I have had several questions lately regarding incentive distribution rights, so here is some data on IDRs free of charge, just remember you get what you pay for…

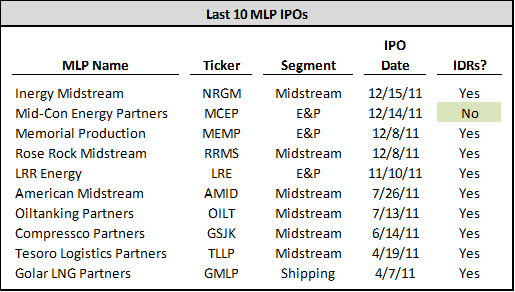

An article will come out soon in Midstream Business Magazine on the subject of IDRs that will feature several quotes from me and some data I pulled together for the article. The original assignment from the editor was something like, I hear a lot about how IDRs are going away, go write an article on the Death of the IDR. But I think I was able to convince the author that IDRs are not dead, in fact of the last 10 MLP IPOs, 9 of them had IDRs, including 100% of the last 10 midstream IPOs. The chart below lists the last 10 MLP IPOs. Note I am not counting MLPs without a stated minimum quarterly distribution (variable distribution MLPs like RNF and UAN).

There are two reasons I can see why IDRs are still prominent for midstream MLPs:

- Doesn’t matter at the IPO – bankers will tell MLP management team (correctly) that the market will not give any extra IPO valuation credit for going public with no IDRs. A few years down the road, when the MLP reaches the top tier, then management can start to hint that the IDRs are affecting their cost of capital.

- At that point, management can extract all of the extra credit that was not going to be given at IPO for those IDRs (and more) when it buys the IDRs back with L.P. equity. Short sighted investors have yet to demand that IDRs go away, so why take them away at IPO.

- Reminds me of the saying, attributed to Thomas Jefferson: the exact amount of tyranny you will live under is the amount you put up with

- Competitive Bids Mostly Against other MLPs – a greater percentage of E&P MLPs have chosen to IPO with no IDRs or with an LLC structure. The thesis behind E&P MLPs is that they will be the entities that roll up the mature properties of the country. When they are bidding on these assets, E&P MLPs are going up against corporations, and cost of capital is paramount to E&P MLPs being able to outbid E&P corporate bidders.

- Midstream MLPs are mostly competing with each other, because there are so many more MLPs. There are not many public corporations whose primary business is gathering and processing.

Click below for an excel file with a list of every MLP and its corresponding top IDR tier, current GP % take (not counting any temporary givebacks like $ETE announced yesterday), and some notes on the MLPs that don’t have IDRs. You will note that the MLPs with paying out the most total cash flow to their GP, are in order: KMP (45%), ARLP (40%), ETP (37%), PAA (32%), WPZ (28%).

Hinds Howard

MLP HINDSight