The Critical Metals Report: Jeb, the U.S. Department of Defense (DOD) recently took the unusual step of contracting with Ucore Rare Metals Inc. (UCU:TSX.V; UURAF:OTCQX) to conduct a mineralogical and metallurgical study on the company's Bokan Mountain heavy rare earth element (HREE) property in Southern Alaska. Tell our readers why that matters.

Jeb Handwerger: It matters because the DOD is now a huge potential partner for Ucore. After researching and studying all domestic rare earth element (REE) assets, it identified the company's Bokan Mountain project as the key HREE resource. It put a stamp of approval and credibility on Ucore as the primary resource for its domestic supply chain.

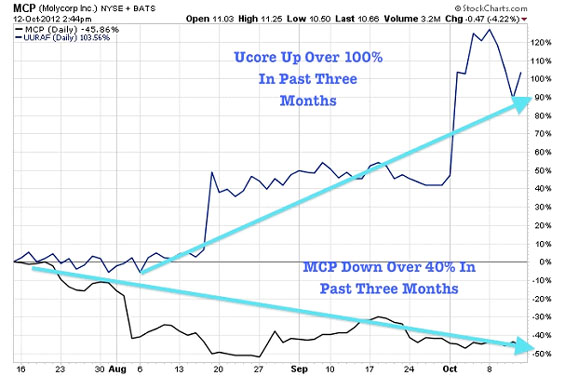

What this means for UCU investors is obvious. It can be seen in Ucore's stock price and volume and the way that it's performing against all other REE miners, recently hitting new 52-week highs on very strong volume. This at a time when the Market Vectors Rare Earth/Strategic Metals Exchange-Traded Fund (REMX:NYSE.A) and many of the other larger REE miners are hitting 52-week lows (see chart below). The stock action is a huge testament to the value and credibility of what the Ucore management team has done to develop the Bokan property so far. By the way, the DOD could eventually become an ideal offtake partner for Ucore.

TCMR: Interesting. Is any money changing hands in this deal between the DOD and Ucore or is it just a study?

JH: Right now, it's at the initial stage. But we believe it could turn into something significant, a substantial financial commitment. In my last TCMR interview, I spoke about the importance, when studying the REE sector, of looking at possible geopolitical support in a mining jurisdiction that could provide financial backing. We're seeing that in this case, the advantage a company has when it gets a partner like the DOD. The DOD's support could really help fast-track Ucore into production of not only REE concentrate but also being able to separate individual rare earth oxides (REEOs). These are needed for weapons, such as the Stealth helicopters and guided missiles.

TCMR: But Ucore's Bokan Mountain certainly isn't the only REEs project in the U.S. Why did the DOD choose Ucore over similar companies?

JH: I think it is because Ucore has a large percentage of heavy rare earths (HREEs), such as dysprosium, terbium, europium, yttrium and neodymium—the critical REEs that the DOD requires. We believe that Ucore has the best plan to produce a usable product in the near term. It has surpassed so many other competitors in the study of solid-phase extraction (SPE) metallurgy, which is completely revolutionary.

TCMR: What do investors need to know about SPE?

JH: The key benefit of it is the efficiency and the accuracy of the extraction process. It's far more advanced than solvent extraction. It shrinks the footprint required to operate a mill, which enhances the economics. It's better economically and environmentally. It pretty much leapfrogs the current technology.

TCMR: It's a nanotechnology, too, right? It's doing it at a microscopic level.

JH: Right. Ucore recently reported it was able to come up with a separation of dysprosium. This feat probably entered into the DOD's decision process when it chose Ucore. A key issue for the DOD was that some other companies made deals with firms in China that would take U.S. ore and ship it to China to process. So you're not really getting the critical REE independence.

TCMR: The other interesting thing about SPE is that, due to the nature of REEs, this isn't like a big base metals mine where mass tonnage is the name of the game. You can have a nano-level separation technology and still have a profitable operation because you don't need to have a lot of tonnage to make a lot of money.

JH: Right. We'll see more on that in the preliminary economic assessment (PEA), which is imminent. It is why UCU decided to delay the release of its PEA in order to incorporate this SPE technology, because it does have a significant impact on the project economics.

TCMR: Orbite Aluminae Inc. (ORT:TSX; EORBF:OTXQX) put out a study that demonstrated the success of its solvent-extraction, ion-exchange technology that it's incorporating into its plant in Quebec. What's your take on this development?

JH: It came out in July with some developments that the market was impressed by. I'd like to see some more progress from other companies, discussing more of these innovative methods for extraction and really where it's becoming a part of the chemistry process. That's why I think companies like Ucore and Orbite are gaining so much market awareness, because they are facing the issues that all REE companies are facing, which is the processing and the chemical cracking of the metallurgy. This is what the market is looking for, and I'd like to see some of the other REE miners make progress in that area.

TCMR: Or perhaps they could even license or borrow these innovative technologies from these other success stories.

JH: It's important that they're trying to separate the oxides, rather than just producing a concentrate to be separated somewhere else. It's a really important part of this process of development.

TCMR: Is the Made in America solution something that other American-based projects could possibly piggyback on?

JH: For the HREEs, with proven rare resources and access to the economically accessible ore, right now the only advanced HREE asset in the U.S. is Ucore. I think Molycorp Inc. (MCP:NYSE) was doing some exploration. Rare Element Resources Ltd. (RES:TSX; REE:NYSE.MKT) has a deposit where it found some HREEs, but it's still earlier stage, and they are predominantly light rare earth (LREE) assets.

TCMR: What's the next catalyst for Ucore?

JH: The PEA, which was delayed to integrate the SPE breakthroughs. After the PEA is published, the company is going to upgrade its NI 43-101 resource to Indicated and Measured based on recent drilling. We expect that there will be lots of interesting news to follow these important announcements as well. That may include continued offtake agreements, partnerships and different support that the company has recently been receiving, and advancements in the extraction technology.

TCMR: Earlier you talked a little bit about the struggles and challenges that the REEs sector is going through and that there are only a handful of companies that are trading near 52-week highs. What are those companies? What are some of the REEs stories that you're following that could possibly rebound with some positive news?

JH: Besides Ucore and Orbite, the other candidates in mining-friendly jurisdictions that have a good percentage of the HREEs and that could possibly supply more are Quest Rare Minerals Ltd. (QRM:TSX; QRM:NYSE.MKT) and Tasman Metals Ltd. (TSM:TSX.V; TAS:NYSE.MKT; TASXF:OTCPK; T61:FSE). Sweden-based Tasman has the HREEs that may be Europe's answer for HREEs. Europe is probably going to try to do something like what the DOD did and have some initiative with Tasman as well.

TCMR: Tasman recently announced that it had a number of drill results from the Norra Karr deposit in Sweden. What were your thoughts when you read those results and some of the changes in the thickness of the mineralization?

JH: I think geologically it is by far one of the best assets in the world. We think that Tasman will eventually be able to gets its material processed and is going to get an offtake arrangement or a strategic partner. Tasman is a very important asset for the European Union (EU). It has very impressive new drilling results. We'd like to see it, like others have done, get a strategic partner. It can then work with that partner to process some of the material and work on the advanced metallurgy and the processing.

TCMR: A number of smaller players have offtake agreements in place and strategic partners. Why doesn't Tasman have that yet?

JH: That's a great question. I really don't know. It's a question many may be asking. It's a hard question to answer because it's by far one of the best deposits out there. It's in a mining-friendly jurisdiction. It could become a major producer for the EU and produce dysprosium for the major car manufacturing industry in Germany. I'm sure it has a bunch of suitors. I guess it's negotiating.

In this sort of market environment, it's tough if you're running a junior mining company. Look at Matamec Explorations Inc. (MAT:TSX.V; MRHEF:OTCQX). It signed a deal and the stock went down because the deal may have not been great for the shareholders. Now rare earth CEOs are saying, "maybe we should wait until the market turns around and there's more of a desperate need for these."

TCMR: What about Quest? It's been up and down for shareholders. Right now it's trading at about $1.32. This is still a great deposit. Why isn't it getting more respect in the market?

JH: I think there are some issues in Quebec right now, mining-wise, politically. With Quest, we'd like to see some geopolitical progress and see how it's going to fund the large capex. It has a large amount of infrastructure to build. Right now, it's a race. So I'd like to see how it is going to compete against some of these smaller deposits that have a lot of political support.

TCMR: What about the notion that China will eventually become a net importer of HREEs and, thus, a deposit like Strange Lake could benefit from that? That's certainly more of a long-term story. Is that a realistic argument? Is that a realistic catalyst?

JH: I think that it's definitely a catalyst for the sector. But some of these other firms need to show me where the money is and where they're making strategic deals, where the strategic partners are. They need to show a lot of derisking of some of those larger capex situations. They also have to realize that this is a race. If you rest on your laurels, you're going to be missing out on an important part of this market, which is getting into production in a timely manner.

TCMR: Should investors be "long" on REEs?

JH: As a sector, it's been a stock picker's market. There are one or two stocks that are hitting near 52-week highs. So really you have to be very selective.

TCMR: In terms of what you're doing, are you holding these for the long term?

JH: I'm definitely holding them. I'm a "hold" on the sector overall and a "buy" on specific stocks, such as Ucore, which have made significant progress with the metallurgy and having the DOD as a partner. I probably would do the same with some of these other REEs miners if I saw some important developments in those areas.

TCMR: As far as that goes, were there whispers about a possible DOD deal at Bokan Mountain before it happened or was it a surprise?

JH: It was a complete surprise. Ucore had been talking about a critical materials strategy for a while but nothing ever happened. Then after the big announcement, the share price shot up 20% or 30% in one day.

TCMR: As we talked about before, we're definitely seeing a lot of 52-week lows and even historic lows for many of these equities in the REEs space. Why should investors stay positive?

JH: Investors should stay positive because demand for these elements is growing. The supply is very limited and the tensions are growing with China. There is a chance of a supply shortfall in the near term, especially of critical REEs.

The equity markets have hit new highs. We're beginning to see the start of a risk-on rally. The sector itself is a new sector, a new mining sector. It's a market lost for 30 years to the Chinese, so there's definitely risk involved with it. We've had a risk-averse market, so it was one sector that was hit hard. But we are beginning to see a rotation into risk-on. We saw this type of environment in 2010 and saw how fast the sector can turn. I believe that we're going to see it again because the REEs are not going anywhere.

There is still need. China needs the HREEs and is looking to expand abroad. When this market turns and when investors begin to realize how critical this area is, we're going to see explosive gains.

TCMR: Over the years, we've seen the biggest players in the space—the BHP Billiton Ltds. (BHP:NYSE; BHPLF:OTCPK), the Rio Tintos (RIO:NYSE; RIO:ASX), the Xstrata PLCs (XTA:LSE) and the Glencore International Plc (GLEN:LSE; 0805:SEHK) diversify into a number of commodities. Do you see that as an eventuality? Could it eventually come to pass where these monoliths start venturing into the REEs because there is significant money to be made?

JH: IAMGOLD Corp. (IMG:TSX; IAG:NYSE) has the niobec nionium deposit and it has REEs nearby it. It announced recently that the REEs may be a game changer for it. We think that once the big miners can see game-changing fundamentals for some of these REE miners, especially the ones with the critical REEs, and we see the prices go higher over the long turn, there's definitely going to be more interest in that. But we first have to be able to produce profitably outside of China, and we haven't really been able to do that yet.

TCMR: Jeb, thank you for speaking with us today.

JH: Anytime.

Jeb Handwerger is a newsletter writer who is syndicated internationally and known throughout the financial industry for his accurate and timely analysis of the equities markets—particularly the precious metals sector. Subscribe to his free newsletter.

Want to read more exclusive Critical Metals Report articles like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent interviews with industry analysts and commentators and learn more about critical metals companies, visit our Critical Metals Report page.

DISCLOSURE:

1) Brian Sylvester of The Critical Metals Report conducted this interview. He personally and/or his family own shares of the following companies mentioned in this interview: None.

) The following companies mentioned in this article are sponsors of The Critical Metals Report: Rare Earths Ltd., Rare Element Resources, Tasman Metals Ltd., Ucore Rare Metals Inc., Quest Rare Minerals Ltd. and Orbite Aluminae Inc. Interviews are edited for clarity.

3) Jeb Handwerger: I personally and/or my family own shares of the following companies mentioned in this interview: Ucore Rare Metals Inc., Quest Rare Minerals Ltd. and Tasman Metals Ltd. I personally and/or my family am paid by the following companies mentioned in this interview: None. I was not paid by Streetwise Reports for participating in this interview.