I always try to get in early on a new area or commodity play. If I'm not in early, then I will simply choose not to play. Obviously I miss some opportunities with this conservative philosophy but, as a contrarian, I refuse to follow the sheeple.

Let's look at the seven junior resource bubbles that have blown up and burst since 2008. Two attracted my speculative dollars: REEs and the pre-Fukushima uranium boom. I ignored the following: Saskatchewan coal, potash, lithium, Colombia and the Yukon.

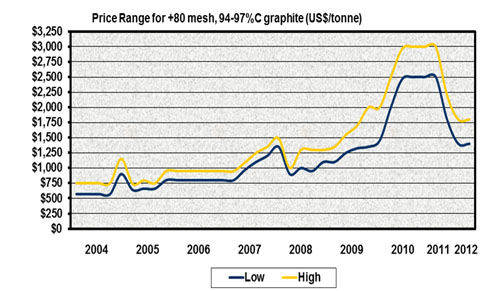

It appears that graphite is next in line for a commodity boom. The market is driven by increasing demand from traditional applications, new technology uses, and China's 75% control of supply, its depleting reserves, and efforts to consolidate operations and restrict exports to the industrialized world. These factors led to graphite prices going parabolic from 2010-2012. Despite 2012's price fall as the world's economy slowed, graphite is still selling at more than double its early 2007 price and has stabilized recently. In fact, I don't think this play is over:

Chart Courtesy of Northern Graphite Corp.

I was first introduced to the supply and demand fundamentals of graphite and a potentially looming shortage over two years ago by one of my dedicated subscribers in the Chicago area. Tom Hartel is a lay investor who quickly learned to do his own due diligence and has become a savvy speculator in the junior resource sector.

So when Tom has an idea, I listen. In the fall of 2010, he asked me about the commodity and soon thereafter introduced me to an opportunity in what is now Northern Graphite Corp (NGC.V). Knowing little about graphite at the time, I researched the commodity and the company, and declined the offer. My rejection had little to do with the company's share structure, its people, or its Bissett Creek, Ontario project.

It was mainly because its predecessor had an OTCBB listing and the corporate presentation I received did not indicate a future listing on the Toronto Venture Exchange. Folks, I don't do the bulletin board. In hindsight, I missed a great opportunity.

Also around that time, I came across another graphite play, Focus Graphite Inc's (FMS.V) Lac Knife project in northern Quebec. I reviewed the company, met with the CEO and ultimately passed on the opportunity because its main focus at the time was as a graphene R&D company. Again, this was another one missed; FMS stock went up over 1,000% from the time of my first evaluation to a spike five months later.

In early Q2/11, these two companies remained the only Toronto-listed junior resource companies dedicated to graphite space.

Meanwhile, my search for a graphite developer continued. In the early spring of last year I was approached by a couple of geologists and alerted to a capital pool company that was acquiring their option on a moth-balled graphite mine in Sweden. Finally I had found the early-on deal that met my investment criteria (Mercenary Musing, December 15, 2008) and speculative dollars were committed in August 2011. In early 2012 this company morphed into Flinders Resources Ltd (FDR.V); it has been a very good speculation for me.

By late 2011, there was a buzz on Howe and Bay Streets about the graphite game and speculators were starting to stir. For a brief while it seemed every snake, shark, charlatan, and shyster occupying an office within sailing distance of Coal Harbor was floating a graphite play. From just two companies in mid-2011, there were over 40 listed on the Toronto Exchanges a year later. Then came the downside of the price parabola and the numerous Johnny-come-latelies are now left holding the bag for tax-loss season.

That said, the three public companies discussed above remain sharp pencils in graphite space. There are a handful of others with recent geological discoveries but at this stage, only a couple can be classified as potentially advanced explorers or developers.

Over the course of the late summer and early fall, I toured the flagship properties of Flinders Resources, Focus Graphite, and Northern Graphite and report on these visits herein.

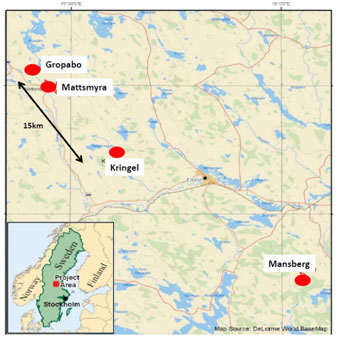

My first stop was in central Sweden at Flinders' 100% owned Woxna graphite project. This fully permitted and financed mining project is located in central Sweden about 300 km northwest of Stockholm. It encompasses four graphite deposits including the Kringel mine, which produced graphite from 1997-2001. In addition, the company owns concessions covering 60 km of strike length of a favorable geological horizon with many known graphite occurrences and geophysical targets awaiting exploration.

I toured the project in August in the company of CEO Martin McFarlane, process engineer Don Pettersson, consulting geologist Lars Dahlenborg, general manager Folke Soderstrom. Office manager Astrid Soderstrom provided logistical support.

Woxna Graphite Project, Sweden

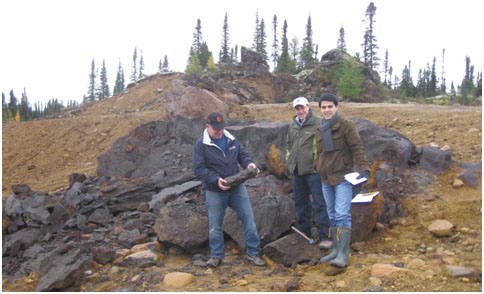

Here's a photo of geologist Lars Dahlenborg and yours truly at the Kringel pit, which is expected to be completely dewatered by the end of Q1/13 and available for development and exploitation:

Kringel Open-Pit Graphite Mine

Flinders drilled delineation and exploration core holes throughout the spring and summer to successfully qualify and expand a previous historic resource. Currently Kringel has a NI 43-101 measured and indicated resource of 2.6M tonnes grading 10.5% graphitic carbon at 7.0% cutoff grade that is open to expansion along strike and at depth. The photo below shows a high-grade zone of graphitic schist:

Graphite-Bearing Core from the Kringel Deposit

As part of project remediation, Flinders has cleaned up, rebagged, and sold low-grade ore stockpiles to its previous European customers. This effort generated minor cash flow to the coffers but more importantly, reestablished relationships with past buyers of Woxna Graphite.

One Tonne Bags of Graphite Ready for Shipment to Customers

In recent news, Flinders appointed London-based GBM Engineering to complete a process flow sheet, design, and refurbishment of the existing mill and concentration plant. It is progressing with mine

dewatering, tailings dam remediation and procurement of mining and processing equipment.

CEO McFarlane recently provided guidance that the company is within its budget and timeline to achieve commercial production at an annualized 13,000 tonnes of graphite in Q1/14. I expect the Kringel deposit to be a robustly economic graphite mine. Plans for expansion are expected after the first phase of production is achieved.

My second tour was at Focus Graphite's 100% owned Lac Knife deposit in northern Quebec. It is located about 30 km southwest of Labrador City and is accessible via highway and 32 km of unimproved dirt road. The main provincial power line is located five km from the site, and a public railway is 30 km away.

Lac Knife Project, Quebec

I was accompanied on the visit by CEO Gary Economo and two company geologists, Director Marc-Andre Bernier and Benoit LaFrance. Here's a photo of our tour group, including four Quebec-based analysts and the aforementioned company personnel:

Lac Knife Tour, September 2012

We first examined an outcrop that was stripped to obtain surface samples for metallurgical testing:

Lac Knife High-Grade Graphite Outcrop

Other stops included the core shed for examination of recently drilled core, a current exploration drill site, and large diameter core to be used for additional metallurgical and process tests:

Graphite-Bearing Core for Metallurgical Testing

Graphite was discovered at Lac Knife in 1959 and the project was explored and developed by various entities with a feasibility study in 1990 by Graftech International. Focus acquired the project in 2010 from Iamgold. Lac Knife hosts a qualified indicated resource of 4.9M tonnes grading 15.8% graphitic carbon and an inferred resource of 3.0M tonnes at 15.6% graphite, both at a cutoff grade of 5.0%.

A recent preliminary economic analysis studied a 20-year open-pit mining operation with a strip ratio of 1.1:1, 15.6% head grade and 91 % recovery. Production of 46,600 tonnes of graphite per annum had a total capital cost of $154M (including working capital and contingency) and $435 per tonne milled operating cost. These estimates gave a pre-tax NPV of $246M and 32% IRR at a 10% discount rate. Focus Graphite currently projects initial production in Q2/14. FMS has $20M in cash and will require project financing in the near future to meet its timeline.

My third project tour was Northern Graphite Corp's Bissett Creek project located 100 km east of North Bay, Ontario and 17 km from the Trans-Canada highway and a natural gas pipeline.

Bissett Creek Graphite Project, Ontario

Northern Graphite's President Don Baxter was my tour guide for the day. Consulting geologist Mehmet Tanner was present at the project site to show me outcrops, current drilling, and core.

Don Baxter and Mehmet Tanner at Old Test Mining Pit

Bissett Creek is a shallowly-dipping, tabular ore body that crops out or is covered by a thin till over a broad area, and thus is amenable to reserve expansion with little increase in strip ratio:

Graphite-bearing Outcrop

It is entirely composed of flake graphite with a significant portion in the large to jumbo category:

Very Large Flake Bissett Creek Graphite

Northern Graphite tabled a bankable feasibility study in July. It is based on a 23-year mine life, an open-pit probable reserve of 18.9M tonnes of 1.89% graphitic carbon at a cutoff of 1.2%, strip ratio of 0.5:1, processing of 2500 tonnes per day, 94.7% recovery, and annual production of 19,000 tonnes of graphite for the first five years. Capital costs are $103M, and life-of-mine operating costs are $968 per tonne of concentrate. Using an $1,800/t graphite price and 8% discount rate resulted in an after-tax NPV of $65M and IRR of 14.8%.

Management sees room for improvement in this financial model with recent drilling to move higher grade inferred resources into the indicated category, resolution of higher pilot plant graphite recoveries than head grade calculations, using company versus contract mining, permitting of lower cost tailings disposal options, and economic analysis of value-added spherical graphite. The company is confident operating costs can be reduced to $800 per tonne and result in better project economics.

The company's current timeline to commercial production is Q2 2014. It has $10 million in cash and will require project financing in the near term to achieve this schedule. Discussions with potential strategic partners are ongoing. Company guidance indicates significant news flow is forthcoming within the next two months.

I consider myself fortunate to have visited the three current Toronto-listed graphite developers. I thank Marty McFarlane of Flinders Resources Ltd, Gary Economo of Focus Graphite Inc, and Greg Bowes and Don Baxter of Northern Graphite Corp for their graciousness and hospitality in arranging these tours and for reimbursement of my expenses. Please note my opinion of Flinders is skewed by financial involvement with the company.

Finally, I wish these gentlemen my best and hope their projects are developed into profitable graphite mines and loyal shareholders are justly rewarded.

Mickey Fulp

Mercenary Geologist

Acknowledgement: Michelle Lopez is the editor of MercenaryGeologist.com.

The Mercenary Geologist Michael S. "Mickey" Fulp is a Certified Professional Geologist with a B.Sc. Earth Sciences with honor from the University of Tulsa, and M.Sc. Geology from the University of New Mexico. Mickey has 35 years experience as an exploration geologist and analyst searching for economic deposits of base and precious metals, industrial minerals, uranium, coal, oil and gas, and water in North and South America, Europe, and Asia.

Mickey worked for junior explorers, major mining companies, private companies, and investors as a consulting economic geologist for over 20 years, specializing in geological mapping, property evaluation, and business development. In addition to Mickey's professional credentials and experience, he is high-altitude proficient, and is bilingual in English and Spanish. From 2003 to 2006, he made four outcrop ore discoveries in Peru, Nevada, Chile, and British Columbia.

Mickey is well-known and highly respected throughout the mining and exploration community due to his ongoing work as an analyst, writer and speaker.

Contact: [email protected]

Disclaimer: I am a shareholder of Flinders Resources Ltd and it pays a fee of $4000 per month as a sponsor of this website. I am not a certified financial analyst, broker, or professional qualified to offer investment advice. Nothing in a report, commentary, this website, interview, and other content constitutes or can be construed as investment advice or an offer or solicitation to buy or sell stock. Information is obtained from research of public documents and content available on the company's website, regulatory filings, various stock exchange websites, and stock information services, through discussions with company representatives, agents, other professionals and investors, and field visits. While the information is believed to be accurate and reliable, it is not guaranteed or implied to be so. The information may not be complete or correct; it is provided in good faith but without any legal responsibility or obligation to provide future updates. I accept no responsibility, or assume any liability, whatsoever, for any direct, indirect or consequential loss arising from the use of the information. The information contained in a report, commentary, this website, interview, and other content is subject to change without notice, may become outdated, and will not be updated. A report, commentary, this website, interview, and other content reflect my personal opinions and views and nothing more. All content of this website is subject to international copyright protection and no part or portion of this website, report, commentary, interview, and other content may be altered, reproduced, copied, emailed, faxed, or distributed in any form without the express written consent of Michael S. (Mickey) Fulp, Mercenary Geologist.com LLC.

Copyright © 2012 MercenaryGeologist.com. LLC All Rights Reserved.