—Albert Camus

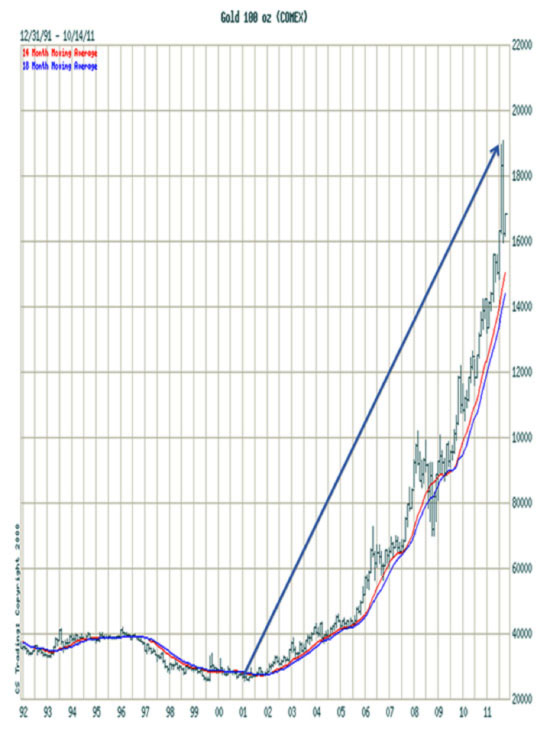

There has been so much talk about gold and so little understanding of the reality behind the move in the price of the yellow metal over the last 90-plus days that I think it’s necessary to separate the wheat from the chaff. I want to discuss what gold has done, where it’s at now, and then end with where it’s going from here and postulate why it’s going to do what it will do. Right now you need to understand that gold is beginning the twelfth year of major bull market; perhaps the most unprecedented bull market in our lifetime. Here’s a quick snapshot of what that bull market has looked like since the 1999 bottom and the 2001 retest of that bottom:

And from the point of view as an investor, this is about as beautiful as it gets. As I mentioned above, gold is entering the twelfth year of its bull market and has posted gains in each and every year. Below I have listed gold’s closing price on the last day of each year:

2000—$273.60

2001—$279.00

2002—$348.20

2003—$416.10

2004—$438.40

2005—$518.90

2006—$638.00

2007—$838.00

2008—$889.00

2009—$1096.50

2010—$1421.40

2011—$1566.80

I know of no other market that can make this claim, although I will admit that I don’t follow certain markets like milk, wine and ferrets.

Now I want to look at the same time period but from a different perspective, this time in terms of corrections, because every primary bull market of any duration experiences secondary corrections. Every significant move in price has reactions and there is no way around it; you just have to be smart enough to recognize it for what it is, a reaction, and sit tight. So here it is:

Source: www.jsmineset.com

If you include the current reaction, the 11-year-old bull market is now in its seventh correction, and the previous six have run anywhere from 12.1% on the low side to 28.9% on the high side. The current reaction that has led to all the negative rhetoric is stuck right in the middle at 17.2%. and yet the media trips over itself to call a top, just like they did the other six times. I would like to point out that they were wrong then, and they are even more wrong now, if that’s possible, and here is why.

I have drawn a very simple nine-month daily chart of gold, and I’ve put in the only two lines that matter. The top line is downward sloping and represents resistance while the bottom line is also downward sloping and represents support:

For those or you who have followed my work you’ll recognize the support line from articles dating all the way back to the September low. Two weeks ago I mentioned that I was looking for a test of strong support at 1,522.30/ounce (oz), and a couple of days later we did in fact spike down to 1,523.90/oz, and I now believe that will prove to be the bottom.

One of the reasons I believe we’ve seen the bottom has to do with the 90-day cycle, one of the most dominant cycles in the markets over the last decade. Gold topped with an all-time closing high of 1,900.60/oz on August 22, and then declined to a closing low of 1,548.70/oz exactly 90 days later. That, in my opinion, is not a coincidence. Since then gold has rallied to yesterday’s 1,622.20/oz close, and that was the second consecutive close above what was good resistance at 1,605.50. What’s more, the back-to-back double-digit rallies on Wednesday and Thursday were in spite of strong rallies in the U.S. dollar and general weakness in stocks. Three weeks ago such conditions would have driven the price of gold down $20-30, so it appears we have a change in character. As I’ve mentioned before, a change in character often precedes or accompanies a change in direction.

Perhaps the most important development in the world of gold has to do with the fact that China, one of the world’s largest importers of gold, is no longer content to buy the precious metal for the floor of the Comex or London metals exchange. Why? There are two principal reasons:

- The Comex has more than US$86 billion (B) in contracts (obligations) floating around at any one time. Yet in storage they have slightly less than US$3B. So the Comex is not only woefully short of supply should there be a run, it is allowing large traders to flood the market with paper gold in an effort to suppress the price. If you’re China and you’re building your inventory, that’s not in your best interest.

- There are questions regarding the purity of the metal sold by the Comex and London metals exchanges.

I should mention that a number of larger players, like Sprott and Kyle Bass, are following in China’s footsteps and the end result will be a default by the Comex and a collapse of the paper system.

All of these big players are now going straight to all the large mining companies and they are inking deals to buy all their production right from the source! That means that the flow of physical into the Comex will slow to a trickle and eventually dry up altogether. That, in turn, will expose the biggest fraud of all, i.e., that the U.S. has no gold. The purported massive gold supplies that exist in Fort Knox, New York, and in several other places are all a work of fiction. The gold disappeared a long time ago. That should make a lot of foreign central banks that supposedly have gold on deposit in New York, very, very unhappy!

Finally, all of those calling for an end to the gold bull market seem to forget one important thing. All major bull markets end with a spike up based on greed and euphoria, and not a top molded out of fear and despair, as would be the case today. (This is actually a title of an article written by Eric De Groot and found on www.jsmineset.com.) Fear and despair would mark a bear market bottom, but it has never signaled a top in a bull market and this will not be the first time. Gold has not topped, I believe the bottom in the reaction is in, and if I am right we are about to embark on the third and final phase of our bull market, and that’s the phase where the general public finally piles into the gold market. It is almost always the most lucrative phase and it is the phase that always caps a major bull market. That phase will take gold up and through US$4,000/oz, with fewer interruptions than most could imagine. My advice is to buy gold (silver) here and hide it some place until all the smoke clears.

Giuseppe L. Borrelli, www.unpuncturedcycle.com

[email protected]

Disclaimer: All the reports and content in the entire Unpunctured Cycle web site (including this report) are for educational purposes only and do not constitute trading advice nor an invitation to buy or sell securities. The views are the personal views of the author. What’s more the author may already hold a position or positions discussed in this article. Before acting on any of the ideas expressed, the reader should seek professional advice to determine the suitability in view of his or her personal circumstances. All material in this article is the property of Unpunctured Cycle.