Last year’s unrest demonstrated how major oil-producing regions can significantly affect oil prices. As I’ve previously stated, according to PIRA Energy Group, the Middle East accounts for over 70% of OPEC oil production and, along with North Africa, more than 95% of the cartel’s capacity growth.

A disruption of the supply chain can also influence oil prices. One of the largest chokepoints along the global oil supply chain is the Strait of Hormuz, which roughly 90% of all Persian Gulf oil tankers—some 18 million barrels per day (MMb/d)—pass through, according to Barclays. With Iran controlling the entire northern border of the strait, there is a significant chance for disruptions should the country fall into conflict or war.

The story will likely continue into the new year, as "sanctions against Iran, including a possible European Union oil embargo, and fear of an Israeli attack on Iran’s nuclear facilities led 2011 to close on a bullish note" for oil, said PIRA Energy Group in its new report today. Additionally, there’s new political uncertainty in Iraq that may keep oil elevated.

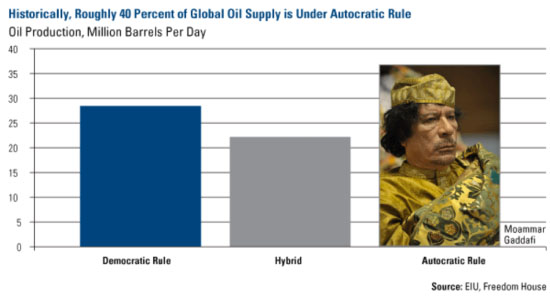

The chart below sums it up: With more than 40% of the world’s oil controlled under autocratic rule, oil supply in democratic nations likely depends on the state of autocratic nations.

Read The Many Factors Fueling a Return to $100 Oil

China Rises to the Top of the Energy Pyramid

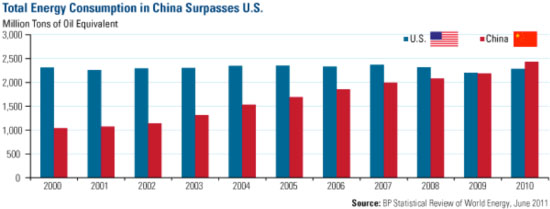

Another significant development in 2011 was that China surpassed the U.S. to become the world’s largest energy consumer. BP’s Statistical Review of World Energy report calculated that China’s energy consumption rate grew 11% over the previous year, with the country consuming 20% of global energy.

Read China Is World’s Largest Energy Consumer

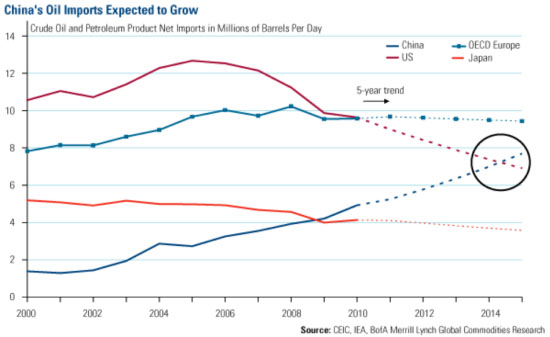

While coal accounts for a significant portion of China’s total energy use, the country’s need for oil should continue to rise. Its rising income levels, the government’s social housing plan, and an aggressive transportation effort to link 700 million people across more than 250 cities should continue drive this growth. Bank of America-Merrill Lynch (BofA-ML) agrees, suggesting that "China’s oil dependency will rise as U.S. imports fall." In the chart below, it’s projected that China’s imports of crude oil and petroleum products will surpass the U.S. in 2014. BofA-ML thinks that on a volume basis, China oil imports "will grow quite rapidly on the back of rapid per capita income growth."

China’s demand is what makes today’s oil situation different from the end of 2007. At that time, a lack of supply increased oil prices even though the U.S. was in a recession. What’s different is that "China is likely to re-accelerate" in 2012, according to Goldman Sachs.

China, along with other emerging markets, and the European Central Bank are in the early stages of a global easing cycle, primarily by cutting interest rates to spur growth. Also, the Federal Reserve should remain stimulative. These government actions set the stage for sustained, or perhaps higher, demand for oil. As stated earlier, geopolitical threats remain on the horizon, and could also be a positive catalyst for oil.

As always, our team will closely follow these events, as well as the monetary and fiscal policies, to find global investment opportunities in 2012.

We wish you and your family a very happy and prosperous new year!

John Derrick contributed to this commentary.

Frank Holmes, U.S. Global Investors