ASK ANY old lags in the gold market what to expect between now and September, and they'll point you to gold's seasonal shape, clearly seen in well over half the last 43 years of traded action.

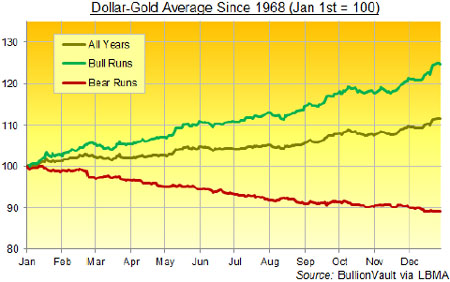

Up in spring, down, and then flat in the summer—gold rises in autumn, recovering (if not beating) that previous high by year-end, or at least rallying to cut its losses in bear runs.

Gold's spring peak has been extended over the last decade by ever-rising Chinese New Year demand, plus strong buying ahead of April's festival of Akshaya Tritiya across southern India. For the summer sale, analysts most commonly point again to Indian gold buying—or rather, the lack of it from the world's hungriest and most calendar-led hoarders during the quiet summer months. Old hands will also note that same "Sell in May" dropoff, which tends to dull most financial markets in the northern hemisphere, too. And thanks to the autumnal crises of the last few years, gold's rally in fall—previously led by Diwali festival buying in India—has only grown stronger as well.

So strong, in fact, you could pack your kids off for a new school year the very day that gold began its autumnal surge.

In 9 of the last 10 summers, dollar:gold has dropped 10% on average from its spring high. It has risen to finish the year higher again in 8 of them. The average wait from top to bottom was just over 5 weeks. Only 1 of those lows came as late as August 1.

Of course, just buying gold and then leaving well alone has been the simplest and most profitable strategy of the last decade, no matter where you got in. Because nice as it is to extend your gains, over trading has been the investor's only true enemy during this bull market so far.

Two curve balls whacked summer-sale traders in particular—the first in 2006 (when gold never quite recovered its startling spring peak) and then in 2008, when the world turned upside down, and the U.S. dollar actually rose. (Buying gold with any other currency showed a fantastic gain by year-end, and it still rose 5% for U.S. investors from Jan. '08.)

Now, until today's new record high, 2011 was playing right to script. But at this rate, gold risks running straight into India's festival demand, and then into China's New Year hoarding, without pausing for breath. And while making a new high for the year as late as July or August isn't unheard of (12 of the last 43 years), any significant new highs in mid-summer have typically come amidst real monetary turmoil. Just the kind of mayhem we've got across Eurozone debt markets, in fact.

The U.S. gold crisis of 1971, Iranian crisis of 1979, less-developed countries' crisis of 1982, Iraqi invasion of Kuwait in 1990, European exchange rate crisis of 1992, global banking crisis of 2008. . .gold's seasonal lull has come unstuck when the kind of events that gold can help defend against strike.

Whether we now get a late seasonal lull or not, most likely depends on a lull in the Eurozone and then U.S. debt wrangles. And given the odds of that, longer-term wealth preservation—seeking simply to avoid fresh chaos breaking out in equity and debt markets—might not want to risk trying to finesse the price of buying gold so tightly.

Adrian Ash

BullionVault

Gold price chart, no delay | Buy gold online at live prices

Formerly City correspondent for The Daily Reckoning in London and head of editorial at the UK's leading financial advisory for private investors, Adrian Ash is head of research at BullionVault—winner of the Queen's Award for Enterprise Innovation, 2009 and now backed by the World Gold Council market development and research body, where you can buy gold today vaulted in Zurich on $3 spreads and 0.8% dealing fees.

(c) BullionVault 2011

Please Note: This article is to inform your thinking, not lead it. Only you can decide the best place for your money, and any decision you make will put your money at risk. Information or data included here already may have been overtaken by events, and must be verified elsewhere,—should you choose to act on it.