I am not surprised to see that the Federal Reserve on Wednesday stood pat on interest rates and said economic growth will remain moderate over coming quarters and then only pick up gradually. The decision to make no changes was expected. Economists think the Fed will wait for more data before deciding how to proceed next. Recent data, such as the monthly jobs report from the Labor Department, point to a slowing pace of economic growth. In a statement, the Fed announced that it will leave its target range for its federal funds rate unchanged at 0–0.25%, as it has for every meeting since December 2008. The central bank also did not change the forecast that "exceptionally low rates" will be here until late 2014. Richmond Fed President Jeffrey Lacker cast the lone dissent, continuing a trend at all three meetings this year. Lacker, one of the more hawkish regional Fed presidents, has argued against the 2014 rate forecast.

In its statement, the Fed said that it "expects economic growth to remain moderate over coming quarters and then to pick up gradually." Fed officials said they expect the increase in oil and gasoline prices "earlier this year" is expected to affect inflation only temporarily. The Fed made some subtle changes to its view on the economic outlook. The Fed statement said that labor market conditions "have improved in recent months." In March, the central bank said only that the job market conditions "have improved further." The Fed repeated that the jobless rate remains elevated. The Fed also repeated that the housing sector remains depressed, but added that there were "some signs of improvement."

At the meeting, the Fed made no changes to its Operation Twist plan designed to put pressure on long-term rates by selling $400 billion of short-term debt and buying longer-term securities to lengthen the average maturity of securities on its balance sheet. This program is set to expire at the end of June. The Fed will also continue to reinvest principal payments from agency debt and mortgage-backed securities back into the MBS market. The Fed will also keep rolling over maturing treasury securities at auction. As a result of the minutes of the last Fed meeting on March 13, Fed experts have scaled back their expectations of another round or asset purchases, or quantitative easing. In the summary of the March 13 meeting, Fed officials indicated that they would be willing to buy more assets only if the economic outlook weakens.

Meanwhile, back in the good old US of A, we saw that the number of Americans who filed requests for jobless benefits was virtually unchanged last week at 388,000 (388K), the U.S. Labor Department said Thursday, keeping claims near their highest level of 2012. Claims from two weeks ago were revised up to 389K from 386K. Economists surveyed by MarketWatch had projected claims would drop to a seasonally adjusted 375K in the week ended April 21. Meanwhile the average of new claims over the past four weeks climbed by 6,250 to 381,750, matching the highest level of the year. Continuing claims increased by 3K to a seasonally adjusted 3.32 million (M) in the week ended April 14, the Labor Department said. Continuing claims are reported with a one-week lag. About 6.68M people received some kind of state or federal benefit in the week ended April 7, down 87,160 from the prior week.

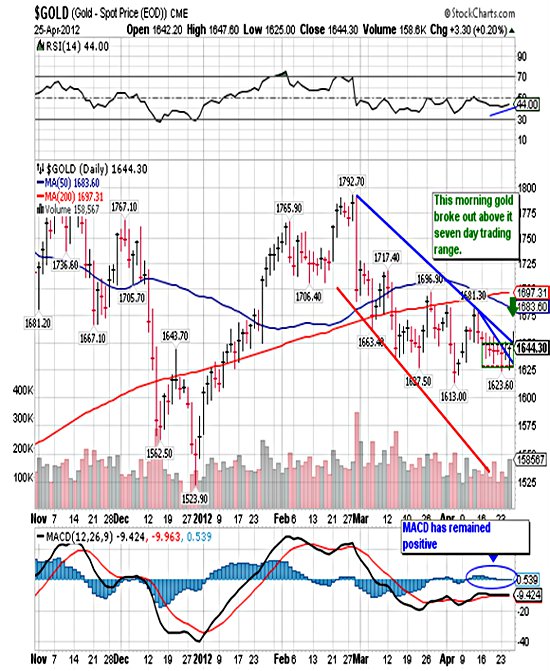

Of course, yesterday was all about the Fed—at least if you believe everything you hear on TV. Many had high hopes for some indication as to when we might see QE3. As soon as the Fed decision was announced the spot gold price fell down to $1,625/ounce (oz), just above strong support at $1,622/oz and still above Monday’s intraday low of $1,623.60/oz, as you can see below:

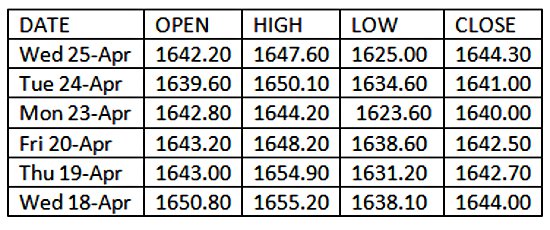

For the last six sessions we've seen gold trade in a range (green box) that runs from $1,623.60/oz to $1,655/oz and the daily closes have gone nowhere as you can see here:

Gold went nowhere over the last week as bears sold $1,650/oz in an effort to push gold down below strong support at $1,622/oz, and bulls bought below $1,630/oz because it looked cheap to them.

Yesterday's Fed decision was the last chance to break gold down but once the initial knee-jerk reaction took place it began to recover and eventually closed up $3.30 at $1,644.30/oz. This morning gold is up another $10.00 at $1,654.30/oz, a breakout to the upside, and has traded as high as $1,656.30/oz as the weak shorts were forced to cover. More than likely the next line of defense will be at $1,671/oz and good support will be down at $1,640/oz as gold works its way higher in spite of the price suppression.

Anti-gold, better known as the U.S. dollar, is, of course. behaving inversely to the yellow metal. It too has been trading sideways in a tight range (green box) but still managed to complete the right shoulder in a head-and-shoulders formation as seen below:

Yesterday it closed at 79.15, just above the neckline, and this morning traded well below the neckline, as low as 78.84. Once the U.S. dollar can close below the neckline, it will begin its descent down to a test of critical support at 78.25. Such a test may not be all that far away.

Guiseppi Borelli, The Unpunctured Cycle

[email protected]

Disclaimer: All the reports and content in the entire Unpunctured Cycle web site (including this report) are for educational purposes only and do not constitute trading advice nor an invitation to buy or sell securities. The views are the personal views of the author. What’s more the author may already hold a position or positions discussed in this article. Before acting on any of the ideas expressed, the reader should seek professional advice to determine the suitability in view of his or her personal circumstances. All material in this article is the property of Unpunctured Cycle.