Why all this attention? Financial markets are presently at a critical crossroads. The economic recovery is far from stable. Europe is not out of the woods yet. More fiscal stimulus is not a political option, yet everyone is hoping that Bernanke will come to the rescue. Studies of previous recessions suggest that a recovery from the recent severe and broad-based downturn we experienced will be slow and gradual, but the last few years will go down in history as a period where government officials tried to control the market at all costs. Bernanke and his group of bankers are attempting to allocate capital through their actions rather than allowing the market to dictate these types of decisions.

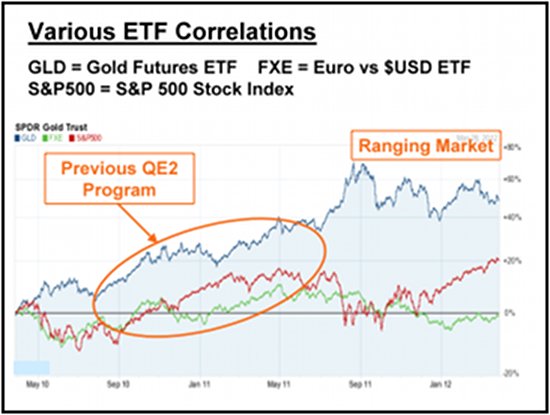

Whether these attempts are worthwhile is a subject for debate, but the reality is that analysts and investors alike would love to hear "QE3" spoken more frequently of late. Many had thought this possibility was erased from the drawing board a few months back, but an overbought condition in nearly every financial market may turn sour without some help from Bernanke and his friends. The chart below helps to shed light on the issue:

The Fed's previous quantitative easing program was definitely a "hit" by any measurement criteria. A lackluster ranging market was suddenly transformed. Stocks, gold, and the euro ramped up in tandem, while the dollar weakened. Expanding the money supply by $600 billion has a way of reducing purchasing power on the global front, but it does increase demand for America's exports, the stimulation desired to reduce ongoing trade deficits. The issue on a global scene, however, is that the action equates to an import "tax" of sorts, leading to the potential for real currency wars.

Gold, precious metals, and other commodities soared in value, many analysts noting that their slope of appreciation was unsustainable. The anticipated correction came as soon as Europe began to address its debt crisis. Trending markets reverted to ranging once more, waiting for some source of fundamental data to guide their next move. Stocks may have overreacted to Europe's malaise, but they, too, recovered and surpassed previous levels, but currently are stalled while consolidation takes place.

What are the current prospects for QE3? Gold, stocks, and the euro would surely benefit from any hint that more easing in the U.S. was definitely on the table. Recent GDP and jobless claim announcements have done little to move market sentiment. The Fed is more concerned with looking forward, not in the "rearview mirror," so to speak. Bernanke and his fellow bankers are far more concerned with the shape of things to come and the picture that current data is "painting."

Analysts have divined that the Fed's biggest concern is whether the warm winter months have actually pulled growth ahead of what may be sustainable for 2012. A scenario along these lines would result in an unwanted slowdown if renewed economic activity did not pick up the slack.

March has put a soft damper on previous favorable data. The housing market is still in the doldrums. Markets may have already factored in some form of QE3, forming a "bubble" that may surely burst without more QE3 "helium." Will Bernanke and his boys "blink"? Only time will tell. Stay tuned.

By Tom Cleveland of ForexCharts.net