Remember when people used to use cassette tapes? Remember how boomboxes had two cassette slots that would allow you to record one tape's contents onto another tape? Remember how each tape copy was worse quality than the original, even when your boom box had fancy words strung together like "high speed dubbing"? This week's MLP price action felt like a crappy copy of last week. Similar, but worse.

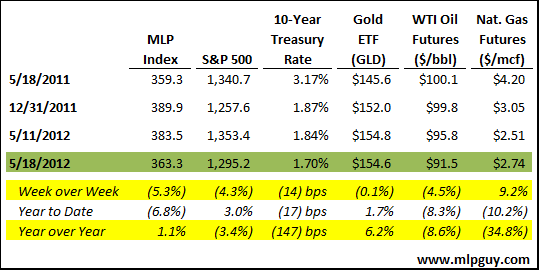

Today was the worst single day drop for the MLP Index since September 22, 2011, and this week was the worst weekly price change since first week of August 2011 when MLP Index was down 6.2%. The chart below shows this week's price action for the Index and the S&P 500. Correlation looks pretty strong, which is a phenomenon I've written about before (like here), how MLPs are uncorrelated with stocks over long time periods, but short term market volatility has had an increasingly correlated effect on MLPs as vehicles for MLP investment (funds) have multiplied. The theory being that funds have simpler tax consequences upon sale, so its easier to jump in and out of MLPs via funds than ever before.

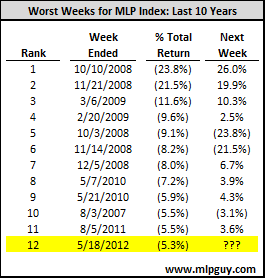

This week's 5.3% drop was the worst week of the year so far for the Alerian MLP Index. It was also the 12th worst week in the last 10 years, in terms of total return. Taking out the extreme volatility of late 2008 and early 2009, this week would have cracked the top 5. And there weren't even any equity offerings or ex-dates this week…so, not great. Good news is that usually the index bounces back the following week, but when it doesn't its usually very ugly. Other silver lining is the index usually bounces back faster and higher than the broader market (as in 2009, and late 2011).

I read somewhere (and am too lazy to find the reference or substantiate what I'm about to write with back up) that investors in the U.S. have been pulling money out of equities and that this year's strength for stocks was the result of fund inflows from foreign investors. That would explain why MLPs have struggled relative to stocks year to date, given that MLPs are pretty difficult for international investors to invest in, unless its through ETFs or other funds. But who cares now, because no one is buying U.S. stocks since May started…

Winners & Losers

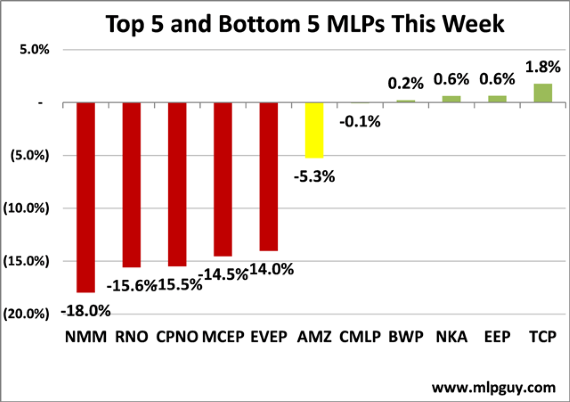

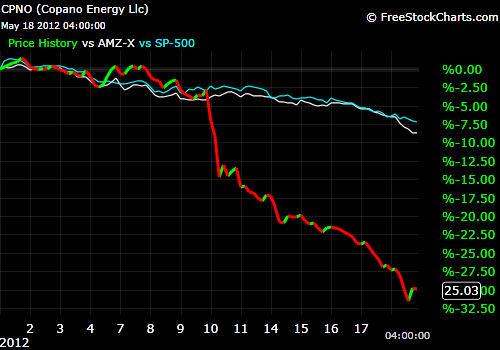

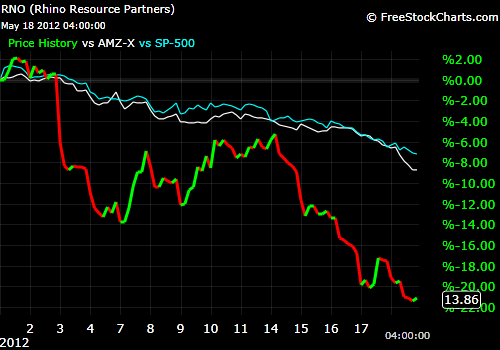

Only 4 MLPs had positive weeks, and CPNO and RNO had their 2nd straight weeks with a double digit percent drop…note the chart below excludes the 5 variable distribution MLPs.

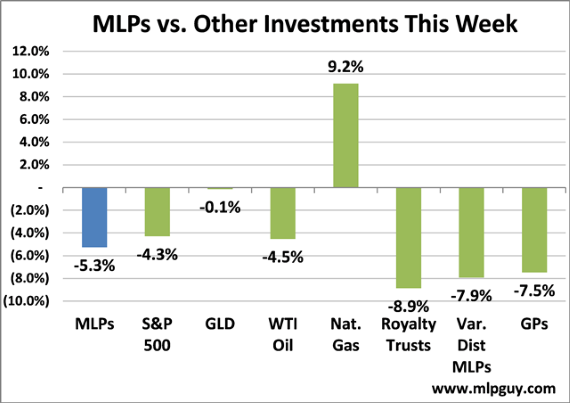

MLP Index dropped 5.3% this week, roughly inline with oil and with the S&P 500. Variable distribution MLPs were crushed, in particular TNH (-14.4%) and recently IPOed PDH (-11.2%). XTXI led the GPs lower with a 14.4% decline, ETE (-9.7%) not much better. Somehow, amid all of this risking off, natural gas had another very sharp uptick in price week over week (+9.2%) on hopes of warmer than average weather this summer.

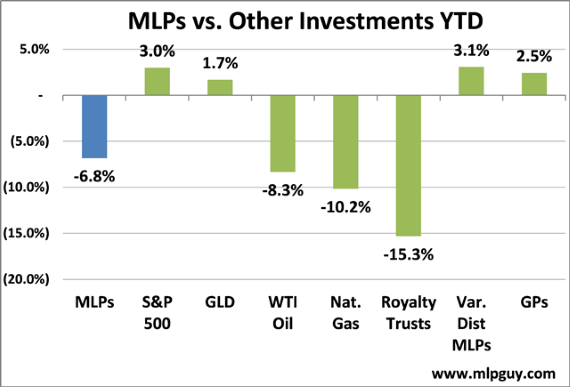

Year to Date

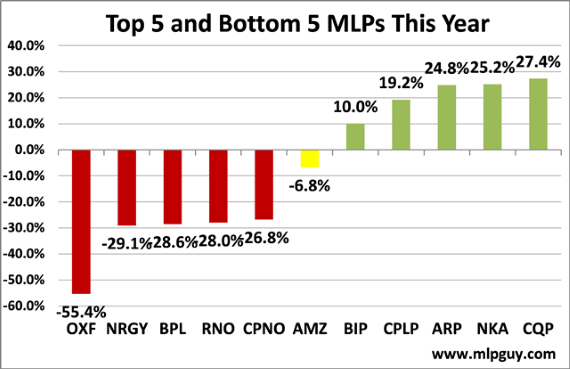

The gap between the year to date winners and losers narrowed a bit this week.

MLPs on a price basis are underperforming year to date, and even with distributions included, the gap is wide.

So, where do we go from here? Seems like we're headed back into high correlation, binary outcome stock market performance for a while with all eyes on Europe again… I may be wrong, but it doesn't seem like the cash being withdrawn in Greece is going to find its way into U.S. stocks or into MLPs for the time being. It's too bad that the global equity markets have become so dependent on central bank stimulus to feed the beast.

Maybe Zuckerberg will take his $1.15 billion in Facebook IPO proceeds and invest it in MLPs (or better yet, hire me to do so)…except that he has to pay $900+ million in taxes as a result of this liquidity event, so not much left over for MLP stimulus…wow.

I won't be wrapping the news this week, too much work to do preparing for a cross country move the day after next week's NAPTP conference. Not much happened in terms of MLP news this week anyway, KMI/EP announced drop down to EPB (equity deal coming), MEMP did a small acquisition, RGP and EEP announced expansions, and KMI is replacing EP in the S&P 500 (and dropped out of the MLP conference). Here is the usual chart I put in that post, and a few other ugly charts highlighting the worst of the worst MLP price action since the beginning of May.

CPNO Since May 1

RNO Since May 1

Hinds Howard

MLP HINDSight