With Elliott Wave Analysis, you have to anticipate, monitor and then adjust. Most of the time I go with my instinct and then only adjust if it looks like I was way off the tracks. The only time I tend to get way off the tracks is when I read too many opinions, so I’ve shut myself off from reading others' opinions and below is my gut right now.

I know I have labeled one option as the S&P 500’s 1,074 lows being primary wave 2, with primary wave 3 underway since (1,074 to current). However, I have to admit my instincts still tell me that the 1,074 lows may have been primary wave 4, and we are in primary wave 5 up now.

Whether it was 2 or 4 is not super important in the short term because we would either be in a primary 3 up or primary 5 up now, which is bullish either way. However. . .if it’s a primary 5 up, then it changes the longer-term pictures—and also, 5th waves can be difficult to assess.

There is another rule that says wave 3 can’t be the shortest of waves 1, 3 and 5 (all up waves). Therefore, if we are in primary 5 up now, from the 1,074 lows, then we can’t rally more than 360 points from the 1,074 lows (wave 3 was 360 points).

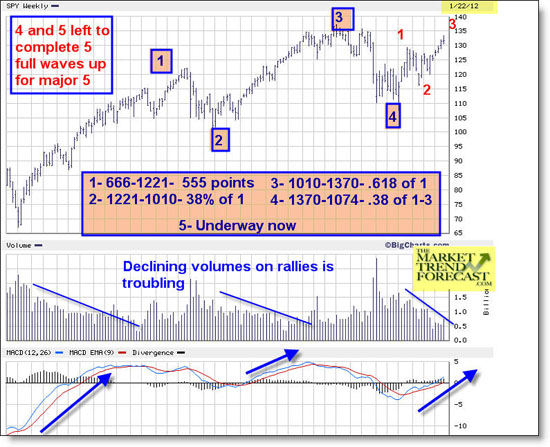

So, here is the possible count if this is primary 5 from the March 2009 lows, with normal Fibonacci relationships:

666 to 1,221–1

1,221-1,010–2 (38% of 1)

1,010-1,370–3 (61.8% of 1)

1,370-1,074–4 (38% of 1-3)

1,074-???–5 (normally 50-61% of 1-3)

So, if wave 5 can’t be longer than wave 3, and let’s say wave 5 is 50% of waves 1-3. . .that would put a top target at about 1,426 on the S&P 500 index. That would make wave 5 just shorter than wave 3, following the rules, and would complete 5 full waves.

So that is what I’m grappling with, because if this is a primary wave 5 up from the Oct 2011 lows of primary 4. . .then we would need to be on our toes for a bull market pivot top. If it's primary wave 3 up, then we have much farther to stretch.

Right now, the evidence is leaning to this being primary 5 up. . .below is my chart and I will keep you updated. The volume, MACD and other indicators will help point the way.

Note how the volume has been declining on every primary wave rally 1, 3 and 5 so far. Note how the MACD line uptrends on each primary wave rally as it is now. . .

Stay tuned.

David Banister, The Market Trend Forecast