Austin Kiddle, an analyst with bullion broker Sharps Pixley, asked the following question in a recent commentary: "Can fear refuel the investment demand for gold?" It's a question many investors are now asking and well worth addressing.

The real question behind this question that investors are asking is: "What will it take to propel gold higher in the near term?" While there's no denying gold is a fear hedge in prolonged periods of deep uncertainty, gold doesn't always benefit from fear in the short-term. The current economic environment is a good example of the exception to that rule. Gold has actually underperformed in the last five months relative to the U.S. dollar. The fear and uncertainty generated by the euro zone crisis resulted in a flight to safety to the dollar while gold was largely ignored by investors.

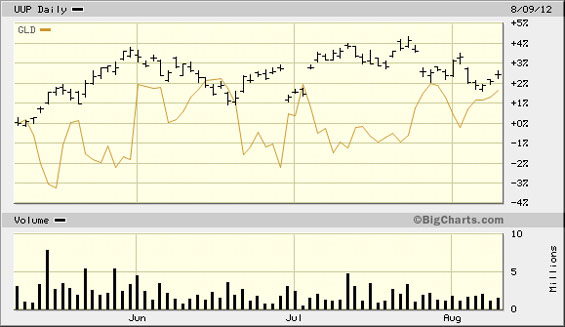

The following chart shows the extent of gold's underperformance by comparing the progression of the dollar ETF (symbol UUP) with the SPDR Gold Trust ETF (symbol GLD). This graph clearly shows that investors have favored cash over the yellow metal during the most intensive part of the euro zone fear in the March-June period.

Since June, which was a pivotal month in reversing the public's extreme fear of a euro zone collapse, gold has been playing a game of catch-up with the dollar and is nearly even with the greenback on a relative strength basis (see chart below).

The lesson here is that gold's underperformance in the March-June period was due to investors' fears, but its subsequent bounce back since June can be attributed to gradually diminished fears. If this relationship holds, gold's short-term outlook will be bolstered by a decrease in risk aversion among investors, not fear. With the 4-year cycle peaking into October, gold can ride the cresting optimism over the broad market uptrend for equities and commodities as well as the latest "quick fix" in the ongoing euro zone crisis.

So it is that gold finds itself—temporarily at least—in the perverse position of requiring a diminution of fear and pessimism among market participants to bolster its price. Gold, in other words, will benefit more from good news than bad news in the near term. Investors shouldn't expect this imbalance of investor psychology to last very long, however. Gold will likely return to its historical tendency of feeding off fear once the election is over and the 4-year cycle has peaked. Until then, we can only follow the lead of the short-term technical indicators while gold benefits from the market's falling risk aversion.

2014: America's Date with Destiny

Take a journey into the future with me as we discover what the future may unfold in the fateful period leading up to—and following—the 120-year cycle bottom in late 2014.

Picking up where I left off in my previous work, The Stock Market Cycles, I expand on the Kress cycle narrative and explain how the 120-year Mega cycle influences the market, the economy and other aspects of American life and culture. My latest book, 2014: America's Date With Destiny, examines the most vital issues facing America and the global economy in the 2-3 years ahead.

The new book explains that the credit crisis of 2008 was merely the prelude in an intensifying global credit storm. If the basis for my prediction continue true to form—namely the long-term Kress cycles—the worst part of the crisis lies ahead in the years 2013-2014. The book is now available for sale at:

http://www.clifdroke.com/books/destiny.html

Order today to receive your autographed copy and a FREE 1-month trial subscription to the Gold & Silver Stock Report newsletter. Published twice each week, the newsletter uses the method described in this book for making profitable trades among the actively traded gold mining shares.

Clif Droke

Gold & Silver Stock Report