On our 6-month chart, we can see gold's breakout and how, after seven days of gains, it is starting to become overbought. However, apart from brief pauses to partially unwind the overbought condition, it is expected to continue to advance strongly in coming weeks and months, overbought or not, and this positive outlook is reinforced by the strongly bullish picture for silver and precious metals stocks.

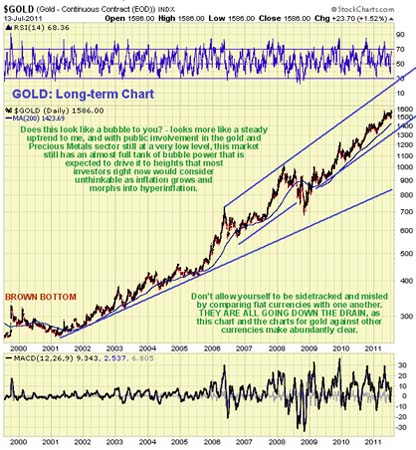

There has been talk in some quarters about gold "being in a bubble," but our long-term chart for gold going back to before the start of the bull market, shows that such an assertion is ridiculous—gold has been in a steady uptrend as it has moved simply to compensate for the destruction of the purchasing power of fiat. What we are seeing here is real money, which gold is, standing out in an ocean if increasingly worthless fiat. Since gold has not been in a bubble and has not attracted the attention of speculators to any great degree it can be said to have an almost full tank of "bubble power," and if, in addition to its continued rise to compensate for the relentless attacks on fiat by central bankers and politicians, it does attract the attention of the investing public at large, its rate of rise could very easily accelerate rapidly and it could go into an ascending parabolic arc. This development is actually viewed as inevitable as we move ever closer to the fiat endgame of hyperinflation, but as we can see on the chart, it hasn't even started yet.

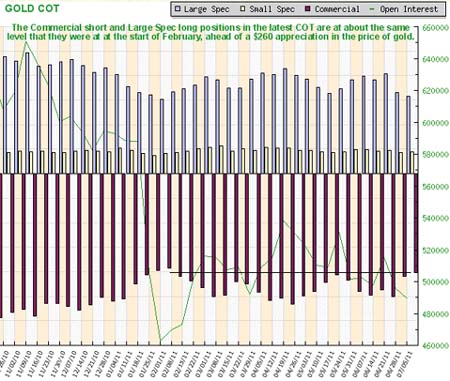

Speaking of gas in the tank, the last COT chart showed a setup similar to that which existed back at the start of February—before a $260 run-up in the price of gold—so the implications of this chart are obvious.

We are going to end this gold market update by briefly summarizing the "global playbook"—once you grasp what is set out below you will understand why the continued advance in the prices of gold and silver are inevitable, and why their rate of advance is set to accelerate.

There is no way of resolving the global debt crisis in a direct and honest manner—any attempt to tackle it head on would result in a global economic implosion and deep depression—and very possibly a state of total anarchy. The "de facto" decision has already been taken to inflate it away. While this will ultimately result in hyperinflation and possibly depression anyway, the transition to that state will be a lot smoother by taking the inflationary approach than it would be by taking the draconian root and branch approach. There will still be small- to medium-sized defaults such as Greece, then Portugal, and after that probably Spain and Italy, but what will happen in each of these cases as they arise is that imminent default will be headed off at the last minute by them being bailed out and propped up, and whatever money is needed to patch things up and keep the system limping along will be forthcoming.

In the United States, after much ritual wrangling, the debt ceiling will be raised—again and again and again, and the Fed will continue to backstop the Treasury market. And there will be QE3, QE4, QE5 and on and on, even if disguised under other names and money will be manufactured in ever increasing quantities to keep everything pumped up. For an investor, it is crucially important to grasp what this means—it means that every default scare of this kind that spooks the markets will present another buying opportunity, as just happened with Greece, especially in commodities and in particular in gold and silver. A country such as Portugal will verge on default, bankers and politicians will run around like headless chickens for a few weeks, markets will drop, then suddenly—hey presto—the necessary funds to "kick the can down the road" yet again will be forthcoming and markets will breathe a sigh of relief and rally—and inflation will continue to build as the debt bill is pushed ever more onto the populace. The middle and lower classes of the world have been targeted to pay down the debts through ever-increasing inflation that will reduce most to a state of penury. The good news is that if you understand the game THAT DOES NOT HAVE TO INCLUDE YOU.

The continuing debasement of fiat currencies around the world means that the bull markets in gold and silver are set to continue and to accelerate. Up until now both gold and silver having been moving higher in large part simply to compensate for the destruction of the purchasing power of fiat caused by inflation, but there is going to come a point when IN ADDITION to these important drivers, speculative interest in both metals is going to ramp up, as speculators are increasingly attracted to both metals simply because their prices continue to rise, with no prospect of them ceasing to do so. In addition, there will be an ever-increasing flow of funds into the precious metals by those desperate just to preserve their purchasing power in the face of the demise of fiat. This increasing influx of funds both from desperate investors and from speculators will eventually power the accelerating ramp in both gold and silver.

While it is true that China and Europe have been playing a dangerous game of chicken in recent weeks by raising interest rates, it is presumed that they will wake up soon and "come on side" and fully partake in the money pumping game, because if they don't the dollar will collapse relative to their currencies and their own economies will implode.

Clive Maund

Gold Market Update