MLPs can afford to lever up more than regular companies because they generally have predictable cash flow (more predictable for some MLP assets than others, of course). It's analogous to how companies with steady cash flow throughout the year with decent margins are favored by leveraged buyout companies. It's also similar to how commercial real estate ventures can afford to be financed mostly with debt, because the cash flow generated is backed by long-term contracts with reputable tenants. For LBOs and real estate deals, the layers of debt are a trade-off offering juicier equity returns for more risk.

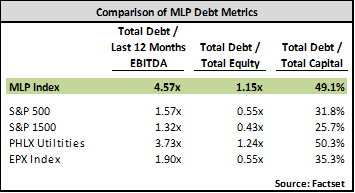

In general, many MLPs target an even split between debt and equity when it comes to financing an acquisition or growth project. The trend in recent years is to raise more equity than debt as a defensive measure against potential future capital markets crises where equity may not be as accessible. But in general, MLPs are comfortable with 50% equity / 50% debt in their capital structure and 3-5x debt to EBITDA multiple. Below is a simple table that shows how 3 debt metrics for MLPs compare with stocks and utilities. MLPs carry more debt than stocks in general and energy stocks specifically. In fact, MLP balance sheets track closely the balance sheets of utilities, which makes sense given the regulated cash flow nature of utilities.

All else being equal when comparing two MLPs, the one that has the least amount of debt (and therefore the greater ability to layer on more debt) is preferable, because that lower-leveraged MLP will be able to add more assets in an acquisition than the other MLP before it has to issue equity. But when comparing MLPs with other energy companies or other stocks generally, higher debt for the MLP should not be a red flag necessarily.

The same goes for EV/EBITDA multiples, which are going to be higher for MLPs because they have tax advantages relative to corporations with the same assets and EBITDA. Again, within the MLP space, it is obviously better to buy an MLP at a lower multiple (lower valuation) than at a higher one, all else being equal. But it's also important to note that the conventions for MLPs are different in terms of valuation and credit metrics.

Disclosure: The information in this article is not meant to be financial advice, we are not your financial advisor and I am posting my comments for informational purposes only.