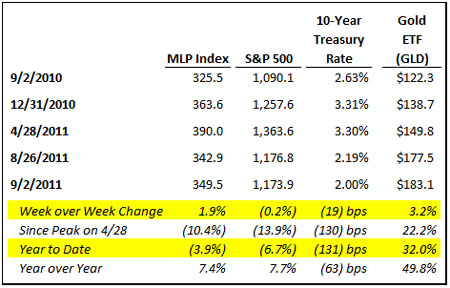

MLP tax fears seem to have subsided, replaced by proof of a faltering economy, and a failure of the U.S. to make a dent in the output gap created with the 2008 recession. Expect MLPs to trade in line with the broader markets in the coming months as volatility tends to breed correlation these days.

Gold and treasuries out-performance was foretold back in 2001 by Eric Janszen at itulip.com. His latest letter came out this week, titled "Illusion of Recovery—Part I: Print and pray has officially failed." In it, he discusses what we're seeing in gold and treasuries today. Basically, the USD based international reserve system started to breakdown in 2001. Since then, the number of countries that are buying gold has increased (to include trade partners like Mexico recently) as more and more of them have lost faith in the global USD treasury reserve currency system. For now, both bets remain safe havens, but many are betting that at some point we have a U.S. bond crisis of some kind. An excerpt from Janszen is below, but you can read more here:

The major gold buying countries are not necessarily allied with each other but rather are aligned against the U.S. and NATO policies, such as in the Middle East. It is no coincidence that the main critics of U.S. and NATO policy in Libya—China, Russia, India, and Venezuela—are also the lead players in the shift from USD Treasury reserve system to gold. The addition of Saudi Arabia, Thailand, Singapore, and recently North Korea and Mexico as major gold buyers indicates a broader disaffection with a system that is proving unstable and politically untenable even to countries with strong geopolitical ties to the U.S.

In contrast to investment banking strategists quoted in Barron's calling for the markets to finish 2011 higher and for U.S. GDP to grow at a rate significantly faster than the first half of 2011, Janszen calls for the market to close 2011 below 1000, and for gold to reach $2200 per ounce in early 2012.

For MLPs, a stagnating economy and falling stock market would not be catastrophic in the short term. If the economy continues to falter, MLPs should generally be ok, but forecasts of accelerated distribution growth are likely optimistic. Commodity prices may come down and volume may fall further, but MLPs are generally less levered than they were in 2008, and have been more conservative with distribution growth of late, choosing to build up coverage ratios. So, operationally MLPs should be able to weather a flat economy without cutting distributions.

In the event of a large stock market decline, MLPs will decline as well, but should outperform in the near term, buoyed by yield chasing investors. However, if foreign buyers of U.S. treasuries continue to dry up, interest rates would have to rise at some point, hurting MLP valuations as yield re-priced higher.