A common index for people to point to when discussing such stocks is the S&P 500 Dividend Aristocrats, which consists of the S&P 500 members that have increased their dividends every year for the last 25 years. That index currently consists of 51 members, mostly household-name type companies such as Walmart, Exxon, Colgate-Palmolive, McDonald’s, Clorox and Coca-Cola.

So far in 2011 (through 12/23/11), the Dividend Aristocrats Index has risen 5.8%, not including those dividends compared with the S&P 500, which has been roughly flat. The average dividend yield of the constituents of the Dividend Aristocrats Index is 2.8%.

What would a list of MLP distribution aristocrats look like, and how would it have performed?

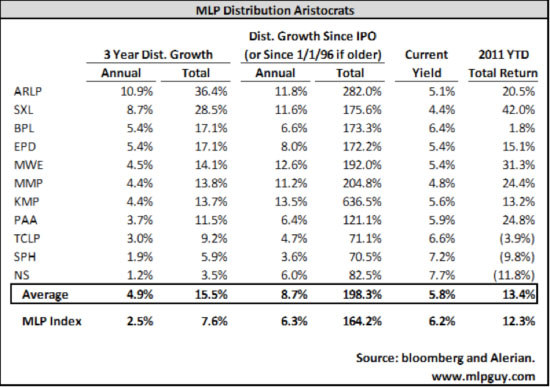

First, given that energy MLPs in their current form have only really been around since 1986, there are not very many MLPs that have been around to pay distributions for even 15 years, much less 25 years. So, to make a distribution aristocrat list, the criteria for inclusion would need to be relaxed a bit. To make it very simple, for my MLP list, I’ll include MLPs that have grown distributions each year for the last 10 years. There are 11 such MLPs, as shown in the table below.

That simple criterion excludes those MLPs that went public less than 10 years ago, even if they have grown distributions consistently since their IPO. Eleven out of the 50 MLPs included in the MLP Index is slightly more than 20% of the index constituents, but 52% of the MLP Index’s weighting. In case you were wondering, the longest streak of annual distribution growth of MLPs that are not in the Alerian MLP Index are HEP and STON, each with seven straight years, followed by TLP at six years.

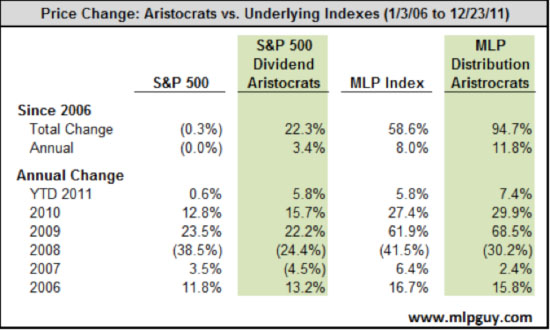

The table below highlights the results over the years. I left out the MLP distributions, because showing these numbers on a total return basis just isn’t fair given by how much MLPs have outperformed stocks on a total return basis over the years, as discussed here.

The results are not surprising, given that large-cap MLPs have outperformed in 2011, and most of the list is large-cap MLPs. The general rule that gets thrown out about dividend aristocrat stocks is that they outperform in down markets and underperform in up markets. That appears to be the case in 2007 and 2008 for both stock aristocrats and MLP ones. But in 2006, 2009 and 2010, all strong years for stocks and MLPs in general, the aristocrats faired very well also.

Looking at these numbers, it’s hard to argue against owning aristocrats vs. regular stocks/MLPs over any time period. Companies that are disciplined about maintaining and growing distributions can’t afford to waste cash flow or earnings on low-return or no-return projects. Capital discipline is extremely important, particularly in an era where capital is so cheap and the temptations to squander capital are rampant.

What do you call your act? I call it The Aristocrats!

Hinds Howard, MLP HINDSight

Disclosure: The information in this article is not meant to be financial advice, we are not your financial advisor and I am posting my comments for informational purposes only.