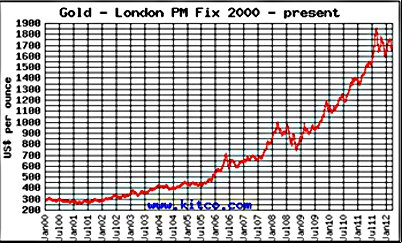

Gold and commodities have gone up, substantially—prices reacted to the increase in the monetary base and the corresponding increase in the velocity of money caused by financial innovations such as mortgage-backed securities (MBS), collateralized debt obligations (CDO), derivatives and credit default swaps etc.

But the call for massive inflation hasn't yet happened, yes there's been more than a modest rise in the real price of goods (much more then the government-measured consumer price index), but treasury yields and home prices are at record lows, jobs have languished and credit has stalled. These are not the conditions one would expect to see in a highly inflationary environment.

This brings up two questions:

- We've not had the much higher inflation called for—why not?

- Are there further gains to be made in the prices of gold and silver (and commodities in general)?

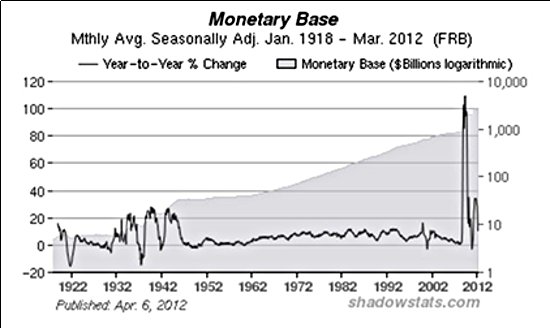

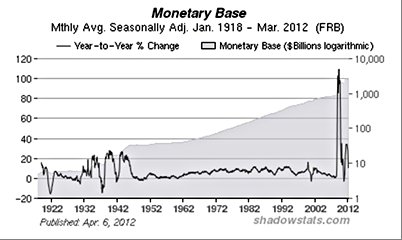

Between Aug. 11, 2008 and the end of 2011, the monetary base, which only the Fed can produce, almost tripled with a Bernanke Fed injection of $1.7 trillion (T).

Most of the money issued by the Bernanke Fed is parked in banks as excess reserves that the banks are not required to hold.

On Oct. 6, 2008 the Fed announced it would begin paying interest on the reserve balances of the nation's banks. The Fed's records show they were paid $2.18 billion interest on these reserves just in 2009.

These interest payments are an incentive to hold the cash. At the end of 2011 U.S. banks were holding 88% of the monetary base ($1.5T of the $1.7T increase) issued by the Fed since August 2008 as excess reserves they are not required to hold.

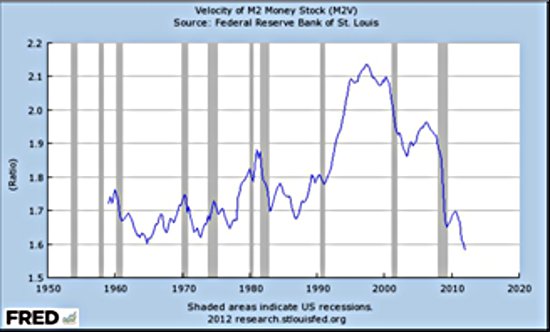

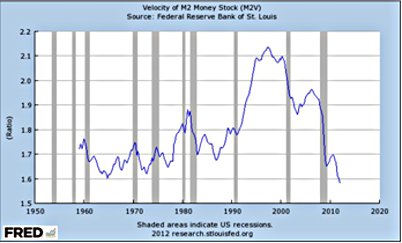

As long as this money stays parked at the Fed it has no velocity, it's not loaned out, it's not changing hands, it's not being spent, its velocity is zero.

When we talk about the velocity of money, we are speaking of the average frequency a dollar is spent. If nobody is spending money the velocity is zero.

Velocity, as shown by the above chart, is currently at a record low.

Most of the dollars created in the stimulus programs (i.e., QEs 1 & 2), after the bubbles burst, have never made it into circulation to be spent by small businesses (the largest job creators) or consumers (the driver of the U.S. and world economies).They are either parked at the Fed or the world's central banks as foreign reserves (many countries hold U.S. dollars in their foreign reserve accounts, China has trillions of U.S. dollars, most of these dollars will never make it into circulation).

Let's take a look at four charts: the U.S. monetary base, gold's price, money velocity and the U.S. dollar index. You can see that gold has not, and is not, responding to the dollar's strength or weakness as much as it responds to the increase in the U.S. monetary base and money’s velocity.

Now we know why precious metals, and commodity prices were so strong—the monetary base was expanding and there was an orgy of money spending fueling expectations of inflation. Currently the monetary base is not expanding, money is not circulating and this is fueling deflationary fears. Add in the multiple fears of a China slowdown, the EU imploding and the U.S. slipping back into recession and we can see why prices are falling.

The questions we need to find answers for are:

- Are the Fed, and the world's central banks, done with increasing the global monetary base?

- Have they given up in their attempts to revive credit and fuel another economic "spend your way to riches" prosperity bubble?

- Is austerity here to stay?

Consider:

Governing parties are suffering major losses in election after election as anti-austerity parties make gains.

Unless continuously fed with new credit the global financial system will implode, when confronted with this possibility governments always respond in the same way—by printing more money. The world's governments have unlimited printing presses. France has elected a socialist leader who will demand an end to austerity.

The European Central Bank has accepted that growth should take precedence over balanced budgets.

German Chancellor Angela Merkel's CDU party won only 31% of the vote in Scheleswig-Holstein, the party's worst showing in 50 years. Merkel's hard line austerity programs, so unpopular in the rest of Europe, are increasingly being viewed with skepticism at home in Germany.

Greek voters just delivered a resounding anti-austerity election verdict—more than 50% of them cast votes for parties opposing public spending cuts. If there's another election in Greece this summer there is a high probability of Greece defaulting and exiting the Eurozone.

Fed chairman Bernanke has made it clear he'll step in with more easing if necessary.

Conclusion

The resource boom isn't over; someone hit the pause button on the printing presses to take stock, do a review of the attempted fix methods and success achieved to date.

Single-minded money printing has to be the next stage. Politicians, governments and central banks will abandon the restraints they have been operating under and do whatever they think it will take to pacify voters, save their reelection chances, "right" their economies and salvage the fiat monetary system. Tax cuts, more and bigger deficits, continued low interest rates into the foreseeable future and aggressive asset purchase programs, steroidal quantitative easing, are all going to achieve previously unimaginable levels.

The monetary base will explode, and if the money velocity chart reverses—if small businesses and consumers actually get their hands on some of this money—precious metals and commodities prices will soar.

The greatest leverage to soaring precious metal and commodity prices has historically been junior resource companies. It is this author's opinion that we are presently being given the greatest buying opportunity of our lifetimes.

The whole world is the stage and the drama is set to continue. The greatest show on earth, a couple of charts (monetary base/money velocity), and a handful of carefully selected junior resource companies, should be on all our radar screens.

Is the drama, two charts and a couple of juniors on your radar screen?

If not, maybe they should be.

Rick Mills

www.aheadoftheherd.com

[email protected]

***

Legal Notice / Disclaimer

This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified; Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of Richard Mills only and are subject to change without notice. Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, I, Richard Mills, assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this Report.