operational. As I write in The Goldwatcher: Demystifying Gold Investing:

"We strongly believe in using cycles to better manage risks and expectations, and we see this as a way for others to manage their emotions when it comes to investing. Knowing where a company is on the mine lifecycle can be a tremendous asset to an investor in gold equities who seeks to minimize risk and optimize performance. It's one more tool the investor can use to try to manage volatility and his own market expectations."

Take a look at the graphic below. Years can and do divide the time when a mine is discovered and when production begins. It's imperative to know which stage of its lifecycle the mine is in to make a better-informed decision on whether to invest, withdraw or wait.

When a mine is first discovered, excitement raises the price of the stock. This is when investment is most speculative since only one in 2,000 companies finds at least a 1 million-ounce deposit. Once reality sets in and miners are faced with the notion that the metal or mineral—assuming there is any—probably won't be exhumed for some time, prices tumble. Years later, after production finally begins, stocks see another uptick. This is when the equity is at its lowest risk factor.

To manage risk and expectations, it's critical for us to know where we are in the cycle of the mine. Because we prefer to confirm this in person, we often visit projects in locations such as Colombia, Panama, Canada, West Africa and elsewhere.

Click here to continue reading the article.

Frank Holmes

U.S. Global Investors