There aren’t many things that are certain in life, but there is one thing can be written in stone. Fear and greed run the markets! It’s been that way since tulips were all the rage. The problem with the markets is that you have to buy when everybody is fearful and sell when everybody is greedy, and that goes against human nature. With respect to gold this human defect is magnified to a much larger degree, and is complicated by the fact that gold is perhaps the only market where greed and fear can work together. For years I have tried to convince readers to buy dips and sit through the declines, but to little avail. Gold is the only market I do that with and for good reason.

The gold market is the most manipulated market in the world and investors are finally beginning to see that. What happened on Feb. 29 is just one example, but perhaps the most blatant illustration that I’ve ever seen. Unfortunately I’ve put a label to it but I haven’t solved anything. I’ve been aware of the manipulation for years—since 2003 to be exact—and that’s when I started to by gold. Manipulation bothers me (like mosquitos), but I’m not afraid of it (like wasps!). Why? Manipulation can change the tertiary trend, modify or perhaps change the secondary trend, but has little or no affect on the primary trend and that’s the key. To beat the manipulators I needed to have time on my side and that means I must focus on the primary trend and use a buy and hold strategy.

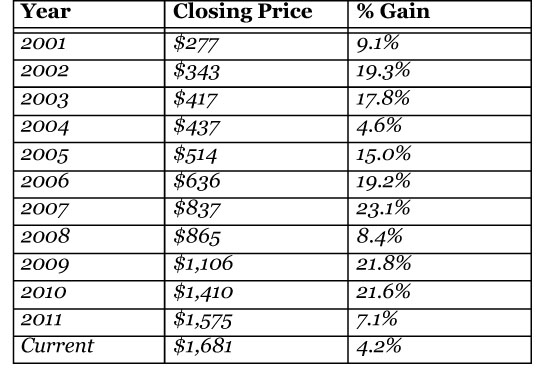

How has this strategy worked? Gold has been climbing a wall of worry and doubt since the 2001 retest of the 1999 bottom. In the process it has carved out a profit each and every year since 2001:

Seven of the eleven years posted gains in double digits and that is much better than the dow. In fact it’s much better than anything I could compare it too! Unfortunately there is a human problem, whereby we are not conditioned to see the big picture (long term) and we all want instant gratification. My experience tells me that is a very hard nut to crack. I continue to receive e-mails from clients who jump in toward the top of tertiary moves and exit toward the bottom of secondary/tertiary reactions. One of life’s mysteries!

Every since the Feb. 29 massacre I have received numerous e-mails from clients declaring, “I’ve had enough.” In fact that’s been a theme since 2003 and if I had a dollar for each and every one I received, I would be more than a few ounces of gold to the good! Still, it solves nothing. Out of the hundreds of clients I have, I estimate that no more than 10 subscribe to and implement the buy-and-hold theory. The rest try to catch the latest wave and fail miserably. As recently as Sunday I told investors that I see the following possibilities over the short run:

- There is a 50% chance that gold bottomed on Wednesday and the reaction was a one-day wonder,

- There is a 40% chance that gold will test good Fibonacci support at $1,676.50/ounce (oz) early this week and then turn up, and

- There is a 10% chance that gold could run down as low as $1,659.30/oz before bottoming, consolidating and then turning back up.

I also said that regardless of how it plays out, it is not an earth shattering event and it does not warrant throwing away your positions in disgust. Yes, the reaction was made worse by manipulation, but we’ve known for years that the market was being manipulated and we made the conscious decision to accept that risk when we purchased gold.

As it turns out gold did close at $1,675.70/oz yesterday, marginally below the $1,676.50 support, and came close to testing the $1,659.30 support as you can see here:

This morning the spot gold is unchanged and trading in a tight 14.00 range as many investors wait for the next shoe to fall.

In the gold market one of the biggest problems we face is noise. By noise I mean useless commentary by ignorant people, or worse yet by people trying to purposely mislead. A simple chart would be a much better way to go:

Here I have drawn in two downward-sloping trend lines, both connecting what were at that time all-time highs with lower highs, followed later by breakouts to the upside. With respect to the higher of the two lines, I have labeled the breakout and you’ll see that this line now comes in around $1,622.00. In 11 years no breakout has every failed to produce a new all-time high, so that’s your risk!

In money terms, the risk is $50 from the current price, while the reward is a close above $1,923.70/oz! If I am buying an April gold futures contract, it’s $5,000 of downside risk, assuming I bought today, versus the probability of making $31,000 if history repeats itself. That’s the type of odds I like and look for when I want to buy. Aside from that note that yesterday’s close was marginally above the 200-day moving average (DMA) and historically this is where investors buy. All the manipulation over the last 11 years hasn’t stopped investors from buying here, so you need to ask yourself why it should be different this time around. Of course the answer is that it isn’t!

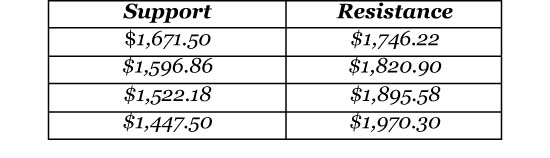

With respect to Fibonacci support there are a series of price extensions that run from the 1981 all-time high of $850.00/oz and are really important. Here are a few of them:

If you take the time to look carefully at the spot chart for gold, you’ll see that these are the Holy Grail of Fibonacci numbers and they invariably play an important role. For example, the $1,895.58 resistance stopped the last big move (the all-time closing high was $1,900.10) while the $1,522.18 stopped the last big sell-off. These are no accidents!

I remain convinced that the $1,523.90/oz bottom experienced on Dec. 29 was in fact the bottom, and the current reaction is nothing but a second degree (seven to nine days) countertrend move that will retrace no more than 7.5%, and then we’ll move on. Manipulation is part of the game—it is annoying, but it is never terminal. If you’re intelligent and buy where history tells you to buy, you may be slightly off but you’ll always end up on top, and that’s what you want. History says that this is the time to buy! Your risk is minimal and the gains would be significant. Is there a risk that gold has in fact topped? Only if you believe that the world’s central banks, the Fed included, have stopped printing and will live within their means. I know of no one who thinks that will happen.

Bloomberg says that you should buy the paper assets (the dollar and bond) of the world’s largest debtor, the United States. Gold should be avoided because it is too risky. Enough said! My best advise to anyone and everyone is to buy gold, physical where possible, and EFTs and futures when not. This is where everyone sold so this is the place to buy. The current 7.5% correction is now out of the way and that leaves no more than 3% corrections along the way to a new all-time high.

This is where fear has set in and it’s where you need to be greedy. Easy to say and hard to do! I remain convinced that we are on the cusp of the single biggest investment opportunity of our lives. Unfortunately, if you want life’s rewards you need to pay the price, a very unpopular message given the press and politics of today’s immediate gratification world. That’s why we elect the Obamas and Romneys of the world; they tell us what we want to hear. Gold is the reality of the situation and my best advice is to plant both feet firmly on the ground and buy!

Giuseppe L. Borrelli, www.unpuncturedcycle.com

[email protected]

Disclaimer: All the reports and content in the entire Unpunctured Cycle web site (including this report) are for educational purposes only and do not constitute trading advice nor an invitation to buy or sell securities. The views are the personal views of the author. What’s more the author may already hold a position or positions discussed in this article. Before acting on any of the ideas expressed, the reader should seek professional advice to determine the suitability in view of his or her personal circumstances. All material in this article is the property of Unpunctured Cycle.