Despite pronouncements that the era of high commodity prices is coming to an end and concerns that China's economy is finally beginning to show signs of fatigue, there are still a number of commentators that see some legs left to the commodities super cycle.

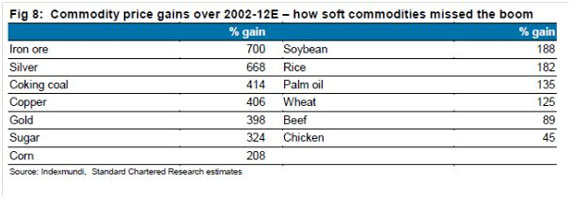

The commodities super cycle, as a concept, began coming to the fore about a decade ago, around the same time that China began to crouch down in preparation for its massive industrial leap forward. And, over the last 10 years we have seen significant growth in the prices of certain commodities. As the table below from Standard Chartered illustrates—bear in mind that these prices are estimates given that we haven't yet come to the end of 2012 but the trend has undoubtedly been up.

From the table it is clear that the commodities that have risen the most in price terms over the last decade are the ones most in need during the Chinese industrialization. But it does not provide the whole picture. It is important to view the so-called super cycle through the lens not only of the commodities used to build railways and roads and cities but also with an eye to the demographic shifts that propel such industrialization.

Not only was there, within China and other parts of the developing world, a move from rural to urban areas, there was also the growth in income and consumption that comes with the burgeoning growth of of a middle class.

As head of commodities research at Natixis Bank, Nic Brown, explained to Mineweb, "There's a second force at work here which is also important which is what happens as people's incomes change—the changing consumer habits of a growing middle class in countries like China."

Speaking on Mineweb.com's Metals Weekly podcast, he explained that when you have an expanding urban middle class with rising incomes, you get very sudden and very substantial changes in spending habits.

"You get big increases in demand for household durables—that's white goods, brown goods, transportation—and this is heavily resource intensive and is taking place still very much in China."

The question now becomes, how will a slowing China affect the overall commodities sector?

Brown, maintains that while the days of 10% growth in the Chinese economy are almost certainly over, it is important to remember that "7.5% growth in absolute terms is more significant now than the 10% plus growth rates we were getting four or five years ago."

And, he adds, while the old model of industrialization and urbanization is not going away, "We think it's moving west and that the lure of cheap energy and in many cases, green energy resources in the western provinces will encourage industrialization and urbanization to take place further inland, and so there will be quite a different feel to the Chinese growth model in years to come, but there's still going to be a substantial demand for additional commodity resources."

He adds that the difficulty right now is trying to figure out whether or not what we are seeing at the moment is simply a low point in the economic cycle or a genuine decline in the intensity of raw materials growth in China.

Standard Chartered has come at the problem from a slightly different angle. In a recent report titled Population Pressure the bank points out that according to its estimates, the world's population is likely to reach 8 billion people by 2020. And, while over the last decade, most of the focus (with good reason) has been placed on China, as we head into the latter parts of this decade so Africa is likely to pick up the baton—as the bank points out, Africa's population is rising five times faster than China's.

The shift in focus from China to Africa is expected to change slightly the nature of the commodities growth that people have come to expect. According to Standard Chartered, "Soft commodities such as palm oil, corn, rice and sugar will likely be the biggest beneficiaries, followed by copper and gold in the hard commodities space."

The reason Standard Chartered likes gold as a way to take advantage of the booming population, it says, is because, "Today, the average person buys 0.5 grams of gold per year. We assume this rate slows as the population increases, but even then, we need to find another four Newmonts as the world's population approaches 8 billion."

Copper is the same, it writes, that while Africa's need for copper for urbanization is unlikely to be as large as China's: "As the global population reaches 8 billion people, the industry would need to build another two new Escondidas."

"The losers," the bank writes, "are iron ore and coal. Africa is abundant in both, and we are concerned that the Australian producers are pushing too hard on capacity expansions, in our view."

Brown agrees that it would be wrong to focus only on China as we go forward.

"Both India and Indonesia are two countries with very similar demographics which are highly conducive to the whole idea of shifting from low productivity agriculture to higher productivity industrial output, and Africa as you highlight, is another area where potentially there's huge growth. Certainly a number of South American countries can grow strongly as well."

So, he says, China is not the only country in town, but adds, "It is important to remember that the country currently makes up more than 40% of global demand for many commodities so it is and will remain very, very important."

Geoff Candy

Mineweb