And since China started restricting export quotas at the end of 2009, the price of some rare earths has climbed over 1600%.

Yet, the market has overlooked a group of smaller metals that are just as vital to industry.

Like rare earths, you'll find rare industrial metals (or RIMs) in smart phones and flat screen TVs. But there are heaps of other applications for them as well.

Take Gallium (Ga) for example. It's been commonly used for tumor imaging in the medical profession. And Bismuth (Bi) is found in digestive medication and even some eye drops. But Bismuth's uses don't end there.

It's even used in pretty much every cosmetic and paint product around the world.

Then there's Tellurium (Te). The latest technological advances have seen it become essential to manufacturing solar cells Ė yet for years it's been useful as an alloy component for steel and copper.

As for Germanium (Ge), you'll find it in dietary supplements aimed at boosting the immune system and has even proven to be a key component in high blood pressure medication.

Because these metals are used in old and new technology, demand has increased rapidly. And for investors, this could lead to a new investment opportunity.

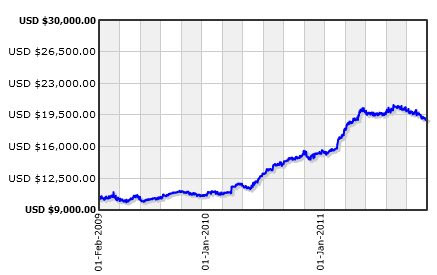

In fact, in the last two years, the price of a key basket of these rare industrial metals has risen 85%:

And there's more good news for investors if you want to get involved. While demand is just being satisfied at the moment for some of these metals, demand for Tellurium is set to outstrip supply soon.

At present, 180 tonnes of Tellurium is produced but as soon as 2013 it's expected that 400 tons per year will be needed. The good news is, that unlike rare earths China doesn't control the supply of rare industrial metals.

Mexico, Canada, China and the U.S. are all miners of these metals. But just because more countries mine these metals than rare earths, doesn't automatically mean there's a large supply.

Rare earths mines can be standalone mines. But the problem with RIMs is they are a by-product of other metals. Tellurium is a by-product of copper mining. And Gallium is a by-product of Zinc and Aluminium mining. This means these metals are only mind as long as Zinc and Aluminium mining is profitable.

If at any point the price of copper, or zinc falls so low that it's not worth mining, the supply of Tellurium and Gallium could be cut off. . .and that would likely mean a spike in the price for these rare metals.

Shae Smith

Editor, Money Morning