Summary

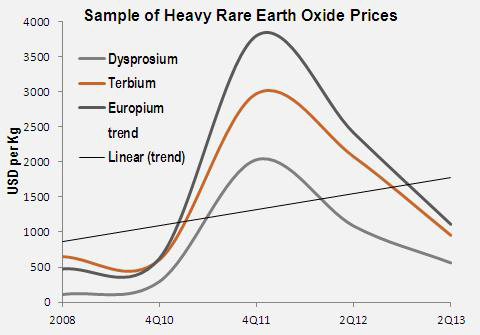

1. The U.S. and Japan still face security of supply concerns for strategic rare earth elements even as prices continue to ease from historic highs reached in 2011.

2. The production and processing for REEs is complex. Included with the usual suspects–grade, tonnage, jurisdiction, and infrastructure–is production scenario.

3. With the completion of the winter 2014 drill program, Commerce Resources Corp. both moves closer to a prefeasibility study for the Ashram Rare Earth Deposit and looks toward cementing designs for mine development.

Rare Earth Elements, All Is Not Forgotten: Security of Supply Should Concern Developed Countries

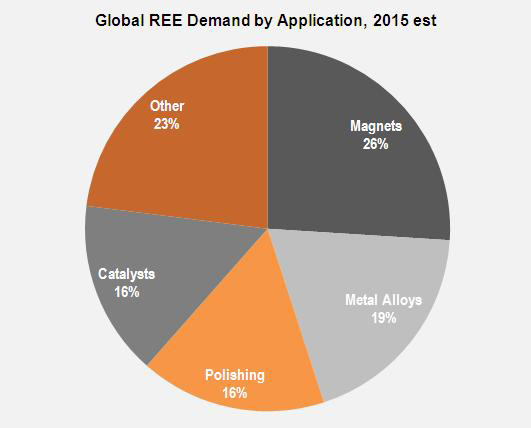

The mania over rare earth elements (REEs) has calmed considerably from the feverish pace reached following China's brief blockade of REE exports to Japan in September 2010. Not by happenstance, China's ability to pursue long-term political and economic policy has resulted in monopoly power for the production and processing of REEs. In fact, China accounted for an astounding 95% of the total 111,000 tonnes of global mine production in 2011. [1] REEs are vital for the high technology and renewable energy industries, as well as many industrial catalysts. Therefore, growth in demand should remain healthy. Globally, the greatest proportion of demand is for application in magnets; though in the U.S. the majority of demand is in catalysts for petroleum refining, chemical processing and catalytic converters. The U.S. reentered REE production in 2012 when Molycorp (NYSE:MCP) restarted mining operations at Mountain Pass, California, after a 10-year hiatus. However, production at Mountain Pass has lagged behind forecasts as financial losses mount. [2] The operating, or projected operating, results for REE assets are highly individualized due to several complexities encountered during production. Therefore, investors and analysts should not conclude recent losses incurred by Molycorp, or Australia's Lynas Corp (U.S. ADR: LYSDY), are synonymous with the entire REE industry.

Source: The Industrial Minerals Company of Australia and the Ministry of Economy Trade and Industry

Instead, care should be taken due to the existing confusion surrounding the REEs. This confusion largely stems from the opaque nature in trading specialty metals, and the proprietary techniques used in separation of REEs from the host mineral(s). I regress, these issues are beyond the scope of an introductory piece; however, investors could look to the breakdown of relevant factors inherent in REE mine development authored by Rockstone Research Ltd, Rare Earth Deposits: A Simple Means of Comparative Evaluation. [3] However, most importantly for investors is the end result of this confusion is potentially a benefit as asymmetric information in the market leads to a situation where abnormal returns are possible for a given level of perceived risk.

Source: The Industrial Minerals Company of Australia (IMCOA) 2011

North American REE Potential: The Shoe Fits for the U.S., Europe and Japan

There are 17 REEs, and are generally classified as light, middle, or heavy. Ideally, one would like to see a relatively even distribution of the elements throughout a deposit. However, in reality this is not the case as the lighter elements tend to represent a significant majority of rare earth deposits. This creates a supply mix imbalance, where there is potentially an overabundance of light elements and tight markets for heavy elements used in high technology. [4] Heavy REEs are needed for growing demand in permanent magnets that able operate at high temperatures (important for military applications), electrical and electronic components, and generators for wind turbines. [5] Taking advantage of this supply mix imbalance, several Canadian deposits are thought to be fairly well endowed in heavy REEs, including the Ashram. Potential Canadian REE production also makes strategic sense for U.S. security as the Department of Defense becomes increasingly reliant on high technology weaponry and defense systems.

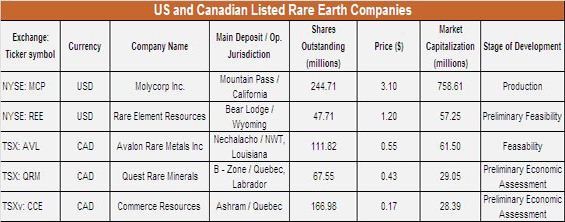

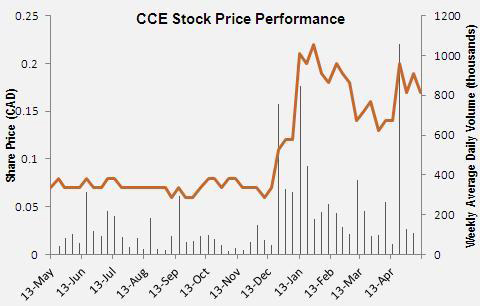

There are several high profile REE exploration are development projects currently being advanced in both Canada and the U.S., some of which I have listed below. However, we believe with the completion of the winter 2014 drill program and continued advancement of the Ashram Rare Earth Deposit in northern Quebec, Commerce Resources (TSXv: CCE), a core equity holding for Zimtu Capital (TSXv: ZC), deserves to be included in the discussion.

Source: Stockwatch

Commerce Resources Corp.: Showing Strength in a Difficult Market Environment

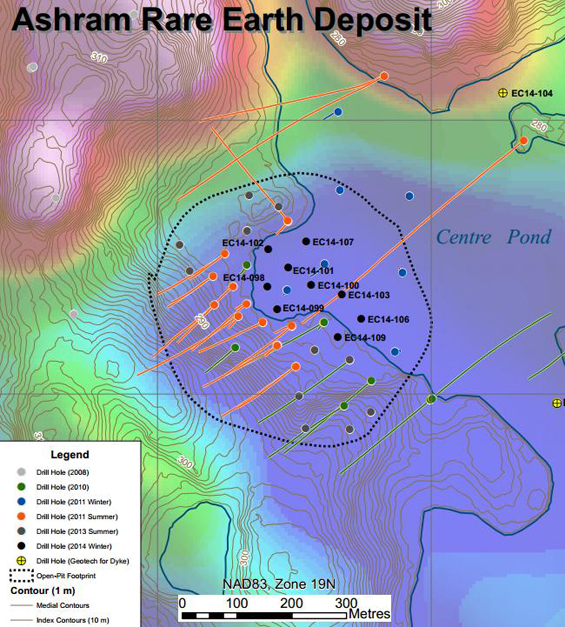

Commerce Resources Corp. recently announced the completion of the winter drill program for its 100%-owned Ashram Rare Earth Deposit in northern Quebec, approximately 220km north of Schefferville, where there is access to the Quebec North Shore and Labrador Railroad. Happily, the winter 2014 drill program was completed on time with costs less than expected. [6] The company's stated aim of the program was to increase the confidence level of existing resources from the current inferred category to the indicated and/or measured categories. [7] The completion of the winter drill program advances the project towards the desired preliminary feasibility study (PFS); and though more drilling is likely required, much derisking of the Ashram Deposit has taken place.

The winter 2014 program was the second occurrence of infill drilling by Commerce since the release of the preliminary economic assessment (PEA) in July 2012. Winter conditions were helpful for the completion of this round of drilling as the targets in question were underneath Centre Pond. In total, 1,495 meters of infill drilling were completed over nine holes and it is hoped that this will be sufficient to fully define the heavy rare earth enrichment of the Middle and Heavy Rare Earth Element Oxide Zone at the indicated or measured level following an updated resource. [8] This zone extends from surface to a depth of 178 meters resulting in a very low strip ratio for the Ashram.

In addition to the infill drilling for resources, three short geotechnical holes were completed on the eastern periphery of the deposit to assess potential dyke locations. Roughly half of the prospective open-pit is located under Centre Pond, meaning a dyke will be required to redirect some of the water for mine development and operations. Assuming the information from these three geotechnical holes is as expected, no further drilling will be required. Fortunately for Commerce, the construction costs for the dyke are a minor component of the projected capital expenditures (capex). In addition, the most favourable location will minimize costs by reduced pumping during operation and less material for construction.

Prior to the winter 2014 program, the Ashram Deposit was based on fifty-seven holes totalling 16,868 meters drilled leading to a measured and indicated resource of 29.3 million tonnes at 1.90% total rare earth oxide (TREO) and an inferred resource of 219.8 million tonnes at 1.88% TREO. [9]

Source: Commerce Resources and Dahrouge Geological Consulting

Quebec REE Projects: Why the Region Should Now Be on U.S. and Europe Radar

There is renewed optimism for Quebec natural resource industries following the return of the Liberals to power. Quebec ranked 21st out of 112 jurisdictions in the most recent global survey of mining companies by the Fraser Institute. [10] Though the ranking is reasonably good, Quebec had fallen in the survey every year since ranking 1st back in 2009. In Quebec, business and politics tends to overlap. [11] This is not necessarily negative as the new premier, Philippe Couillard, has publically reintroduced Plan Nord–whereby 72% of Quebec–will see infrastructure assembly over 25 years. [12] This is a huge boon for mining located in northern Quebec with limited access and infrastructure, the Ashram included; which is only 100km from Adriana Resources' large scale iron project. Indirect public-private partnership between the Quebec government and the mining industry should lure increased investment dollars to the region.

Conclusion

The advantages of the Ashram Rare Earth Deposit, are tonnage, grade, common mineralogy and metallurgy, balanced distribution (well-balanced REO distribution with appreciable HREOs), and potential government infrastructure investment in the region. These reasons should warrant further analysis from potential joint venture partners as well as investors.

Source: Yahoo Finance

1 U.S.GS, Mineral Commodity Summaries, 2008-2013

2 Molycorp (NYSE: MCP) Reports First Quarter 2014 Financial Results, 7 May 2014

3 Rockstone Research Ltd in conjunction with Darren Smith, M.Sc., P. Geol., 23 April 2014

4 DOI/U.S.GS Fact Sheet 087-02, Rare Earth Elements – Critical Resources for High Technology

5 Marc Humphries, Rare Earth Elements: The Global Supply Chain, Congressional Research Service, 16 December 2013

6 Commerce Resources Corp. News Release

7 Commerce Resources Corp. News Release, 20 March 2014

8 Ibid

9 Ibid

10 Miguel Cervantes et al, Survey of Mining Companies: 2013, Fraser Institute, 3 March 2014

11 Nicolas Van Praet, How Quebec politicians are piggybacking on the battle for Osisko Mining, Globe and Mail, 3 April 2014

12 Daniel Tencer, Quebec's Plan Nord Promises A Mining Boom, The Huffington Post Canada, 8 April 2014