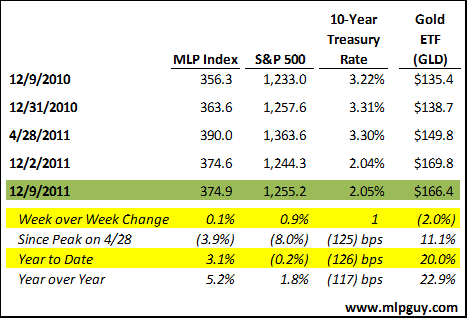

The MLP equity deals seem like they won’t stop either. There were 4 this week: 2 IPOs (MEMP and RRMS) and 2 follow-ons (EPD and NS), for a total of $1.035 billion in gross proceeds. Nonetheless, MLPs had a decent week, continuing the recent trend of barely flinching in response to mountains of new paper. The MLP Index finished the week flat, compared with a slightly positive week for the S&P 500, despite back to back 20+ point S&P 500 days to end the week as the not so bad economic news here remains in conflict with the mess in Europe.

The two follow-ons traded well, particularly EPD, which closed Thursday above issue price, despite strong market headwinds that sent the MLP Index down 1.3% (although EPD represents a fairly large percentage of the MLP Index, and it was down from the prior close more than 2%). The IPOs both traded poorly, although RRMS was at one point up 4.5% before drifting all the way back down to its IPO price.

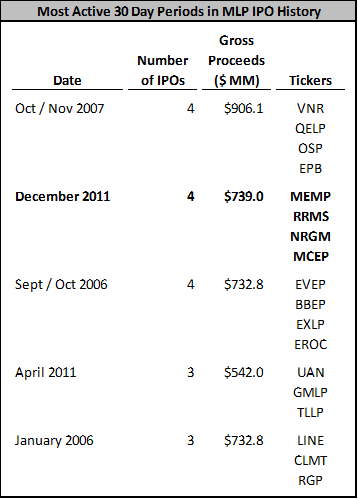

Poor IPO trading is evidence of some fatigue in a IPO market that has been very busy this year. Its not over, either, with 2 more IPOs set to price next week for a combined $428 million in planned gross proceeds. With the late flurry of IPOs, this year will be tied with 2007 for the most active ever for pure MLPs (i.e. not including GP holding company IPOs that proliferated in 2006) with 13 total MLP IPOs. 6 of those IPOs will have come in the 4th quarter, and 4 in the last month, tying this month for the most active 30 day period in the history of the sector, only surpassed in gross proceeds by the October / November period of 2007, as shown in the table below.

If the 2 announced IPOs get done next week at the midpoint, a total of $4.6 billion in equity will have been raised in the 4Q2011, more than twice as much as was raised in 3Q2011, and in-line with 1Q2011. I’ll have the full year stats in year-end wrap up posts planned for early January, but it’s safe to say that 2011 will go down as the largest equity year in the history of the sector, with almost $20 billion in equity raised. In a favorable market climate, MLP equity raised should continue to grow year after year, as the sector market cap grows and distribution growth drives an ever increasing need for equity capital as a result. Obviously the MLP sector can’t grow forever, but record equity issuance years should be no surprise going forward for the next few years.

These record years are not much more than confirmation that the market is open for MLPs, which is a positive indicator for MLPs in 2012, as MLPs generally don’t raise and spend capital unless its for capital projects with attractive returns. A glut of equity issuance usually portends growth in the coming quarters for MLPs. From all indications via recent management presentations, there are some MLPs with assets in the right basins that are limited in their growth only to the extent they can access capital.

The 2 IPOs that are slated to price this week are Mid-Con Energy Partners (MCEP) and Inergy Midstream (NRGM). MCEP is an oil rich E&P MLP backed by Yorktown, priced at the same range and distribution as the last two E&P MLPs, LRE and MEMP. Both of those settled around $19 per unit, but with its oil focus, maybe MCEP can price higher.

NRGM is the natural gas storage and transportation subsidiary of Inergy. NRGM has just one incentive distributions rights tier (50%) that starts immediately above the initial quarterly distribution, and NRGM does not have any subordinated units, so doesn’t seem too unitholder friendly. We’ll see if the 7.4% yield at the midpoint is enough to compensate potential IPO investors for the slanted structure.

Winners and Losers

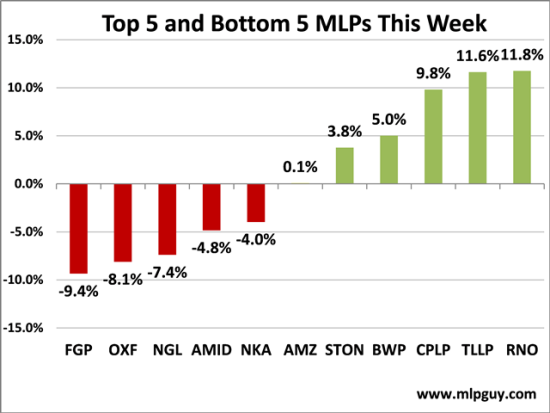

RNO and TLLP biggest winners this week. TLLP released some positive guidance, no obvious news piece to justify the 11.8% move for RNO. It is interesting to note that another coal name, OXF, was on the other end of the spectrum this week, down 8.1%, also on no obvious news. STON continued to recover from last week this week (up 3.8%), and BWP finally started moving up, after largely sitting out the recent move by the MLP index. It appears investors are searching for some value here with names like RNO and BWP, which look cheap after the run the rest of the sector has had of late.

Disclosure: The information in this article is not meant to be financial advice, we are not your financial advisor and I am posting my comments for informational purposes only. Long MMLP, EPD, NRGY.

MLP HINDSight