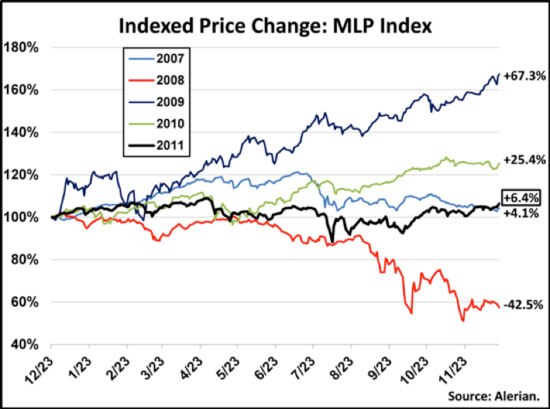

It has not been smooth sailing for MLPs this year, however. There were a few corrections and scares along the way that flushed out some of the weaker MLP holders, providing opportunities for long-term holders. The chart below shows the performance of the MLP index with each of the five years plotted across one calendar year. Looking at the 2011 line, there were periods during May and August when it seemed the index was tracking 2008. But the 13%+ rally this Q4 looks more like 2009 and 2010 than 2008. However, also noteworthy is that the last time MLPs had a somewhat complacent year amidst a weak economic backdrop (2007), the following year turned out pretty bad.

Also, the year-to-date MLP index price change of around 5% is somewhat deceiving. An equal weight average of the Alerian MLP Index members would have been up only 0.2% so far in 2011. The 10 largest MLPs, which collectively account for 59.3% of the MLP index, have gone up on average 9.4% so far in 2011, compared to -2.0% for the other 40 members of the benchmark Alerian MLP Index. Large-cap MLPs were the best performers this year.

All year, investors seemed to be struggling with the same question Laurence Olivier’s dentist asks Dustin Hoffman’s character repeatedly in the Marathon Man (video below, starting around one-minute mark): Is it safe? And it appears that many investors determined it wasn’t safe, and were not participants in the fourth-quarter light-volume melt-up.

Is it safe? Hoffman’s character doesn’t know the answer, and neither did anyone else this year. Large, famous managers were confounded by the market this year, as outlined in this post by Josh Brown. Some very famous players even folded up shop (like Soros). For them and for the rest of us, much of the year we felt more like Hoffman’s character, tortured by daily swings up and down, numb to the pain of what seemed like an endless stream of disappointing economic data points.

In the end, the year turned out fine and it was safe, but many investors have given up on the market in the process, or they are waiting to time their entry for when things seem more "certain." That mountain of cash on the sidelines remains. If history is any guide, when it finally appear "safe" for investors to jump back in the markets, it will be just when the market is no longer safe.

Hinds Howard, MLP HINDSight

Disclosure: The information in this article is not meant to be financial advice, we are not your financial advisor and I am posting my comments for informational purposes only.