Scotiabank analysts are bullish uranium. They have been for some time. As we noted in early 2013, Patricia Mohr, Scotiabank's vice-president economics and commodity market specialist, made the case that uranium prices, decimated by the 2011 Fukushima Dai-Ichi nuclear disaster, would rebound mid-decade. It's not a position that has changed. In her latest commodities report on December 19, 2013 she labeled uranium a "turnaround story" for the mid-2010s. Her thesis—as outlined at the AME BC Roundup conference last year—is heavily contingent on three factors: decreasing sources of stockpiled uranium, increasing reactor builds in China and restarting reactors in Japan, still on idle after the Fukushima Dai-Ichi nuclear disaster in 2011, which decimated uranium prices.

The first two parameters are better known entities. Stockpiles have dropped. China is building reactors. But the third is a more fraught issue. It's an open question if, or (perhaps more realistically) how many, reactors Japan will restart. It's a contentious subject in Japan given justifiable fears over nuclear contamination following the Fukushima disaster.

Still, that some nuclear power plant will come back online, seems quite possible. According to The Japan Times Japan's government led by Prime Minister Shinzo Abe has called nuclear power an "important baseload power source." The high cost of importing fuels reportedly has power companies pushing hard to clear the way for some reactor restarts. Bloomberg counts some 16 applications for permission to do so under stiffer regulations enacted last year. And if they do restart?

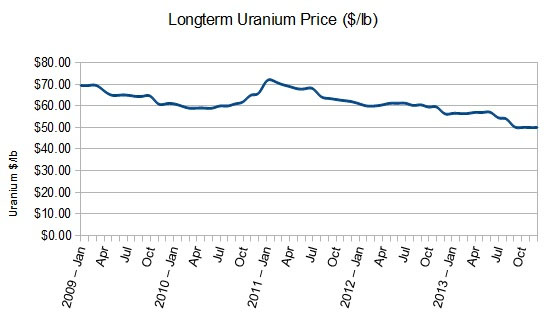

Again over at Scotiabank, analyst Ben Isaacson takes the view that supply/demand will tighten and prices will rise. In a recent note, he plotted his view, in some detail, of uranium prices and producer share prices assuming Japan restarts 10 reactors in the next 18 months and more thereafter. Isaacson sees contract uranium prices—down 30 percent from 2011 to around $50 a pound in recent months—climbing to $59 a pound, on average, this year and rising to $78 a pound by 2017. Spot prices, likewise, climb to $39 a pound this year and hit $70 pound in 2017.

"Without rising demand, the uranium price would likely stabilize at the current level since we are in a temporary supply-driven market," Isaacson noted. "However, our base-case demand outlook sees an incremental 34 million lb U3O8 needed annually by 2020." That's the effect of Japan restarts and new Chinese reactors coming on-line.

Long-term uranium prices after Cameco monthly averages. Graph: Kip Keen

Isaacson makes an interesting point on the uranium investment sector. "Simply put, there aren't many ways to play the space, which we like to see." As evidence of that, he notes that excepting Areva, which you might consider more a nuclear company and less a miner, Canadian uranium-miner Cameco is the only large-cap uranium play. Thus, in initiating coverage, Isaacson covers some of the usual suspects. Cameco gets a $27 a share target; Denison Mines: $1.80; Paladin: $0.55; and Uranium Participation (a uranium stockpiler): $6.75.

He concludes: "However investors choose to play this niche commodity, we believe patience will be rewarded as we forecast a bull market (beginning) to form over the next 18 months. Accordingly, we think investors should position for a recovery."

But much, as ever, depends on what Japan decides to do with its idled reactors. Developments there must be watched closely.

Kip Keen

Mineweb