The Gold Report: In a recent issue of Weekly Trends on visualcapitalist.com/plus you discussed the "sell the news move" in the gold price as the U.S. shutdown and debt-ceiling worries weighed heavily on the markets. Now that a debt-ceiling solution has been found temporarily, what do you expect from gold and silver prices through Q4/13 and into Q1/14?

Rob Fuhrman: We remain cautious over the next three months and through Q1/14. We anticipate a gold price range of $1,250/ounce ($1,250/oz) to $1,400/oz.

TGR: China and Russia have called for a new global currency. Given the ongoing political climate in the U.S. and economic issues related to the greenback, will those calls get louder?

RF: Recent politics definitely suggest a call to action. It is a major problem that the world's current reserve currency is paired with a government that appears unable to get things done responsibly. I'm sure the conversations about an alternative currency will get louder, probably the next time the debt ceiling issue comes up.

TGR: Will gold play a role in a new global currency?

RF: A role for gold in a new global currency would add a level of fiscal and monetary responsibility, which is something we haven't seen in a while. Adding legitimacy by using gold or commodities would be important. However, there are some limitations if the money supply becomes too fixed. At that point growth and innovation become more difficult because access to capital is limited.

TGR: What would the impact be on the gold price?

RF: It would be extremely positive for gold, given its rarity and its nature as a safe-haven asset.

TGR: The biggest markets in Canada have, for the most part, underperformed in recent years, in particular the TSX Venture Exchange (TSX.V), which is home to most of the companies we discuss here at The Gold Report. The TSX.V index is at 950. In a recent edition of Market Intelligence on visualcapitalist.com/plus you posed the question, "Will the fourth quarter be one of tax-loss selling or will bargain hunting take over and propel the TSX Index above 975?" What's your best guess?

RF: My best guess is that the TSX.V and the resource sector will become more of a stock-picker's market. We expect Q4/13 to go out with a whimper and not a bang. However, a handful of names will do well.

TGR: You cover about 350 companies on the TSX and the TSX.V. What is your standard vetting process for a typical gold exploration company?

Jeff Desjardins: Our current universe consists of 350 companies, but we are adding new companies every week. Our goal is to cover every precious metals company on the TSX and TSX.V.

TGR: How could you stay on top of all 1,700-odd mining companies listed on the TSX.V?

JD: We are focusing only on precious metals mining companies: gold, silver and platinum group metals. That brings the number down to approximately 1,000 companies. We also expect to see a number of companies disappear off the exchange in the short term. As of right now, about 35% of the companies we cover have less than three months of cash left.

That still leaves a lot of companies and information to tackle. However, we have two full-time mining analysts and expect to scale up as we add companies to our coverage.

TGR: What is your methodology?

JD: We separate companies into jurisdiction and then into three different stages depending on the extent of their progress: exploration, development and production. An exploration company is one that has not yet defined a resource. A development-stage company is one that has an NI-43-101-compliant resource. Lastly, a producer is one that is mining and producing ounces of a precious metal. For each, we look at about 20 metrics in four broad categories: financials, management, project and performance. The weightings of the categories are dynamic and based on current market conditions.

TGR: At the end of your analysis, you arrive at a Tickerscore on each company. Tell us about the weighting of the Tickerscore.

JD: The first thing to note is that the weighting for each overall score depends on how far along a company is in developing its primary project. For example, the weightings for exploration companies are different than how we weigh development or producing companies.

TGR: Let's use a gold exploration company as an example. How would you typically weight those four factors?

JD: Right now financials are weighted 54%, management is 20%, performance is 4% and the project score is 22%.

The financial score has the most weight because companies can only make discoveries if they are able to put money in the ground. Companies score well in this category if they have money in the treasury and can withstand tough market conditions over time.

For the management score, the important factors are management common share ownership, insider buying, fund and institutional ownership, merger and acquisition (M&A) experience, and the general and administrative (G&A) expense ratio. We want to see experienced, vested and disciplined teams that put shareholder money in the ground.

We also look at a company's performance against the TSX.V and companies of the same stage and jurisdiction. Lastly, we look at the project itself and the potential upside for discovery. The most important weight in the project score is our drill hole analysis.

TGR: Who does the analysis? After all, good drill results don't mean that the deposit is mineable.

RF: Our team uses a formula that analyzes the economics of drill holes by using metrics such as interval length, grade, the number of holes drilled and the average scores of other drill holes in the region. The remainder of the project score depends on other factors, such as the proximity to infrastructure, power and water. If a project has great drill holes, but is on the side of a mountain in the middle of nowhere, the score in this section would be lower.

We obtain this information from technical reports the companies put out. We also look at the jurisdiction ranking, using the Fraser Institute rankings that examine political climate, tax regime and mineral policy potential.

TGR: How accurate have your Tickerscores proven to be?

JD: If we analyze baskets of companies based on their overall Tickerscores, the performance is exactly what one would expect. On average, companies that have high scores have outperformed the market. Conversely, low scores underperform the market. For some context on the distribution of scores: the lowest score is a 2, the average is 45 and the highest is an 85.

More specifically, we found that companies with scores above 70 have averaged a return of 14.2%. Companies that scored below 20 ended up losing 10.37% of their value. Over the same period of time, the TSX.V went down 0.9%. Details on how the scoring system has performed are available here.

Also noteworthy is the fact that the five stocks with the highest scores over the summer averaged a return of 25.3% during that time.

TGR: That's noteworthy. The producers are at the opposite end of the scale from the explorers. You spent a lot of time on all-in cash costs. Tell us a little bit how you account for those in the Tickerscore for a producing company.

RF: All-in cash cost has been a buzzword in the industry lately. It's essentially a non-GAAP or IFRS way of measuring the actual cost of producing an ounce of gold. The World Gold Council has worked with several major producers to come up with a standardized method to calculate all-in cash cost, but it's not an accounting procedure.

We've done our best to arrive at the actual cost of producing an ounce of gold or silver. Along with everyday production costs at the mine, we account for exploration expenditures, sustainability costs and the G&A. The all-in cost has a fairly large weighting on the production score.

TGR: How is the weighting different for a producing company?

RF: For a producer, how a company is performing is our most important metric, valued at about 40%. This is where we look at the all-in cash cost, revenue growth and the growth forecast.

Management is 22% because we feel a strong management team is needed to keep production in line.

Financials come in at 18%. Finally, performance and valuation is worth 20%. That includes enterprise price value per ounce, book value per share and such. At this point, we're looking for a company that may have underperformed, but has high potential to increase in value.

TGR: What are the weightings for development names?

RF: As you might expect, they are in between. Financials are rated at 27%, management 22%. The project itself is 46% and the valuation is 5%. Within that are several sub-variables, such as proximity to infrastructure and the project economics. The internal rate of return (IRR) is the most important weighting in the project section. We also look at the actual overall resource, enterprise value per ounce and performance compared to peers in the area.

TGR: How does this type of analysis serve investors compared to standard analyst reports or even pundit commentary?

JD: From the perspective of a retail investor, the difference is that analysts typically cover a select few stories in great depth. Uniquely, we use an independent, empirical platform that scores every company and allows investors to compare stocks based on a set of universal criteria.

There are several benefits to this approach. First, we create context among the thousands of exploration companies out there. This makes it easier for investors to navigate the market as a whole. Second, by using categories to group companies based on the stage and jurisdiction of their major project, we make it easier for investors to compare apples with apples. We cover every company in each jurisdiction, good or bad. Because every metric we use is empirical and quantitative, our analysis is 100% independent and unbiased. No company can pay to get a higher score and investors can see the breakdown of all our metrics to see what is going on behind the scenes.

TGR: Companies don't pay you for this information; your revenue model is strictly subscriber based?

JD: Correct.

TGR: Have companies complained or disagreed with your analysis?

JD: We use an empirical process that pulls numbers from company-approved financials and technical reports, so it's hard for companies to disagree with the data itself. Subscribers can open up our worksheets and see all of the metrics that we use and it's completely transparent in that sense.

It is true that companies or investors may disagree on the specific weightings of a particular variable. This is a fair criticism. In the near future, we plan on making the system dynamic so that investors can enter their own personalized criteria and all scores will be adjusted accordingly on the front end.

We have received some fan and hate mail on Tickerscores but that is the nature of the beast. We welcome all constructive feedback from companies as well as investors so that we can put together something that ultimately everyone can benefit from.

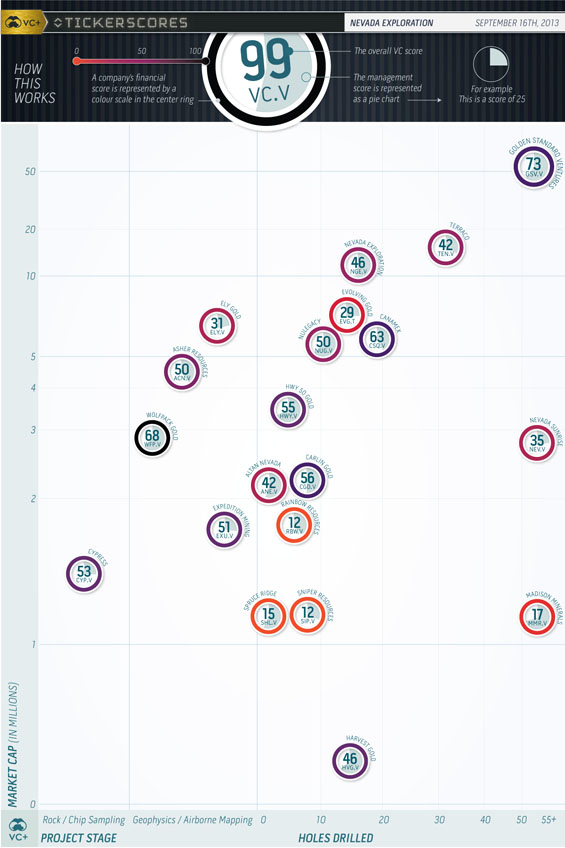

TGR: Let's talk about some specific companies. Most of our readers are American so let's start with the U.S., and Nevada in particular.

RF: One of our top exploration picks in Nevada is Gold Standard Ventures Corp. (GSV:TSX.V; GSV:NYSE). Its Tickerscore is 73. This company has excellent liquidity ratios. Its financial report showed $3 million ($3M) in cash and it raised another $5M in August; this is impressive because the average cash position in Nevada is approximately $1 million. Management owns approximately 20% of the common shares outstanding; when management puts its own money into physical shares, it demonstrates strong belief in the project. In addition, insiders have bought more than $275,000 of stock in the open market so far this year, another good indication.

Drill results have been solid. The last drill result was 98 meters of 3.26 grams per ton (3.26 g/t); an extremely solid hole that rates highly in our drill-hole analysis compared against all the other drill results in Nevada.

TGR: One of the first things your subscribers see on your website is a graphic that shows the overall Visual Capitalist score in a circle, which for Gold Standard Venture is 73. You also use colors; the darker the outer circle is, the more money the company has. Gold Standard Venture's circle is purple, indicating that the company is reasonably funded.

There's also a pie chart that rates management. You rate Gold Standard Ventures' management a 69. Why not higher?

RF: It's virtually impossible to score 100% because a company can always improve. In this case, the management score could be higher for Gold Standard Ventures if it had a higher level of institutional ownership as well as a lower general and administrative (G&A) expense ratio.

TGR: Can you give us a couple of development names in Nevada?

RF: One company we really like is Klondex Mines Ltd. (KDX:TSX; KLNDF:OTCBB); it has been a top pick for several months. Its Fire Creek property has some extremely high-grade gold. Given the soft gold price, that will help its IRR. Klondex's recent raise of over $19M will allow the company to pay off its short-term debts and give it a solid cushion moving forward.

We also like Midway Gold Corp. (MDW:TSX.V; MDW:NYSE.MKT). The company has a couple of projects in Nevada. It owns 100% of the Pan project, which has a 32% IRR using $1,200/oz gold. It also has a joint venture with Barrick Gold Corp. (ABX:TSX; ABX:NYSE) on a project called Spring Valley.

TGR: You said that your highest Tickerscore is 85. Midway scores 81—just about as good as it gets.

JD: Yes, Midway is in the top 5% of all companies that we have scored. Right now, anything in the 70s or 80s is a very high-scoring company. In general, investors should try to avoid companies that score below 30 in our system. A low score means that a company is missing one or more of the most important criteria for long-term success in the market: a disciplined and experienced management team, good financial backing or a quality and economic project.

TGR: Klondex has a 61 Tickerscore, but the color is purple due to its financial position. Klondex also has 14,000 oz waiting to be milled. How do you factor in those ounces?

RF: It is tough for us to accurately model those ounces because there are many variables that we can't factor in. For the meantime, we make a note of that in our Power Rankings to our subscribers. With our empirical model, we try to eliminate guessing. A 61 is a 61. That being said, milling those ounces will generate cash, which will improve Klondex's financial and overall scores.

We update our spreadsheets almost continuously and will do that as Klondex starts to pull in that revenue.

TGR: What accounts for the 74 management score for Klondex?

RF: Management owns 18% of common shares, which is above average. Institutions and funds own another 25%. That's important in two ways. First, this demonstrates management’s experience, connections and ability to raise capital. Second, the due diligence conducted by the institutional team also should provide investors with further confidence and assurance that Klondex is a strong company.

Another important thing to note about the company is that year-to-date purchases by insiders totaled almost $1M, telling us that the people with the most intimate knowledge of the company feel that the company is undervalued.

TGR: Let's move on to exploration names in Mexico.

RF: One of our top picks is Cayden Resources Inc. (CYD:TSX.V; CDKNF:NASDAQ). Cayden has about $3.6M to work with. Management common share ownership—corporate and directors—is almost 20%. The company has two projects: Morelos Sur in the Guerrero Gold Belt and El Barqueño, close to Primero Mining Corp.'s (PPP:NYSE; P:TSX) mine.

TGR: Cayden's overall Tickerscore is 67, but management scores even higher.

RF: The management score is 86. It is a great team with a good record of getting things done and the team has shown its belief in the projects by purchasing physical shares, not just options. Institutional and fund ownership is 25%, which helps out the management score.

Cayden also has a good G&A expense ratio, which translates into the majority of its money going into exploration for shareholder benefit, not into lining corporate pockets.

TGR: The highest score for Mexico exploration companies belongs to Plata Latina Minerals Corp. (PLA:TSX.V) at 69. Tell us about Plata.

RF: There isn't much difference between a 67 and 69. Plata Latina's cash management and liquidity ratios are a little better. The company has virtually no liabilities on the balance sheet. It's also further along in exploration. Plata Latina has drilled 40 holes, so it is a step closer to defining a resource.

TGR: There are several good scores among the Mexican developers. Tell us about those.

RF: MAG Silver Corp.'s (MAG:TSX; MVG:NYSE) Tickerscore of 79 puts the company among our top scorers.

MAG Silver has a great cash position and little debt. The management team is excellent. The company has two solid projects in Mexico. One is Juanicipio, a joint venture with Fresnillo Plc (FRES:LSE), with MAG Silver owning 44%. This joint venture project is a $1.4 billion ($1.4B) net present value (NPV) and has a 47% IRR, which is fantastic. MAG Silver owns 100% of its other main project, Cinco de Mayo. Both are high-grade projects, which add leverage to the silver price and help the IRR.

TGR: The other two high scores in Mexico Development are Chesapeake Gold Corp. (CKG:TSX.V) and Torex Gold Resources Inc. (TXG:TSX). Tell us about those.

RF: Construction is underway now at Torex's mine, and it will be in production in 2015. The company has a pile of cash, most of which will go toward production. Management has put the right people in place and has raised enough money to get the project off the ground. Institutional ownership is about 45%, which is good to see. The IRR is about 24%, which, on a $900M NPV project, is pretty good.

Chesapeake is another really solid company flush with cash. Its last financial statement showed $37M, more than enough for what the company is doing right now.

However, Chesapeake will face substantial capital expense (capex): $4.36B in initial capex and $584M in sustaining capex. That's a serious hurdle to overcome in a penny-pinching world. Its IRR is only 21%, which is the second-lowest IRR among the projects we cover in Mexico.

Readers can see the Visual Capitalist Tickerscores report on Mexican development companies here.

TGR: What are the high scores among the Canadian exploration names?

RF: We've divided our Canadian coverage into regions. So far we have Ontario, British Columbia, Québec and the Atlantic provinces covered.

In Ontario, the Rainy River deposit that New Gold Inc. (NGD:TSX; NGD:NYSE.MKT) bought is a big deal. One of our top scorers in Ontario is Bayfield Ventures Corp. (BYV:TSX.V), which scores a 73 overall. Its property is in the Rainy River area right next to New Gold. Given New Gold's historical M&A preference to consolidate an area as it did at Blackwater, we believe Bayfield is a high-potential takeover candidate. Plus, the company is doing a lot of work. It has drilled 275 holes already and is in the midst of another 100,000-meter drill program.

TGR: Bayfield must have financial clout behind it to fund something like that.

RF: The latest financials show about $1.7M, enough to keep day-to-day operations going for a while.

TGR: That won't be enough to drill 100,000 meters.

RF: No, the company will have to raise funds to keep the program going as it sees fit. The management team is strong and recent holes such as 6m of 14.34 g/t will help in generating interest in a Private Placement. I believe Bayfield will get it done.

TGR: What are some other names in Canada?

RF: Colorado Resources Ltd. (CXO:TSX.V) is an exploration company that woke up the TSX.V this summer and shed light on the Iskut region in northern British Columbia.

Colorado's first drill result was fantastic. Subsequent numbers have been less than stellar and the stock price has come back down to earth.

Other companies in the region are more under the radar: Prosper Gold Corp. (PGX:TSX.V) and Garibaldi Resources Corp. (GGI:TSX.V). Both are smaller but have interesting land positions.

TGR: Once Colorado sufficiently derisks its property, do you think Imperial Metals Corp. (III:TSX) will take a closer look?

RF: I wouldn't rule that out.

TGR: Are there any other names that you want to mention?

RF: There are two development companies. The first, Probe Mines Limited (PRB:TSX.V), is in Ontario and scores a 78. It has had a great run since we scored it months ago. The resource seems to be getting better as the company keeps drilling. It has about 4 million ounces (4 Moz) right now. Economics will be the next big hurdle for Probe. We'll look to its preliminary economic assessment to evaluate how robust its economics are for the near future.

The second company, Rubicon Minerals Corp. (RBY:NYSE.MKT; RMX:TSX), has more than 3 Moz at an average grade of 8 g/t, which is fantastic, and leads to some fairly robust economics. Its NPV of $531M and its 27% IRR are solid.

TGR: Do you have any parting thoughts on strategies for investors as 2013 wraps up?

JD: The work we've been doing has uncovered good companies with excellent projects that are feasible even in these market conditions. We also found many that investors should avoid.

RF: Precious metals investors have learned some hard lessons by taking on too much risk in companies with projects that may not be feasible.

Companies that are doing well in a down market are the ones that will rise to the top and perform well, but it will continue to be a stock-picker's market.

TGR: Jeff, Rob, thanks for your time and your insights.

Jeff Desjardins founded Visual Capitalist, a popular investor website that focuses on precious metals and commodities. Desjardins believes in the fusion of information and design to give investors insight in ways never done before. At the beginning of 2013, he created the concept for Visual Capitalist's latest endeavor: a universal, independent and comprehensive stock scoring system that would give investors unprecedented access to investment research on mining stocks.

Rob Fuhrman, lead analyst at Visual Capitalist, is an energetic economist and trader specializing in Canadian and U.S. stock markets. At Visual Capitalist, his focus has been on creating and developing the Tickerscores system for gauging the health of precious metals stocks. Fuhrman's background in financial economics allows him to visualize big picture scenarios, while his trader mentality allows him to pinpoint areas in the markets to focus on.

Want to read more Gold Report interviews like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent interviews with industry analysts and commentators, visit our Streetwise Interviews page.

DISCLOSURE:

1) Brian Sylvester conducted this interview for The Gold Report and provides services to The Gold Report as an independent contractor. He or his family own shares of the following companies mentioned in this interview: None.

2) The following companies mentioned in the interview are sponsors of The Gold Report: Gold Standard Ventures Corp., Klondex Mines Ltd., Cayden Resources Inc., Primero Mining Corp., MAG Silver Corp., Colorado Resources Ltd., Probe Mines Limited and Rubicon Minerals Corp. Streetwise Reports does not accept stock in exchange for its services or as sponsorship payment.

3) Jeff Desjardins: I or my family own shares of the following companies mentioned in this interview: None. I personally am or my family is paid by the following companies mentioned in this interview: None. My company has a financial relationship with the following companies mentioned in this interview: None. I was not paid by Streetwise Reports for participating in this interview. Comments and opinions expressed are my own comments and opinions. I had the opportunity to review the interview for accuracy as of the date of the interview and am responsible for the content of the interview.

4) Rob Fuhrman: I or my family own shares of the following companies mentioned in this interview: None. I personally am or my family is paid by the following companies mentioned in this interview: None. My company has a financial relationship with the following companies mentioned in this interview: None. I was not paid by Streetwise Reports for participating in this interview. Comments and opinions expressed are my own comments and opinions. I had the opportunity to review the interview for accuracy as of the date of the interview and am responsible for the content of the interview.

5) Interviews are edited for clarity. Streetwise Reports does not make editorial comments or change experts' statements without their consent.

6) The interview does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer.

7) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned and may make purchases and/or sales of those securities in the open market or otherwise.