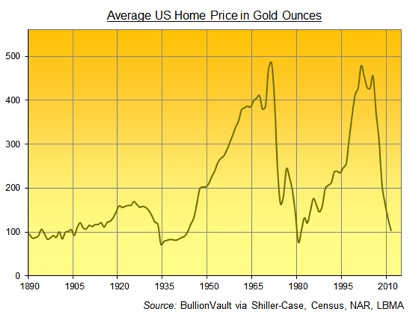

Falling hard as the gold price doubled and more since 2006, the average U.S. home is now priced at 103 ounces of gold—little more than one gold bar for settlement of a 100-ounce Comex gold futures contract.

Housing has only been cheaper in 26 of the last 121 years, and is currently priced around half the long-run average of 201 ounces. But might there be further to go?

Unlike the fine content of a gold bar, necklace or tooth filling, no two residential properties are ever quite the same. Buying or selling the average home can only ever be notional, most especially in a nation of 313 million people, spread out between the shining seas.

But you get the idea, no doubt, as well as the point made on our chart above. Since the housing bust began, the average U.S. home has lost over 70% of its value in gold. It's dropped nearly 80% since the gold-market found its own floor back in 2001.

All told, swapping gold bar for bricks—whether as investment or a place to live—hasn't looked this attractive since the inflationary depression of 1981. U.S. housing's previous low came during the deflation of the Great Depression. Never mind that the average U.S. home doubled in size in between, or swelled another 40% since. Because whichever flavor of depression we've got today, the immutable object of unchanging, unencumbered gold has once more whipped back to its pre-20th century value against the ever-changing, credit-reliant market of residential housing.

It's almost as if the "long boom" of easy credit never happened. At bottom, the average U.S. home cost the equivalent of 71.5 ounces of gold in 1934. Forty-six years later, it fell below 77 ounces of gold. Today's price tag of one Comex gold bar isn't rock-bottom yet. But compared to the top of a decade ago, it's getting there.

Adrian Ash

BullionVault

Gold price chart, no delay | Buy gold online at live prices

Formerly City correspondent for The Daily Reckoning in London and head of editorial at the UK's leading financial advisory for private investors, Adrian Ash is head of research at BullionVault—winner of the Queen's Award for Enterprise Innovation, 2009 and now backed by the World Gold Council market development and research body, where you can buy gold today vaulted in Zurich on $3 spreads and 0.8% dealing fees.

(c) BullionVault 2011

Please Note: This article is to inform your thinking, not lead it. Only you can decide the best place for your money, and any decision you make will put your money at risk. Information or data included here already may have been overtaken by events, and must be verified elsewhere,—should you choose to act on it.