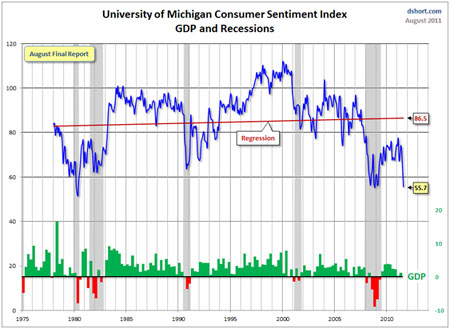

The probability that the U.S. will slip into a recession is rising as the economic data is increasingly tepid or negative. Bloomberg's chief economist notes that every time the GPD has fallen by more than 2% year-over-year, it has led to a recession. We are currently down 1.5% year-over-year.

The University of Michigan consumer sentiment report shows sentiment is now at one of its lowest points since the 1970s and in the same range as the depth of the crisis in 2007/08. Historically plunges in sentiment are highly correlated to recessions.

Over in Europe, Germany is approaching a potential constitutional and political crisis. The Germans were highly disciplined during the financial boom. Real estate prices stayed flat and the German people did not borrow to consume, unlike their European neighbors. While German banks behaved very conservatively domestically, they invested like drunken sailors abroad, heavily investing in Wall Street's toxic debt instruments and European debt.

So the fiscally conservative German public is in no mood to bail out the PIIGS. Yet, German banks are on the line with huge potential losses on European public and private debt.

George Soros warns that unless Germany takes the initiative in launching a sizeable Eurobond offering, we are headed for a global depression. But the mood in Germany is turning sour toward bailing out profligate nations.

The German President, Christian Wulff, has accused the European Central Bank of violating its treaty mandate with the mass purchase of southern European bonds. In a cannon shot across Europe's bows, he warned that Germany is reaching bailout exhaustion and cannot allow its own democracy to be undermined by EU mayhem.

'I regard the huge buy-up of bonds of individual states by the ECB as legally and politically questionable. Article 123 of the Treaty on the EU's workings prohibits the ECB from directly purchasing debt instruments, in order to safeguard the central bank's independence,' he said.

Mr. Wulff said Germany's public debt has reached 83pc of GDP and asked who will 'rescue the rescuers?' as the dominoes keep falling. 'We Germans mustn't allow an inflated sense of the strength of the rescuers to take hold,' he said.

'Solidarity is the core of the European Idea, but it is a misunderstanding to measure solidarity in terms of willingness to act as guarantor or to incur shared debts. With whom would you be willing to take out a joint loan, or stand as guarantor? For your own children? Hopefully yes. For more distant relations it gets a bit more difficult,' he said.

The Bundesbank slammed the ECB's bond purchases and also warned that the EU's broader bail-out machinery violates EU treaties and lacks 'democratic legitimacy.' Germany's Labour Minister has suggested that countries requiring bailouts provide gold as collateral, following Finland's collateral deal with Greece which may seriously undermine European unity on debt resolution.

The combined attacks come just before the German Constitutional Court rules on the legality of the various bailout policies. The verdict is expected on September 7.

Eurosceptic law professor Karl Albrecht Schachtschneider argues that the rescue measures violated a no-bailout provision in the European Union's Lisbon treaty without sufficient justification.

He also contends that they violated German constitutional clauses protecting property and democracy, the latter by restricting the German parliament's control over its own budget.

"A union of liability and debt favoring other states has been created," he said.

While the Court is not expected to rule against the bailout, the complexity involved in trying to sort out the mess grows as German Chancellor Angela Merkel also faces challenges within her ruling coalition in approving a deal she worked out in July with other European leaders.

A crisis of confidence can, at any time, overtake the markets and create a crash that is worse than what we witnessed in 2008. Both the U.S. and Europe will have to continue to rely quantitative easing to defer the dangerous consequences of default, making the eventual and inevitable crisis much worse.

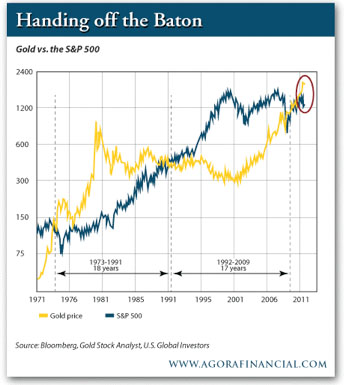

Gold has benefitted over the last decade, firstly from the artificial boom due to low interest rates and then the fear arising from the crisis. It has risen from $ 256 in 2001 to a peak of $ 1,917. It is up 676% from its low to its recent peak, while the S&P 500 is down 3.2% since 2001.

The gold ETF, GLD, has now surpassed SPY, which was the oldest and largest ETF and which tracks the S&P500. Jim Cramer, on the TV show 'Mad Money' and during market hours on CNBC, is constantly urging retail investors to have a 10-20% allocation in gold as a hedge against currency debasement.

Gold has had a substantial run in recent weeks. It has corrected sharply from its peak but further weakness is possible, as is a parabolic move to the upside if the debt crisis has an inflection moment.

In the second quarter, central banks globally were net buyers of four times more gold than last year. It was only in 2009 that central banks became net buyers of gold, for the first time since 1980.

From Japan: "Investors are seriously treating our gold ETF as a legitimate asset class, just like investing in equities, bonds and currencies," says deputy general manager Osamu Hoshi at Mitsubishi UFJ Trust.

Lessons from History

Gold and silver used to be money in most countries throughout most of history. It is the inability of governments to print or create precious metals out of thin air that has ensured its stability and universal acceptability. But governments that run into trouble with deficits have generally debased the currency, whether diluting the gold or silver content of coins, or replacing it with paper money.

The Song dynasty first came up with widely circulated paper money in the 9th century as silver was in short supply. When Kublai Khan conquered China, his Yuan dynasty adopted the concept of printing money ceaselessly.

As Marco Polo put it: ""You might say that [Kublai] has the secret of alchemy in perfection. . .the Khan causes every year to be made such a vast quantity of this money, which costs him nothing, that it must equal in amount all the treasure of the world."

At first things went well. The money was convertible into gold or silver and widely circulated. But, as now, a lack of fiscal discipline and inflation led to a delinking from real money (as Nixon did with the dollar in 1971). Then, as now, the pernicious effect of money printing asserted itself.

"This was the most brilliant period in the history of China. Kublai Khan, after subduing and uniting the whole country and adding Burma, Cochin China, and Tonkin to the empire, entered upon a series of internal improvements and civil reforms, which raised the country he had conquered to the highest rank of civilization, power, and progress.

Population and trade had greatly increased, but the emissions of paper notes were suffered to largely outrun both. . .All the beneficial effects of a currency that is allowed to expand with a growth of population and trade were now turned into those evil effects that flow from a currency emitted in excess of such growth.

These effects were not slow to develop themselves. . .The best families in the empire were ruined, a new set of men came into the control of public affairs, and the country became the scene of internecine warfare and confusion."

There have been innumerable instances in history of excess paper money printing to cover deficits ('quantitative easing' in modern parlance). They have generally ended badly.

Government debt is now the problem; money is being printed in copious quantities by many governments to paper over the problem. Holding interest rates down to negative levels did not help Japan and will cause distortions that lead to economic catastrophe if this continues.

Ironically, when Marco Polo returned back to Italy, his accounts of the riches of Asia were rejected and he became known as a 'man of a million lies.' The paper money he brought back as a gift from Kublai Khan was seen by the chief magistrate of Venice and the cardinal as the work of the devil and was burned.

IOU

Look at the U.S. Dollar. This bill is denominated as $ 100 but it is (top left hand corner) a Federal Reserve Note. It is an IOU issued by the Federal Reserve Bank.

Let's say you want to redeem this paper debt. You take a ten pound note to a bank in England. The note says 'I promise to pay the bearer on demand the sum of ten pounds.' So, the bank will give you a ten pound note in return for your ten pounds. It sounds ludicrous until you realize that the phrase is a relic from the era where the bank would give you gold or silver in return for the note, on demand.

This is the heart of the issue, and why the price of gold is going a lot higher. Paper currency requires public confidence to continue to be used as legal tender.

As the Bank of England puts it, "the meaning of the promise to pay has changed. Exchange into gold is no longer possible and Bank of England notes can only be exchanged for other Bank of England notes of the same face value. Public trust in the pound is now maintained by the operation of monetary policy, the objective of which is price stability."

Quantitative easing will inevitably undermine both price stability and confidence. Germany is very concerned about this after their Weimar Republic hyperinflationary experience but they are being forced into a corner as the European sovereign debt crisis grows.

Gold and silver do not present counterparty risk. Governments, if they run huge deficits and print excess money, can become insolvent and money (and the bonds representing that debt) can lose value significantly in nominal or real terms and even become worthless. Gold and silver may vary in value, depending on supply and demand, but they have never become worthless. They are not someone's liability.

In the U.S., Utah passed the Utah Legal Tender Act in March 2011 recognising gold and silver coins issued by the Federal Government as legal tender in Utah, the first time gold and silver have had that status in that state since 1971. Since then, ten other states are in the process of passing similar legislation.

Switzerland has legislation pending linking the Swiss Franc back to gold. China and Russia are advocating that the U.S. dollar be replaced as the world's reserve currency by a basket of currencies and gold.

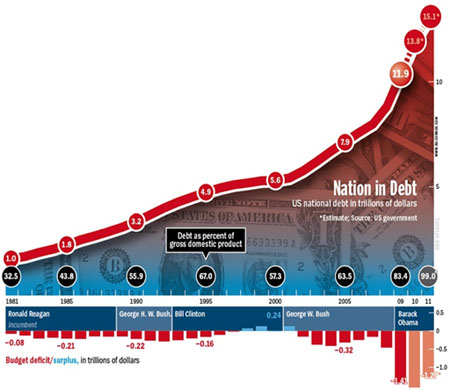

So, gold is being recognised as money again. But the dollar is backed by the full faith and credit of the U.S. government. So how do the finances of the U.S. government look?

Graph: The cumulative Increase in U.S. Debt

While the debt is almost $ 15 trillion, the present value of future unfunded liabilities ranges from estimates of $ 75 trillion to $ 202 trillion. For a government that expects to raise just $ 2.6 trillion in revenues in 2012 and spend $ 3.7 trillion!

In the 65 years following World War II, from 1946-2011, the U.S. has only had 12 years where they have had a budget surplus (in 3 of those years, the surplus was negligible at 2% or less). And both the Congressional Budget Office (CBO) and the Office of Budget and Management (OMB) project endless deficits into the future.

The reality is that the U.S. either defaults or pays back its creditors in dollars that are massively debased: le deluge of more paper currency and more debt. Europe is in the same boat. Quantitative easing is the mechanism for debasement and runs the danger of creating a crisis of confidence in paper money, hyperinflation and other undesirable economic consequences.

When the Indian CEO of S&P courageously acknowledged this reality by downgrading U.S. debt, he was immediately made to 'resign.'

In April 2011, the BRICS (Brazil, Russia, India, China and South Africa) countries held a summit in Hainan. They pledged to settle trade between themselves in the own currencies rather than the U.S. dollar and to use IMF's Special Drawing Rights for interbank exchanges. China and Russia already trade oil in rubles. The dollar is rapidly losing its cherished status as the world's reserve currency.

That's why you must own gold and silver, in physical form in your possession. And equities of quality gold and silver mining companies which are now generating substantial cash flows and sporting low p/e multiples. Be prepared to handle volatility, though.

Déjà vu?

As Yogi Berra put it, "it's déjà vu all over again."

Credit default swaps (CDS) on the bonds of Royal Bank of Scotland, BNP Paribas, Deutsche Bank and Intesa Sanpaolo, among others, are flashing warning signals. The cost of insuring RBS bonds is now higher than before the taxpayer was forced to step in and rescue the bank in October 2008, and shows the recent dramatic downturn in sentiment among credit investors towards banks.

Similarly, CDS rates for Japanese bonds have risen sharply in recent days as Fitch has downgraded Japan's debt to Aa3.

This was the same kind of market action that led to the crash of 2008. Investors need to be very cautious here as the crash season (September-October) approaches.

Visit

www.acamaronline.com

For a unique perspective on global economic events

Disclaimer

The Acamar Journal is intended to provide factual and timely research on general economic trends, opinions about trends in specific industry sectors, information on specific companies, references to other publications and reports that may be of interest to investors, and information on general trading strategies. Zabina Ventures Inc. ("Zabina") is not a registered investment dealer or adviser.

Although the statements of facts in this report have been obtained from and are based upon sources Zabina believes to be reliable, we do not guarantee their accuracy, and any such information may be incomplete or condensed. All opinions and estimates included in this report constitute Zabina's judgment as of the date of this report and are subject to change without notice. Zabina makes no warranties, express or implied, as to results to be obtained from use of information in this report, and makes no express or implied warranties of merchantability or fitness for a particular purpose or use.

This report is for informational purposes only and is not intended to be advice, or an offer or a solicitation with respect to the purchase or sale of any security. This report does not take into account the investment objectives, financial situation or particular needs of any particular person. Investors are advised that investing in securities entails certain risks, and they should obtain individual financial advice and undertake extensive due diligence based on their own particular circumstances before making any investment decisions.

Zabina may from time to time perform corporate communications or other services for companies mentioned in this report. Zabina and/or its principals may be compensated for such services, in the form of fees and/or options. In addition, Zabina or any individuals preparing this report may at any time have a position in any securities or options of issuers mentioned in this report. Directors, shareholders or employees of Zabina may be a director or officer of a company mentioned in this report.

© Copyright 2004-2011. All rights reserved.