The Critical Metals Report: Mickey, your presentation at the recent Murdock Capital Partners Symposium, a primer on specialty metals for the layperson, was fascinating. What inspired the topic?

Mickey Fulp: There has been a lot of confusion in the minor metals space. There are a number of newly invented terms, such as electric metals, critical metals, rare metals, technology metals and strategic metals. If we go back through the demand history of what I prefer to call minor or specialty metals, these latter two terms have existed for a long time. By making the terms obscure and puzzling, we're doing a disservice to not only the lay investor, but also to professionals and analysts. My goal is to simplify this, go back to our roots and do away with superfluous names.

TCMR: The term that you prefer is "specialty" or "minor metals." But what metals actually fit the critical metals designation?

"My goal is to simplify this, go back to our roots and do away with superfluous names. "

MF: In my opinion, the critical metals have a few crucial criteria: They are essential to modern-day industrial processes, and by extension, modern civilization and global economic health. They generally have major tonnages mined. They trade on open markets, including futures and options markets, or they trade as bulk, dried commodities via negotiated contracts or preset prices.

Critical metals would include iron ore, which comprises 95% of the world's total metal production and was a major advancement for humanity with the dawning of the Iron Age; aluminum, which had no application until the 1890s and now is the world's second most important metal; and copper, which is really the true electric metal, and whose price most directly affects global industrial and economic health.

I would also include the major ferrous alloys, such as chromium, manganese, nickel and molybdenum, which are essential metals for making various grades and types of steel; titanium, which in oxide form is used in nearly all pigments and in metallic form as ferrous and specialty metal alloys, and zinc, lead and tin, which are essential for major industrial applications, including galvanizing, batteries and alloys. Copper-tin alloys ushered in the Bronze Age, which was another major advancement for humankind. Finally, I consider uranium a critical metal. It had no known use, application or supply until the 1950s and now contributes 14% of the world's electrical energy supply.

TCMR: Uranium is less understood among the investment community. What's the source of the confusion?

MF: Uranium is different than the other critical metals in that it is not mined in large tonnages. About 50–55 thousand tons are produced per year, and it sells by the pound. It does not trade in a futures market of any significance, but through negotiated long-term contracts or via the spot price. As I mentioned earlier, the main criterion for a critical metal should be that it is essential to the function of modern-day industrial civilization. One out of every seven people in the world are using electricity that's sourced from a nuclear reactor, so in my book, uranium fits the bill.

" The junior resource sector has been in a severe bear market since early March 2011. We are now 17 months into it. But rest assured—it's absolutely a buying opportunity."

A specialty or a minor metal is not essential to world economic health. In other words, if the supply were to dry up tomorrow, the world would find substitutes. Specialty metals are produced in small quantities, often as a byproduct in large mines. If their deposits exist as small mines, the concentrating, processing and refining costs are integral to their economic viability. They have sales and market opacity, meaning they do not trade on open markets but usually through offtake agreements or spot price negotiations. The metal is often controlled by a monopoly or an oligopoly—a cartel, if you will. This monopoly may be characterized by a single dominant company, country, region or singular deposit.

TCMR: Let's go over some specialty metals on your list. I notice you have lithium, beryllium, scandium and vanadium, among others. Where is the potential opportunity for investors in the space?

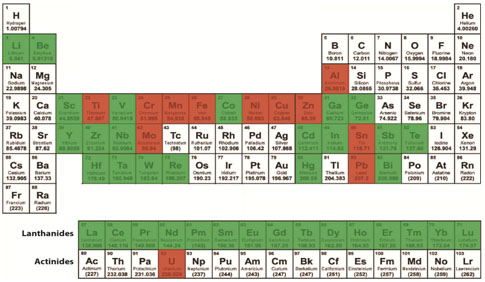

MF: I've come up with a list of 35 elements that I consider specialty metals. I tend to group 16 of those together as rare earth elements. Most investors will probably have heard of about half of these metals.

I apply additional criteria for the ones that I consider viable for speculation as flagship properties in the junior resource sector. I tend to like the elements that occur in small monometallic deposits that can be developed for relatively low capital expenditures (capex) because a junior has limited access to funds. These elements can be concentrated, processed and a final product sold into a free marketplace without incurring significant third-party risk. Therefore, I don't like metals that are controlled by monopolies or cartels or are byproducts from large smelters that are owned by giant mining companies. In my mind, the juniors can't compete in those spaces.

TCMR: Given that criterion, doesn't that eliminate most of the rare earths because those development projects require very large capex?

MF: That's true. That's one reason the rare earth bubble was so short-lived—it existed for a couple of years and has burst. There were 200 companies that ran willy-nilly into the rare earths space. I picked less than a handful of the earliest companies with the best deposits from 2007–2009. Those "cream of the crop" companies are among the only ones that have a chance of being viable. And they are still the only ones that have secured New York Stock Exchange listings. The rare earths space is different from most of the other specialty metals. We probably won't see another bubble like that in the junior resource space for a long time.

TCMR: What's left on the periodic table that you find interesting? You mentioned antimony and tungsten in your presentation.

MF: I consider antimony and tungsten the top targets for juniors in the specialty metals space right now. Those two metals form standalone deposits that tend to be small. There are many countries in the world that have produced these metals, but both are now dominated by Chinese production. As China moves away from strictly an export economy, it will no doubt invoke additional government incentives like export taxes, quotas and tariffs to keep its mined supplies for internal use.

I see opportunities for both antimony and tungsten, especially in North America, which is a geologically and geopolitically favorable region. There are many past-producing tungsten mines in the U.S. and Canada that are relatively small deposits with capex in the range that a junior could handle.

Antimony is a little different in that there are two sources. One is stibnite (antimony sulfide) veins, which occur in many parts of the world. Production of stibnite is now dominated by small mines in China. But antimony is also a product of large integrated smelters controlled by the world's largest mining companies. A stand-alone stibnite deposit is preferable as opposed to copper-antimony deposits, which are common and need big smelters to be refined.

TCMR: Isn't there a tungsten deposit being brought on-line in Nevada?

MF: There are many past-producing tungsten mines in Nevada. Antimony and tungsten used to be produced extensively in North America. In the late 1970s and early 1980s, China flooded the market with cheap tungsten mined by hand from small mines. It destroyed the North American tungsten industry.

The same has occurred over the years with antimony. The U.S. used to produce a lot of antimony, especially from Silver Valley Idaho. China came in and flooded the market with cheap antimony, generally from vein stibnite deposits, whereas much of the antimony in the U.S. came from large base metal smelters. Those smelters that would take complex polymetallic ores (the so-called "dirty" ores) no longer exist in the United States.

TCMR: What about graphite, which of course, is not a metal?

MF: Your point is well taken. Carbon as graphite is a semi-metal and I separate those elements from the specialty metals. That said, I'm very bullish on graphite. I started studying the graphite market more than two years ago. I looked at two up-and-coming graphite juniors and finally chose to delve into the market a little less than a year ago with a startup company, Flinders Resources Ltd. (FDR:TSX.V). That company is now recognized as one of the three leaders in the graphite space.

There are opportunities in graphite. I've gone on record as saying graphite is going to be the next big thing and could be the next bubble. It hasn't panned out yet, but I attribute that to the overall negative junior resource market we've had this year.

TCMR: Flinders has a really smart group behind it. It has a deposit in Sweden, which is very mining friendly.

MF: Sweden is at the top of my list for mining-friendly countries in the world. Flinders has a past-producing mine. The people who are running this company have had very good success with two sister companies. The capex to put this project back into production is about one-fourth the amount that its peers require. It has raised all the money it needs to go into production and is actually selling graphite from stockpiles as we speak. We expect this graphite mine to be in commercial production again by early 2014, if not before.

TCMR: In your presentation, you said, "Build it and they will come," and you gave the example of how affordable color televisions didn't exist until Molycorp Inc. (MCP:NYSE) found a use for europium. We forget that we're still gaining knowledge about the uses for some of these specialty metals.

MF: That's absolutely correct. A lot of new knowledge comes from major company and university laboratories that employ materials science researchers to find new and better applications. The first semiconductor substrates were made out of germanium. Then it was found that silicon was not only easier to obtain but also functioned better and was much cheaper. Sometimes there are new uses found that enhance or negate the demand for a particular metal. That's going on right now.

TCMR: I like what you said in your presentation about how Earth is a cornucopia that has everything we need and, of course, has things that we don't even know we need yet.

MF: I am a Cornucopian—that's a person who thinks that Earth has provided us with a bounty of whatever we need and through new technology, engineering, hard work and due diligence, we will find what we need when we need it. The polar opposite to this would be a Malthusian. The infamous Malthusians are Paul Ehrlich from Stanford University and the Club of Rome. In the late 1960s and early 1970s, these were the people who believed we were going to use up everything we needed and modern-day civilization was doomed to fail. A lot of their pseudo-science and dire predictions were based on booming population growth. Well, since the late 1960s, the world's population has more than doubled and we still seem to have everything we need when we decide we need it.

TCMR: I like your attitude. It's more of a glass-is-half-full sort of attitude.

MF: As an economic geologist, you have to be an eternal optimist because the chances of finding what you're looking for are so slim.

TCMR: The junior resource market is in need of some optimism. It's essentially on life support.

MF: It's in the toilet right now.

TCMR: But there are bright spots within the space. Discovery is still being rewarded. What are some of the interesting deposits or discoveries that you have seen in the last several months?

MF: The junior resource sector has been in a severe bear market since early March 2011. We are now 17 months into it. But rest assured—it's absolutely a buying opportunity. I have been buying targeted stocks during the summer. I have been relatively cautious because I don't think the bottom is quite in yet. Until we get through the summer doldrums and past Labor Day, it's still risky.

"The market is anxious and is looking for good stories. New drill discoveries are being rewarded."

You can adopt the philosophy that if you like a stock, buy it on a stink bid and if it goes lower, buy it lower because you still like it and you want to accumulate it while it's beaten up. That said, the entire sector is beaten up. During my 20 years in this market, I have seen stocks go down no matter what news comes out—good news is looked on as a selling opportunity. What's encouraging to me is that I know of three or four new drill discoveries this summer in the gold sector where the market has moved up quite dramatically on good assay results.

The market is anxious and is looking for good stories. New drill discoveries are being rewarded at this time, which means there is still an appetite in the junior resource sector. The earth continues to give of its bounty as we continue to drill, and the market has reacted positively. That's encouraging to me.

TCMR: Do you have any parting comments?

MF: My rule of thumb is there are always exceptions to my rules of thumb. The metals I like this year are not necessarily the metals I liked two years ago or the metals that I will like two years hence.

The beryllium space is a monopoly, but there is one beryllium company that is competing and I think will be successful in the downstream end.

The niobium space is a monopoly controlled by one mine and one company in Brazil, but there are two other mines that are allowed to produce in the space because the monopoly company needs high-cost producers to justify higher costs for niobium.

That said, North America, especially the U.S., needs niobium. There is one company that could be of interest in the niobium space that I have looked at more than once and it continues to be on my watch list.

Just because I beat up on a metal and say I don't like it doesn't mean that there can't be exceptions that have a legitimate chance of being successful.

I do a biweekly commodity show for Kitco Radio, where I have talked about most of these metals, which ones I like, which ones I don't and the reasons behind my views. It's called Mercenary Musings Radio with Mickey Fulp and Rob Graham. You can find it either on my website under the Interviews page or on the main page of Kitco.com, where each interview is posted for about a week.

TCMR: Thank you, Mickey.

Michael S. "Mickey" Fulp is author of The Mercenary Geologist. He is a Certified Professional Geologist with a Bachelor of Science in earth sciences with honor from the University of Tulsa, and a Master of Science in geology from the University of New Mexico. Fulp has 35 years of experience as an exploration geologist searching for economic deposits of base and precious metals. He has worked for junior explorers, major mining companies, private companies and investors as a consulting economic geologist for over 20 years, specializing in geological mapping, property evaluation and business development. He is currently an analyst and speaker specializing in commodities and the junior resource space.

Want to read more exclusive Critical Metals Report articles like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent interviews with industry analysts and commentators and learn more about critical metals companies, visit our Critical Metals Report page.

DISCLOSURE:

1) Sally Lowder of The Critical Metals Report conducted this interview. She personally and/or her family own shares of the following companies mentioned in this interview: None.

2) The following companies mentioned in the interview are sponsors of The Critical Metals Report: None. Streetwise Reports does not accept stock in exchange for services. Interviews are edited for clarity.

3) Mickey Fulp: I own shares of Flinders Resources Ltd and it is a paying sponsor of my website. I was not paid by Streetwise Reports for participating in this interview.