You need to capitalize on this pricing mismatch right away. If you remember, earlier this year I was pounding the drum hard for graphite miners. . .

Prices for graphite were some of the last to respond to the commodity supercycle.

Copper had run, gold had run, rare earths had certainly run. . .

But graphiteóessential for making both steel and the batteries of tomorrowólagged behind.

Gold ran from below $400 to over $1,800 an ounce and copper went from $1.00 per pound to almost $5.00óboth increases of several hundred percent.

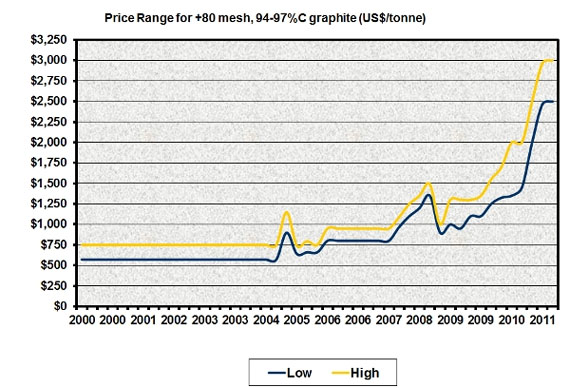

But graphite prices remained relatively flat, trading between $1,000 and $1,500 from 2005 until the last couple years.

Once the world realized graphite was in the same position as rare earths (that demand was and will continue to rise, but supply was controlled by the Chinese), prices took off quickly.

Graphite prices tripled in short order:

It was when the price for the commodity was rising that I started telling you to buy graphite mining stocks.

It was when the price for the commodity was rising that I started telling you to buy graphite mining stocks.

And You Still Should Be

Whenever the price of a commodity rises as dramatically as it did with graphite, inevitably companies try to find more graphite to mine.

Makes sense, right? If the price is flying, why not mine it and sell it?

Well that's exactly what happened.

Before graphite prices took off, there were only a couple graphite companies outside of China. Now there are 36.

A major securities firm just ranked every non-Chinese graphite mine in the world. There were 98 mines owned by 36 companies.

Call it like you see it,

Nick Hodge

Energy & Capital