In the 15 decades since Col. Drake drilled his first well at Titusville, in 1859, it's never been easy to pull oil out of the ground. It's still a tough job, and looking forward, it'll only get harder.

The good news is that the world economy has a robust, innovative oil service sector. This sector is filled with companies and people who do the hard work of building oil and gas wells, so that operators can pull out the hydrocarbons.

Let me illustrate this point.

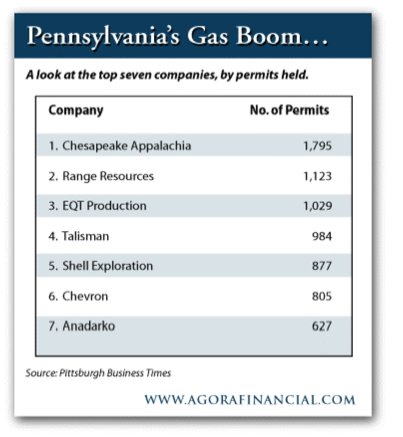

Recently, the Pittsburgh Business Times listed the top seven companies with permits to drill in the gas-rich (and in some sweet spots, oil-rich, as well) Marcellus Formation of Pennsylvania. Here are the raw numbers.

As you can see, a couple of familiar names are strong players in the Marcellus. And the list doesn't cover the Utica Shale play that underlies the Marcellus Formation and extends over an even larger area.

When you add up the rankings—only the top seven Marcellus players—there are 7,240 well permits on the books in Pennsylvania. We're not even looking at operations in Ohio, West Virginia, New York or anywhere else. In other words, there are dozens more firms operating in Marcellus country with fewer leases and more-modest ambitions.

Overall, there are over 10,000 drilling permits outstanding in Pennsylvania for Marcellus wells. And that number is still growing.

Consider that only a few years ago, there were ZERO permits in Pennsylvania, because the Marcellus wasn't on anyone's radar screen as a gas or oil play. Yet now the scope of Marcellus drilling is vast.

The Marcellus play illustrates how quickly the energy industry is changing. New kinds of geological thinking, along with impressive new technology, are attracting huge investments. So let's take just one aspect of Marcellus development—the 7,240 Pennsylvania well permits—and discuss what it means to resource investors.

Drilling Math—Over $36 Billion

Let's say that the average Marcellus well costs $5 million to drill and complete. If that number gives you any sticker shock, it shouldn't. When you account for all of the moving parts that go into well construction, completion and production things can add up quick. Without getting into too much detail, let's just look at this raw, overall cost. (To be clear, some wells cost more than $5 million. Some wells cost less. The $5 million is a rough, average.)

So take $5 million for each well—the permits, roads, fuel, drilling rig, equipment, drill pipe, fracking, completion services, wellhead equipment, environmental controls, management and overhead and whatever else is left.

Do the math. Multiply $5 million times 7,240 wells. That's $36.2 billion. That's a big number. Actually, it's a REALLY BIG number!

Again, we're talking about only Pennsylvania, not adjacent states. This is just permits for Marcellus wells, and not the underlying Utica Formation. The number is for the top seven Marcellus players, not the dozens of other operators with similar Marcellus ambitions. And still, the basic math comes out at $36.2 billion.

These days the money is headed to the oil service sector.

You see, in a world with rising oil prices (regardless of the day to day price fluctuations) the companies that have the technical know-how to get the oil out of the ground will do very well.

Indeed, that's what oil service companies do. These are the guys who are pioneering new drilling techniques (horizontal drilling), seismic imaging, well completion services (hydraulic fracturing), onsite technical consulting and anything else that will enhance oil recovery rates and lower costs.

With the "easy" or cheap oil dwindling the rest of the world's deposits are harder and more expensive to get to. A quality oil service company will help major oil companies (national or independent) get their oil out of the ground and into the market.

The world's oil supply is in a race between natural depletion and a constant drive by oil companies to drill new wells. And we are not referring to just the major international oil companies (IOCs) like Exxon Mobil, BP and Shell. In the U.S. there are plenty of small drillers that need the wellhead services that these companies provide.

With some quick back of the envelope math, it's clear these companies are poised to be making money for years to come.

That's all for now. Stay tuned for more detail on this opportunity soon.

Thanks for reading.

Byron King