To help turn around the lagging US economy and stubbornly high unemployment, the Federal Reserve recently announced "QE3".

Quantitative easing (QE) is an action taken by central banks to stimulate the economy, typically when interest rates are already very low.

QE involves buying financial assets with newly created money. QE is designed to increase bank reserves, and the demand for loans. Increased demand for loans increases their prices, and reduces their yield which helps reduce interest rates across the board. Higher bank reserves means banks have more money to lend out, and this combined with lower interest rates increases borrowing, which increases investment and consumer spending. The whole idea is to give the economy and growth a boost.

As its name implies, QE3 is not the first iteration of quantitative easing employed by the Fed. QE1 began in late 2008 not long after the collapse of numerous financial institutions. At that time the market was in a very bad way, having lost nearly 50% of its value in under a year. QE1 was a much needed fund injection and helped resume interbank lending and boost investor confidence. With almost $1.5 trillion in stimulus, QE1 gave the market a massive lift and helped limit the damage in other sectors of the economy.

The downside to QE programs is that they create money out of thin air. Elementary economics tells us an increase in the money supply leads to inflation. The more money that is printed, the more expensive goods and services become, which does work in practice to a certain extent.

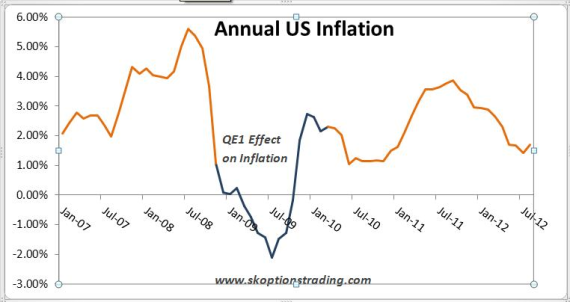

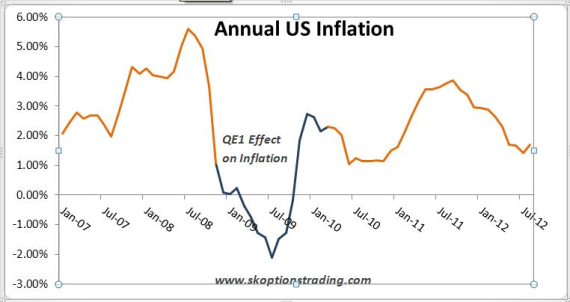

The following chart shows US inflation before, during and after QE1 (QE1 is the blue segment).

On the face of it, QE1 had no measurable effect on inflation. A superficial correlation/causation look at the chart would imply QE1's deflationary effects. Not long after it was began, the price level fell!

Obviously the reality is not so simple. The minor deflation in 2009 was due to a myriad of causes, including a massive retraction in consumer spending and business investment post the 2008 crisis. So QE1 did not so much cause inflation, but served to inhibit the deflation that was perceived at the time.

Inflation is an indicator for us, not an investment in itself. We primarily trade precious metals and this is where our focus and interest lies. Inflation is of massive importance any investor, but those in the precious metals and commodities markets especially.

With the announcement of QE1, one would have expected a spike in the gold price. Gold is often considered the traditional hedge for inflation. Gold is far less a commodity than it is a currency and as such we prefer to view gold as a hedge against currency devaluation more than a hedge against inflation. Unlike FIAT currencies, central banks cannot print gold. Supply remains fairly constant, as yearly mining production is insignificant relative to the gold in existence. This makes gold the ultimate store of wealth and protection against inflated paper money.

Over the duration of QE1, gold gained around 50%.

Not long after QE1 was ended, the recovery began to slow and the Fed became frustrated with unemployment and weaker growth. More stimuli was enacted, in the form of QE2. Although much smaller at "only" $600 billion, QE2 helped the overall situation if not considerably improving it, at the very least helping to avoid a deterioration.

Gold rose a further 25% on the back of inflation fears once again during QE2, not as large as the rise during QE1 but keep in mind that QE2 was less than half the size as QE1. The S&P 500 rose to near pre-crisis levels and although increasing, inflation stayed within an acceptable range. From those indicators, QE2 could be judged successful.

Fast forward to 2012 and unemployment is still high, but gradually decreasing. The last round of QE was in January when gold prices increased by around $200.00, as investors anticipated another round of money printing.

This rally was essentially baseless and unfounded and we saw through its superficiality. Before long, gold corrected back down to the low $1500s.

With a poor May payrolls number, we changed our outlook in early June. The May NFP payrolls number came in at 69,000 when the forecast was 150,000. This was a huge miss and with the Fed's mandate to pursue full employment we believed this was to be the first trigger for more QE. Accordingly, we got long gold in the following months and generated some great returns for subscribers, outperforming gold 10x over.

We were proved correct in September when Ben Bernanke announced QE3. We believe this will push gold above its record highs set in 2011 and are so confident of the yellow metals upside we have made a limited offer to new subscribers.

Looking forward, we are very bullish on gold. QE3 has given gold a launching pad and we have several open positions to profit from this view. QE3 will inject $40 billion into the economy per month until unemployment is at satisfactory levels. We believe this will take three years or more, amounting to total stimulus of no less than $1.44 trillion. This is incredibly bullish for gold and with the leverage and flexibility options give us; we are very excited about the trading opportunities that lie ahead.

$40 billion/month is the planned amount for QE3 at this stage – for "as long as it takes". The best result for gold would be no employment growth for the next several months. This would necessitate further stimulus by the Fed and this would undoubtedly come as an increase in the monthly $40bln injections.

We see this as a very likely scenario.

This all paints a very rosy picture for gold. We have several speculative gold trades currently open and some very attractive ones in the pipeline.

The key thing with options to maximize your profits is to time the market well. This is what we excel at and is how we generate such high returns for our subscribers. Join now to be part of a winning team, and don't miss out on the opportunities that gold is presenting in the very near future!

Sleep tight.

Sam Kirtley

SK Options Trading