Earlier this year I made a bad call on natural gas.

"With a very mild winter and tons of shale gas coming online natural gas storage is up big time year over year" I told you in late April.

Related Articles:

Play US Energy Independence with Income-Generating MLPs: Stephen Maresca

Ron Paul-Style Resource Investing: Malcolm Gissen and Marshall Berol

Enzymes and Algae May Spur a Biofuel Boom: Ian Gilson

My point was simple, with an outstanding glut of gas, underground storage could be filled up by September — leading to a vicious drop in natural gas prices.

Here we are in late-July and the downtrend for natural gas prices has snapped.

Today I want to explain exactly what happened. As you'll see, there's a brand new story to be told. Plus I'll share two takeaways for your portfolio…

So why am I retreating on my natural gas prediction so soon?

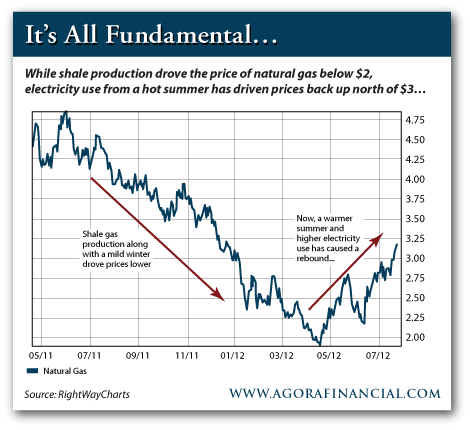

Well, first, you have to remember that we called the natural gas bear market long ago. Back in early 2011 natural gas was trading hands for $4.25-$4.75 per mmbtu. As of April of this year prices were cut in half, trading below $2.

It was an impressive shale-based downfall, take a look…

Now, natural gas prices are up over 50% in the past few months. That's not a drop in the bucket. In fact, it shows a new trend emerging in natural gas usage.

Much like the obscenely warm winter left natural gas supplies uncharacteristically high, the summer heat has done the opposite. With more air conditioners running full blast, and more of that energy coming from cheap natural gas — the glut in underground supply has started to alleviate.

Remember, natural gas is a physical market. If demand increases it can almost immediately spur prices higher. The past few months are a testament to that.

But let me be the first to tell you that this trend isn't just seasonal.

Here's what I mean…

My dad is one of the most frugal people I know. But this summer he's gone and done something I didn't think I'd EVER see. I'd even go as far to say, it's completely unprecedented…

He turned the thermostat down….meaning, he moved the dial to a much cooler temperature than he normally would.

No, he's not just getting older and crotchety about climate control. Instead, as he recently told me, his gas and electric bills are much lower than they used to be.

This is uncharted territory, folks.

Never in my life have I seen my dad spend more money than he needed to. But in a twist of events only a sea-change in the natural gas market could accomplish, it's happening.

You see, we've been conditioned to believe that gas and electric bills always creep higher. One winter's bill may have been $250 and next years could be 10% higher at $275, those types of increases have been indoctrinated in our everyday lives. (You may remember an article I wrote on the topic over 8 months ago.)

But now, noticeably lower natural gas prices have caused bills to drop precipitously. It's creating an unforeseen, latent demand for natural gas. The way I see it, this demand, spurred by cheap energy, is another solid reason natural gas prices have recently rebounded.

When energy is cheap, people use more of it.

With that said, there are two takeaways…

First, with natural gas prices fluctuating — heck they could swing anywhere from three and a half bucks to a buck — it's going to be tough to call where the price will be even just a few months from now.

To be sure, we know that Marcellus production and the rest of the shale plays around the country are still adding to total gas production (year over year shale gas for the month of May is up 24%, Bloombergreports.) But for now, high summer demand has made up for any current over-supply issues.

In short, guessing prices at this point is like guessing the weather.

The second takeaway comes as an ancillary thought to this gas discussion. In short, latent demand for OIL can easily keep prices buoyed. The growth in natural gas supply was unprecedented and just look how quickly supply and demand righted the ship. All it took was a few months of $2-$2.50 gas and markets found a place for excess supply.

I'd bet the oil markets would love to see prices drop to $75 a barrel. But low prices won't last long. All said, I'm still confident that we won't see an amazing retreat in oil prices — and if we see prices head below $75/bbl don't expect them to stick.

That's all for now.

Keep an eye on the weather… and Keep your boots muddy,

Matt Insley

Natural Resource Hunter