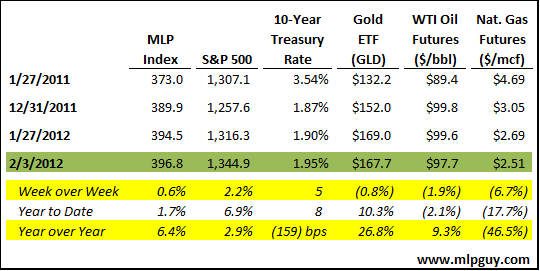

Despite all this good news, interest rates remain very low, the 10 year treasuries remains under 2.0%, a paradox of sorts in the face of such large positive swings for stocks since September 30. Oil and gas prices were both down as well, even as the U.S. Dollar lost ground to the Euro this week. So, it seems like all cash flowed into stocks today and away from almost everything else.

As I discussed in my Winners and Losers post earlier this week, there is now and has been for at least the last 18 months, dichotomy between haves and have nots in the MLP sector continues to grow. This week, that was epitomized by the strength in earnings from Enterprise Products ($EPD) and Markwest ($MWE) compared with weakness from earnings of Inergy ($NRGY), Niska Gas Storage ($NKA) and Suburban Propane ($SPH). EPD is so well positioned in the active shale plays that it is able to pick and choose high return crude and NGL projects, as highlighted by its blowout quarterly earnings. Markwest announced expansions to its processing facilities in the Marcellus and Utica. Whereas NRGY, SPH and NKA are struggling just to keep their heads above water.

Also, there were 2 equity offerings this week, $150M primary issuance from Breitburn and an untimely Chesapeake Midstream secondary sale of units owned by Global Infrastructure Partners. CHKM had traded poorly for the last week prior to the deal following the announcement from CHK that it would curtail drilling in areas where CHKM has assets: Barnett and Haynesville shales.

In SEC filing news, there was a new initial S-1 for an MLP filed this week: Foresight Energy Partners. Foresight is a coal operator backed by Carlyle. There have been no other S-1 filings or updates to S-1's this year to date. Also, KMP updated its shelf registration to add an additional $600M, for a total of $1.2B.

Expect MLPs to outperform this week, as some of the stock market euphoria fades and MLPs catch up with ex-dates now finished. Also, expect to read a piece from me about how certain MLPs typically do after ex-dates.

Hinds Howard, MLP HINDSight