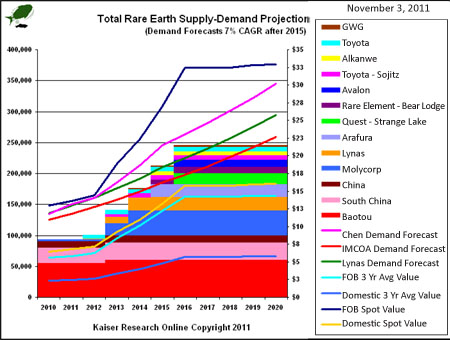

John Kaiser: This ironic comment was designed to convey the absurdity of what is happening in the rare earth sector. So no, I don't think that is our future. The slamming of the rare earth stocks based on warnings that global growth is slowing and high prices are generating "demand destruction" is the reverse of the media hype that we had before. It has had a negative effect on the valuations of rare earth juniors, in particular the ones that are still in the process of developing a new supply. The pullback we saw in Molycorp Minerals (MCP:NYSE) was justifiable because Wall Street analysts had been fooled into taking a pretty high percentage of the rare earth free on board (FOB) "quoted" export prices as real and plugged them into their cash-flow models. Now those astronomical export prices are coming down because China is releasing material back into the market. But it doesn't explain the downgrade in equities prices for companies like Quest Rare Minerals Ltd. (QRM:TSX.V; QRM:NYSE.A), Rare Element Resources Ltd. (RES:TSX; REE:NYSE.A) and Tasman Metals Ltd. (TSM:TSX.V; TASXF:OTCPK; T61:Fkft), which are early-stage projects, but still advanced compared to their peers. These company valuations never followed Molycorp and Lynas Corp. (LYC:ASX) up, yet they are being punished on the down side because the leaders in the sector retreated significantly. It is very unfair.

TCMR: So, even though the small companies didn't rise with the bubble, the mainstream media and J.P. Morgan's negative reporting on Molycorp is hitting their prices?

JK: Yes. The rare earth prices were definitely in a bubble. That is not the same as the rare earth stock prices. The rare earth prices did not really start to move until July 2010 when China drastically cut its export quotas. And even then, it was just the export prices that moved dramatically. Chinese domestic prices stayed flat. Only when China cracked down on polluting operators at the end of 2010, did domestic prices start to go up because the world had gotten used to about 120,000 tons (Kt) of production from China, instead of the officially sanctioned 93,800 tons. The West faces losing 30 Kt of production, which is a problem because last year China reported its domestic rare earth consumption as 87 Kt. A rare earth mine can't be rushed into production overnight so it will take time for capacity outside China to be developed. This reality has caused pressure, even in China, which is fulfilling its own needs first. Furthermore, the crackdown included plugging lucrative smuggling channels, through which rare earths bypassed the quota system.

China's crackdown on polluting operators has implications far beyond the rare earth sector. It shows that China is becoming impatient with its status as the world's cost dumping ground. As China is coming under pressure internally from an emerging middle class demanding environmental and working standards, it is being forced to take action. The rare earth sector could be a leading indicator of a trend shift, which has positive implications for countries such as the United States and Europe, which have not been able to compete in manufacturing goods because they won't tolerate the types of operating standards that China has allowed. As the Chinese cost structure rises, the rationale for moving production to China will diminish. China's ability to dominate 95% of total rare earth supply critical to a lot of sophisticated downstream technologies is one of its bargaining chips keeping end users in the country.

TCMR: How are end-users reacting?

JK: We have seen two reactions. One is companies shifting production capacity to China to get access to these critical materials. The problem is that China does not yet have any serious laws protecting intellectual property, so companies are taking a chance that they can protect their technology from being stolen by operators who will compete by making cheaper versions of their own products. Of course, this is a serious threat to Western countries that want to retain high-end manufacturing.

Other companies are trying to engineer out hard-to-access materials, thus creating the "demand destruction" being discussed. The substitution is usually for an inferior substance, but it is a temporary solution for a supply gap that every company has to manage. Rare earths are already coming back into the market as Chinese hoarders realize this substitution response could ease the shortage and wipe out their profits. The result is a healthy normalization of rare earth prices. Domestic prices, to a large degree, are starting to approach the 3-year average for export prices. The export prices still have a ways to come down. I think we will soon see Chinese domestic prices stabilize, and that will be the new reality, rather than the cheap pricing from 2008 or the elevated pricing during the middle of this year. That normalized pricing could make a lot of mining projects more economic than three years ago and technologies more practical than they are right now.

TCMR: Are some end users trying to lock in resources for the future?

JK: One of the big things missing from the junior sector has been any serious action by any party—major mining company or end user—to acquire a stake in a rare earth mining project. There have been nonbinding offtake arrangements that are meaningless because they don't involve any commitments. What the sector really needs is for the end users to step up to the plate and make some serious investments to guarantee 2015-2016 supply. I think in 2012 we will see movement. The juniors need to know how much of an ownership premium end users are willing to pay to control future supply. The end users don't need to make money on these rare earths. If they can produce this stuff at a reasonable price, they make all their money downstream by selling a Prius hybrid with a lanthanum-based nickel-metal-hydride battery. A lot of these decisions involving future product lines cannot be made unless inputs are secured.

We have seen some signs that this is happening. CBMM, a Brazilian company that owns the Araxá niobium deposit with substantial rare earth resources has realized $4B in investments by a consortium of Korean and Japanese entities and a group of Chinese companies. We do not know what this capital will cover, but I suspect a good chunk of it will go toward mobilizing the rare earth resources, which are mainly of the light variety. When this kind of deal happens to any of the junior companies, that will be a big milestone for the sector.

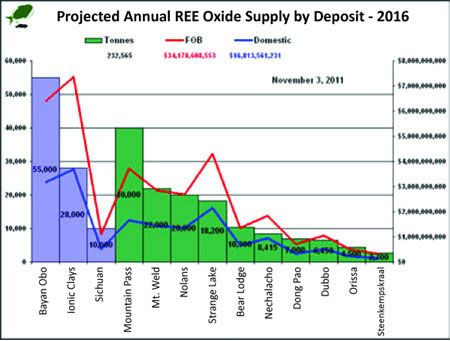

TCMR: You mentioned that it takes a long time to get one of these mines up and going, and you named three companies: Quest, Rare Element Resources and Tasman. Where will they be in 2016?

JK: If Quest continues to move along at its current rate of progress and does not encounter any significant permitting hurdles, it could be in production by 2016. Quest has 40-50% of the so-called heavy rare earths. Rare Element, which has the second-best light rare earth deposit in the United States, has a similar development timeline. Tasman, which has a lower-grade heavy rare earth enriched deposit, is at least a year behind.

Tasman's advantage is a very large deposit in Sweden called Nora Karr. This deposit will have something like 70-80 Mt and could conceivably take care of Europe's needs for 50+ years. Sweden is a stable country with local infrastructure in place. The problem is the Nora Karr involves a mineral that has never been commercially exploited. So a key milestone is the publication of a preliminary economic assessment based on a bench scale-established metallurgical flow sheet that establishes the recoveries and the associated energy and reagent costs.

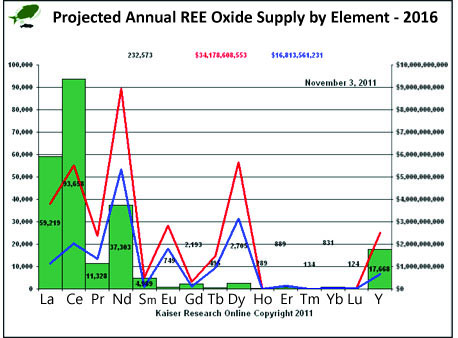

TCMR: You mentioned that all the rare elements are not the same. You have a chart of the prices of some of the different ones—europium, terbium, dysprosium, which are used in batteries and lasers. Those are commanding very high spot prices. Are these heavy rare earths going to be in demand beyond 2015? Is that still going to be an area where companies can make good money?

JK: Yes. The heavy rare earths today primarily come from ionic clay deposits in China. Once they are stripped away, you cannot drill and find more of them. They are gone. This is a problem because they play an important role in technology growth. China could actually become a net importer of the heavy rare earths down the road. So deposits such as Tasman's Nora Karr and Quest's Strange Lake are of interest to Western and Chinese end users. That means it is in China's best interest to have rare earths available from multiple sources around the world. So this concern that China is setting everybody up for another big gotcha by encouraging Western companies to develop deposits only to open the taps and flood the market with new production may have been the case in the '80s when China was a full communistic nation desperate for hard currency, but it is no longer the case today.

The world does not need dozens and dozens of these deposits, however, which is why I think the race has already pretty much been wrapped up by companies such as Quest, Rare Element Resources, Tasman and another that I follow, Avalon Rare Metals Inc. (TSX:AVL; NYSE.A:AVL; OTCQX:AVARF) in Canada with its Nechalacho deposit.

Large deposits like Strange Lake and Nora Karr will go on-stream at rates that will produce a pretty good amount of heavy rare earths. They will have the ability, should demand increase beyond expectations, to scale up production. These companies will have enough material to keep everyone supplied for 50-100 years.

There could be a little window for the smaller deposits to come in and produce some material, but because these things are chemical plants, it is not like starting a gold mine by digging up a gold vein and processing it. Small scale is not necessarily a solution for quick supply. A number of companies on the promotional circuit with smaller deposits will be inconsequential in solving long-term problems, but still require an extraordinary amount of time and effort to actually bring on-stream.

Domestic = what users pay in China; FOB = what export users outside of China pay; FOB + domestic value = total projected output in 2016 at today's REE prices

TCMR: What about in the light rare earth elements? Is it a similar timeline and outlook?

JK: No. There is a huge abundance of light rare earth deposits in the world, including what I suspect the Chinese, Korean and Japanese investors in CBMM are after at Araxá. So there will be no shortage of light rare earths by 2015-2016. There have been some major discoveries, including Commerce Resources Corp. (CCE:TSX.V; D7H:Fkft; CMRZF:OTCQX), which made the huge Eldor discovery in the far northern part of Quebec. I think that in 2020 and beyond, when the anxiety about supply security diminishes, overall demand will increase as end users become comfortable once more with deploying rare earth dependent technologies. Quebec will open up its north through its Plan Nord development initiative to create access and power infrastructure and that will benefit some of the remote deposits like Eldor. So I see no shortage of future supply for the light rare earths. There are numerous smaller deposits all around the world with grades of 2-3% or higher. Right now, a lot of work is going into the process technology for recovering rare earths and separating it. So even from all the failures that will happen, there will be a windfall of knowledge on how to do it and how not to do it.

This is sort of an interesting thing about the whole mining and exploration sector. People make all these negative statements about the extraordinarily high failure rate in mineral exploration, but all those failures generate valuable information. Sometimes the failures are simply a function of grade and the price of the commodity. We saw that in the last decade where the juniors generated more than $60B worth of takeover bids largely on the basis of taking deposits found in prior decades and abandoned as worthless and rethinking them in light of scaled-up demand. So even when these companies fail, they often generate valuable information, which is a legacy for future generations. All the work going into the rare earth sector right now is a gift to the future, even if it has no payoff for many of the participants in the short term.

TCMR: That is a great thought to leave with our readers. Thank you very much for your time.

John Kaiser, a mining analyst with over 25 years' experience, is editor of Kaiser Research Online. He specializes in high-risk speculative Canadian securities and the resource sector is the primary focus for an investment approach he developed that combines his "bottom-fishing strategy" with his "rational speculation model." Kaiser began work in January 1983 as a research assistant with Continental Carlisle Douglas, a Vancouver brokerage firm that specialized in Vancouver Stock Exchange listed securities. In 1989 he moved to Pacific International Securities Inc., where he was research director until April 1994 when he moved to the United States with his family. He launched the Kaiser Bottom-Fishing Report (now Kaiser Research Online) as an independent publication in October 1994 and developed it into an online commentary and information portal. He has written extensively about the junior resource sector, is frequently quoted by the media, and is a regular speaker at investment conferences. Since 2008 he has developed a focus on security of supply issues and how they relate to critical metals such as rare earths.

Want to read more exclusive Critical Metals Report articles like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent interviews with industry analysts and commentators and learn more about critical metals companies, visit our Critical Metals Report page.

DISCLOSURE:

1) JT Long of The Critical Metals Report conducted this interview. She personally and/or her family own shares of the following companies mentioned in this interview: None.

2) The following companies mentioned in the interview are sponsors of The Critical Metals Report: Commerce Resources, Quest Rare Minerals, Tasman Metals, Rare Element Resources.

3) John Kaiser: I personally and/or my family own shares of the following companies mentioned in this interview: Quest Rare Minerals and Tasman Metals. I personally and/or my family am paid by the following companies mentioned in this interview: None.