That, of course, is definitely a reason for Vulture Speculators (like us here at Got Gold Report) to be filled with jollity. No, not because the shares we already own have fallen along with the mighty (and in many cases they have fallen mightier than the mighty). What stokes our holiday fires in this 2011 Christmas season is that we are able to acquire meaningful positions in so many of the Resource Company Guru-chosen issues we track at super-sale, ultra-low-priced bargain prices. Prices that only a Vulture would love.

For Vultures it just doesn't get all that much better than this. Huge plunges in prices, followed by devastating, sell-at-any-price-to-book-tax-loss "stock hurling" by disgusted, disillusioned and weary retail penny stock gamers. (Most of it on low or even tiny volume too – An extra special condition all Vultures take note of, or should.) Take a look at the chart just below.

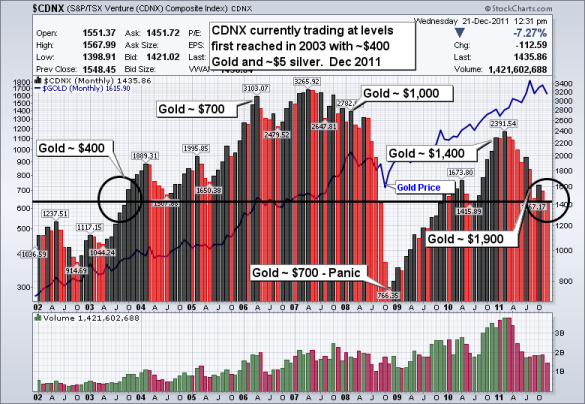

CDNX, since 2002, monthly, with the gold price in blue.

The CDNX is actually trading at about the same level it did when gold had yet to take out $400 and silver was then less, that's less than $5 the ounce in 2003. What is wrong with this picture? Anyone?

What is wrong is that the small miners haven't "answered" the metals prices since at least 2007.

Do You Believe in Bargains?

Let's get one thing out of the way first. This is indeed the second largest correction in the history of theCanadian Venture Exchange Index. It should leave little doubt in the minds of speculators that the constituent members of the CDNX have been trounced, pummeled, trashed, clobbered, wasted, decimated. . .clocked (you get the idea) in 2011.

The correction of 2011 is horrific in size (as much as 47% at the October lows), second only to the gigantic all-time collapse of 2008 (a bone crushing and wide ranging 79.9% in 2007-8). This correction is also wide ranging in scope, taking virtually all of the smaller miners down in a sea of uncertainty like a great falling red tide.

It's. . .well, it's nothing less than beautiful! Beautiful in the sense that many of the companies we booked profits on to begin the year are now selling for small fractions of what we booked then. (And remember the flak we took back then for building our Bargain War Chest (BWC) when the rest of the gamers were so ebullient and so cocky? How times change…) Beautiful in the sense that we have been able to add many, many more shares of our Guru-chosen promising companies for much less capital than we had dreamed possible at the beginning of the year. This, despite gold being higher than when the year began, and silver too (a little). This, despite gold having reached all time nominal highs in the $1,900 neighborhood and silver having tickled the $50 level in April.

Second-Best Buying Op Ever

What we are witnessing is the second largest liquidity vacuum/buyer's strike in the history of the CDNX, and it comes at a time when it is virtually a "lock" that prices for precious metals will remain at a multiple of where they traded back in 2003.

Think about that for a moment. Now consider that the CDNX traded as high as the 3,200 level with gold then in the $670s in Q1 of 2007.

We raise the Bargain Banner today with the CDNX trading at less than half where it was with $670s gold as gold is trading more than 2X that 2007 period. (CDNX cut more than half, gold at more than double the price. Own that idea. Nothing remains so out of kilter forever.)

The precious metals may not move to all-time highs in the next little while, but with worldwide quantitative easing (read money printing) underway (and underway in a big way in Europe now), the metals are much more likely to make new highs in 2012 than they are to return to the extremely low levels that would justify the very sorry, super buyer's strike level of the CDNX today, in our opinion.

Not that the small miners need higher gold prices, they don't, they lack confidence by the market participants instead.

Bird's Nest on the Ground

So, in our simple way of looking at the market for small, thinly capitalized and lightly traded junior miners, we are being given a fantastic buying op. The second best one ever. We are, right now, in the midst of what we here in Texas call "a bird's nest on the ground." (Meaning the easiest of easy pickings.)

But now hear this, Vulture Compadres, that fantastic buying op is not for the mealy mouthed, squirmy cowards among us. It is likely not for those expecting instant gratification, either.

Rogers' Way

Jim Rogers is fond of saying that he just likes to wait until he sees a pile of money sitting in a corner and then he just goes over and scoops it up. By that, of course, Mr. Rogers is saying that he looks for the point in time when prices for something become absurdly cheap and people hate them. Then he positions in them confidently until they return to where they belong and people love them again. He's also noted for saying that he's a terrible short-term trader and is willing to position "as long as it takes." How about that? Apparently Mr. Rogers is a fully fledged Vulture.

All 'Good Things' Come to an End

We cannot know, in advance, what the catalyst will be that breaks the nasty fear-based shunning by the market of the small resource companies. We cannot know how long it will be before our super-cheap position taking (buying shares today at 4 for 1 and even up to 10 for 1 red tag sale prices) will bear big time "home run" fruit. We only know that these fear-greed cycles, these waves of human sentiment are always temporary. We only know that at some point buyers will be buying today because they fear that prices will be higher tomorrow, instead of selling today because they fear that prices will be lower tomorrow.

We only know to expect that today's second-worst liquidity vacuum and buyer's strike will morph into the exact opposite. We only know to target and to position at Ridiculous Cheap (RC) prices in our "Faves" ahead of time.

Change Can Happen Very Quickly

Because if history is any guide, once a super-harsh liquidity vacuum gives up its last, it can happen suddenly, in large percentages, leaving little time to accumulate a meaningful position the issues we wish to build positions in. As just one example of that notion, consider this chart below from 2008-2009, the last time we had a similarly harsh buyer's strike end.

CDNX from June 2008 to June 2009, daily.

Note the comments on the chart itself. Suddenly, with little warning, there were no longer huge numbers of shares on offer and constant dumping of shares by the panicked or the depressed. Just like that there were zero tax loss sellers willing to hit any bid, no matter how stupidly cheap those bids had become. That is how the super-harsh 2008 buyer's strike ended and we see no reason to think that this current buyer's strike example cannot follow that same script.

At some point in the future people will go from being confident they can add a large number of shares at super cheap prices to not being able to add a large number without moving the price higher considerably. At some point people will find that all those shares that were being dumped (and scooped up by Vultures) are just no longer available and they will have to pay up to in order to fill up their want lists.

For Vultures, who have been scooping up their fair share of the market throwaways, that's where the really fun part begins, but that is a different story for another time.

For Now to Close Out 2011, a Few Impressions for Vultures

As confidently as we can say it, as Got Gold Report Vulture-in-Chief, we believe that this fantastic 2011 buyer's strike event is certainly a good one. It already ranks as number two of all time for the CDNX and therefore is an exceptional example of exactly the kind of market imbalance we hope to exploit. It has given us the exceedingly rare opportunity to target our Guru-chosen Faves in lower-than-low blue target boxes on our Vulture Bargain (VB)and Vulture Bargain Candidates of Interest (VBCI) charts – and to actually build significant, meaningfully large positions in them in some cases.

As Vultures we cannot ask for more opportunity than that. We might get better opportunities, but we dare not even dream they might arrive or count on them arriving. This really is about as good as we can hope for. When we can repurchase shares we sold in February or March at the rate of five, six, seven or even 10 shares for the price of each share we booked back then, that is a sure-enough, no question, bona fide sale price in our view. Especially when the company in question is the same or even better off than they were then.

We really cannot expect such unusually large market imbalances to last for much longer, either. That kind of fear just isn't the norm in markets, no matter how it "feels" today, but we must also be prepared mentally for our timing to be "as long as it takes." We don't get to choose the timing in our chosen market, but we do get to choose to let the market tell us what that timing is. (One of the most important lessons a Vulture ever learns.)

We cannot know in advance when the market we have chosen to game will pull a 2008-style reversal, but we could very well be nearing that time as tax loss selling comes to a close. In any event, we think that the CDNX is like Jim Rogers' pile of money sitting in a corner right now, though. How about you?

There is an efficient and convenient way to play the coming end of the buyer's strike, but that is also a story for another time. Very soon too! We plan to share that "story" with Vultures along with our 2012 Top Pick for Steven Halpern's The Stock Advisors event on MSN and AOL just ahead. Look for it shortly.

Until next time, happy holidays and merry Christmas from the entire team here at Got Gold Report.

Gene Arensberg, Resource Investor