That's the feeling that swept over me yesterday when I was filling up my gas tank for $3.75/gallon (I realize that's actually cheap considering what some of my West Coast readers are paying).

And I know $5/gallon is right around the corner.

But truth be told, I don't think I'll complain when it tops $5/gallon.

Because I've been hearing—and telling my readers—about a little theory called "Peak Oil" that was presented more than 55 years ago. . .

Perhaps the most common misconception about Peak Oil I come across is this idea that we're running out of oil.

That simply isn't the case here—and it's never been about how much oil is still in the ground. . .

Instead, it all comes down to the rate at which we can produce what's left.

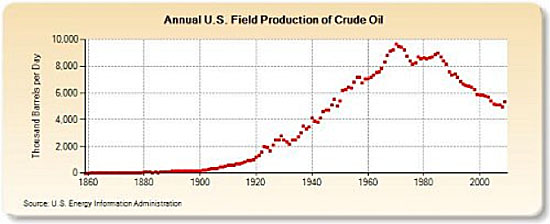

And if you want a firsthand look at production rates, take a quick peek at this chart:

That's the story of U.S. oil production—at least, it was up until a few years ago.

And while we'll never return to the good old days, it isn't for lack of trying.

More Drilling, More Profits

Three days ago, when I saw that the latest number of U.S. oil and gas rigs had fallen below 2,000, I wasn't concerned in the least.

In places like North Dakota, there are still more than 200 rigs drilling away.

In Canada, there's an outright drilling surge currently taking place. They added 250 rigs just this week.

And this is all leading to a tremendous opportunity. . .

You see, we know what's coming in 2012. Billions of dollars from the North American oil and gas landscape will pour into investors' pockets.

For the last few weeks, I've shown you time and again that the smaller drillers are consistently outshining the lackluster performances of ExxonMobil and friends. . .

That much isn't going to change.

But it's not just the speculative players that will be flushing our pockets with cash in 2012. Smart investors are constantly finding new ways to play the oil and gas renaissance taking place in Canada and the United States.

I'll give you an example.

Today, Carbo Ceramics (NYSE:CRR) is still one of the best shale plays that most investors have never heard of—and the best part is they don't have to produce a drop of oil to deliver you gains.

Carbo manufactures ceramic proppants, which replace the sand used in the hydraulic fracturing process. They're making artificial sand to help drillers improve productivity.

And right now is the perfect environment for companies like Carbo. . .

Over a million wells have been stimulated using hydraulic fracturing—including more than 90% of the wells drilled today.

Although many of us have been following the war over hydraulic fracturing that's being played out in the media, the entire issue comes with a huge catch: It doesn't matter which side you are on.

Fact is, an outright ban could potentially be crippling to us. Without it, production would plummet—and we'll be headed right back down the Peak Oil slope.

We'd also have to find someone to ship us hundreds of thousands of barrels a day.

Believe me when I say our sources are drying up faster by the day.

Aside from Canada, not many other producers would help us out—mostly because they're having struggles of their own. Mexico's oil and gas production is in just as much trouble as ours.

And let's be honest, do we really need to add more OPEC oil into the mix?

Our outlook is grim enough. . .It's mid-January, and oil prices are still in triple-digit territory.

Until next time,

Keith Kohl, Energy & Capital

A true insider in the energy markets, Keith Kohl is one of few financial reporters to have visited the Alberta tar sands. His research has helped thousands of investors capitalize from the rapidly changing face of energy. Kohl connects with hundreds of thousands of readers as the managing editor of Energy & Capital, as well as investment director of Angel Publishing's Energy Investor. For years, Kohl has been providing in-depth coverage of the Bakken, the Haynesville Shale, and the Marcellus natural gas formations—all ahead of the mainstream media. For more on Kohl, go to his editor's page.