At the Cambridge House’s Vancouver Resource Investment Conference this week, I am part of a special debate on whether China will boom or bust with bestselling author Gordon G. Chang. The title of Chang's book, The Coming Collapse of China, states his position quite clearly and I look forward to the intellectual challenge of convincing him otherwise.

I've found many people are particularly energized about predicting a hard landing for China's economy, but I believe the country is no sinking ship. China isn't fast-approaching an iceberg in the dark of the night like the Titanic. Beijing has long been anticipating the ice chunks and subtly adjusting the rudder around inflation without steering the economic ship too far off course.

China's government angled its vessel away from inflation by increasing the required reserve ratio (RRR) every month for the first six months of 2011 and raising interest rates three times. Once inflation was sufficiently under control, the country began to steer in a direction of growth again.

Recent results show how positive this easing has been. In its latest research this week, BCA Research reported that despite the policy tightening of 2011, the "most recent economic data out of China has all but confirmed that the economy remained incredibly resilient."

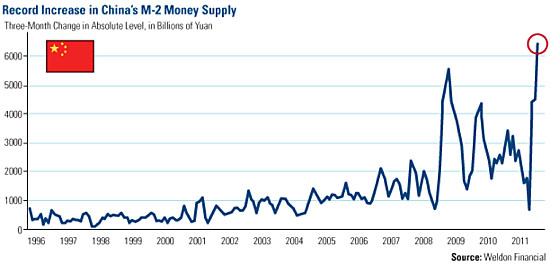

After the country hit a low level of monthly money supply growth, the three-month change in M-2 money supply climbed to record levels during the final month of the year, says Greg Weldon of Weldon Financial. He says that money supply "pegged at +6.419 trillion (T)," easily exceeding the previous record three-month increase, seen at the peak of the global crisis in March 2009.

Easing in China is expected to continue through 2012, with ISI Group anticipating a potential RRR cut after Chinese New Year celebrations in February, then possibly again in April, June and August. Also, loans "have become more readily available in recent weeks," says ISI. This should all be bullish for commodities, such as copper, oil and gold, and also trickle down to boost share prices of natural resources equities.

Chinese Copper Inventories Increase

Base metals were the laggards among commodities last year, with copper one of the worst performers, losing 21%. (Download our Periodic Table of Commodities now.)

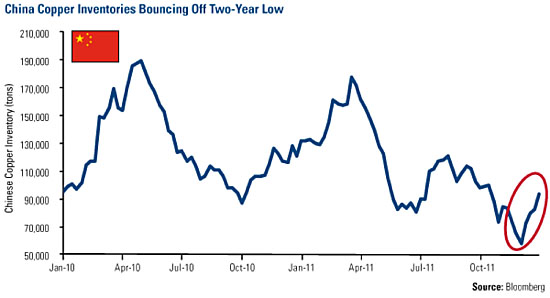

Global consumption of copper increased only 4% in 2011, which is lower than the 10% growth in 2010, but higher than the decade-average of around 3%, says Macquarie Research. China's consumption of copper—which makes up 40% of the global demand—was a primary reason for decreased consumption, as the country was drawing down on its own supply throughout the year.

This can’t continue forever, Macquarie says, adding that "demand made on new supply direct from producers would need to rise, with positive implications for prices." Europe's largest copper fabricator agrees with that sentiment, indicating that it anticipated China's copper demand would be strong in 2012, according to Barclays.

A recent rise in copper imports is likely the result of restocking China's depleted copper inventories. As is typical for China, after the metal fell in price last fall, the world’s largest buyer of the metal advantageously scooped up copper to replenish its cupboard, says Barclays Capital. As shown below, copper inventories into China reached a record low in 2011, but have sharply reversed recently.

An increase in copper demand places pressure on the supply side, which continues to experience shortfalls in mine output versus forecasts. These are caused by a variety of factors, such as weather, labor strikes, or simply a poor grade deposit. While Macquarie says there's a possibility the world's two largest copper mines, the Los Bronces mine in Indonesia and Peru’s Escondida mine, could deliver year-over-year increases in production, it concludes "it is highly unlikely that miners will succeed in delivering this level of additional output in total."

While Chinese demand growth for commodities is not expected to be as robust as it has been historically, demand is expected to pick up throughout 2012. As confidence returns, Macquarie says there should be "a slow gradient of recovery in the near term before gathering pace into the mid-year."

Increasing Reliance on Energy Imports

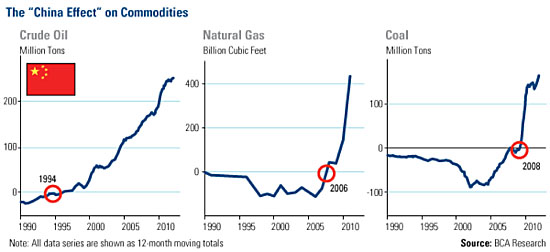

China's rapid growth and increasing reliance on other countries for key resources has made a powerful case for commodities over the past several years. These three charts from BCA Research illustrate that once the country shifted from exporting to importing a commodity, there was no looking back.

You can see in all three how dramatically the energy balance has shifted to an ever-increasing dependence on imports. In each major commodity, after China began importing, growth took off.

China became a net importer of crude oil in 1994, and today is the second largest oil importer in the world. BCA forecasts the country is expected to surpass the U.S. as the largest oil importer in only a few years.

To obtain more natural gas, China spent years building massive pipelines to transport the commodity from Russia and other western Asian counties, and since 2006, natural gas imports have "gone vertical," says BCA.

Coal, which accounts for the majority of total energy consumption in China has also been imported since 2008, and since that time, imports rose substantially.

Even with these imports, energy consumption is only a fraction of developed countries. The China story is just getting started: Urbanization just surpassed the 50% mark, hitting what I believe to be the pivotal moment that dramatically shifts buying patterns, driving an enormous demand for housing, consumer staples and durable goods. You ain't seen nothing yet!

Happy Chinese New Year!

This weekend, the world's largest annual migration takes place. Millions of people in China head home to celebrate Chinese New Year and welcome in the Year of the Dragon. U.S. Global Investors' research analyst and Shanghai native Xian Liang recently talked about the significance of the dragon in Chinese culture:

"Unlike its western counterpart portrayed as evil, the Chinese dragon is an imaginary, mythical creature. Its body parts are from nine animals, including the horns of a deer, mouth of an ox, nose of a dog, trunk of a snake and claws of an eagle. It has auspicious power because it can make itself invisible or visible at any time. It can both fly and swim. It makes clouds and rain. Because of these magnificent things, the dragon is associated with royal powers as well."

After bounding through a tough Year of the Rabbit, we anticipate the Year of the Dragon will breathe fire back into Chinese markets in 2012. Kung hei fat choy!

Frank Holmes, US Global Investors

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.