For gold to rise to levels significantly higher than the recent high of $1,920 per ounce (oz), a new impetus is needed. Without additional energy from such an impetus, gold could just trade sideways for a very long time, or even fall further. See the following chart (from barchart.com):

Gold price forecast with support

There is only so much value in the world economy, and it is split between all the different instruments (like gold, silver, stocks, bonds, etc.) where value resides.

For gold (and silver) to rise significantly, relative to other instruments of value, value will have to be diverted away from those other competing instruments. The printing of more money does benefit gold, but it does not necessarily benefit gold more than other assets—such as commodities, for example.

Historically gold has made its significant gains, relative to other assets (as well as nominally), not during inflation, but during deflation (Note: I am using the terms inflation and deflation very loosely in this case). These significant gold rallies historically occur when value flees instruments such as stocks and certain commodities.

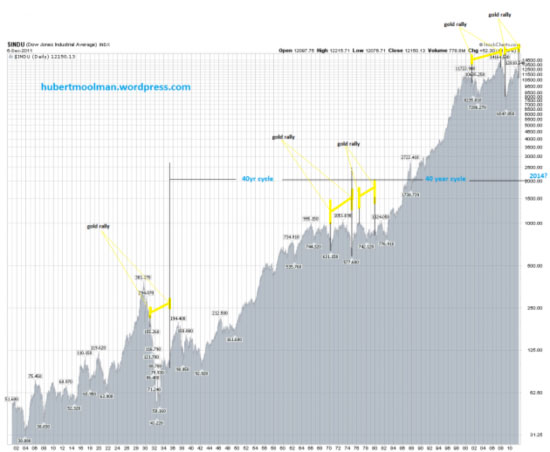

Since the 1920s there have been three major gold rallies (1930s, 1970s and the current rally). Below is a Dow Jones Industrial Average chart (from stockcharts.com) from 1900 to today:

On the chart, I have indicated the periods where a gold rally occurred. During the 1930s there was one big rally (increase based on the real price of gold [data from minefund.com]) from about 1931 to 1934. During the 1970s there were two rallies, and I have also indicated two rallies since 2001.

All three major gold rallies came after a significant top in the dow and the dow:gold ratio (1929, 1966 and 1999). A great portion of the 1930s and 1970s rallies occurred when the dow was falling significantly. In fact, the biggest rise in the gold price occurred when the dow was falling or was trading closer to the bottom of its trading range during that period.

- The 1932 bottom in the dow came during the 1930s gold rally indicated. Also, the top in the price of gold came when the dow was trading closer to the 41.22 low than to the 381.17 high.

- The 1974 bottom in the dow came during the 1970s gold rally indicated. Also, the top in the first of the two gold rallies of the 1970s came at about the low in the dow in 1974.

From the above, it is clear that the dow was weak and/or falling when gold had its best rallies. In other words, much value was diverted from the dow and related instruments to gold during these periods. A weak and/or falling dow (or what it represents) was an impetus for the massive increase in the gold price during these rallies.

The current gold rally (since 2001) has mostly been during the time when the dow has also been rising, with the exception of a short period in both 2002 and from the end of 2008 to February 2009. The best of the current gold rally, since 2001, has been during a time when the dow was rising as well. Therefore, based on the evidence from the 1930s and 1970s gold rallies, I believe the current gold rally has not yet had its best period—it is still to come. My current fundamental and fractal analysis of the dow and gold supports this view.

The dow is currently trading close to its all-time high, and it is my opinion that gold will step into the next phase of this bull market when the dow starts to fall. A falling dow, with weak economic conditions, will be the impetus for the next massive rally in gold, just like it was in previous bull markets. A falling and/or weak dow will in some way represent the diverting of value from stocks to gold. For more on the fundamentals of why a falling dow will cause the next massive rise in gold, see my article Is a Gold Parabolic Blow-off Long Due?

My current analysis suggests that this is likely to happen soon, since gold appears to be bottoming (or has already bottomed), whereas the dow appears to be looking for that final point (see this article for more details).

For more detailed analysis of gold, silver and the dow, you are welcome to subscribe to my free service or premium service. Also consider my fractal analysis report on gold, silver and gold mining.

Warm regards and God bless, Hubert

http://hubertmoolman.wordpress.com/

[email protected]